New listings jump in April giving buyers a few more options

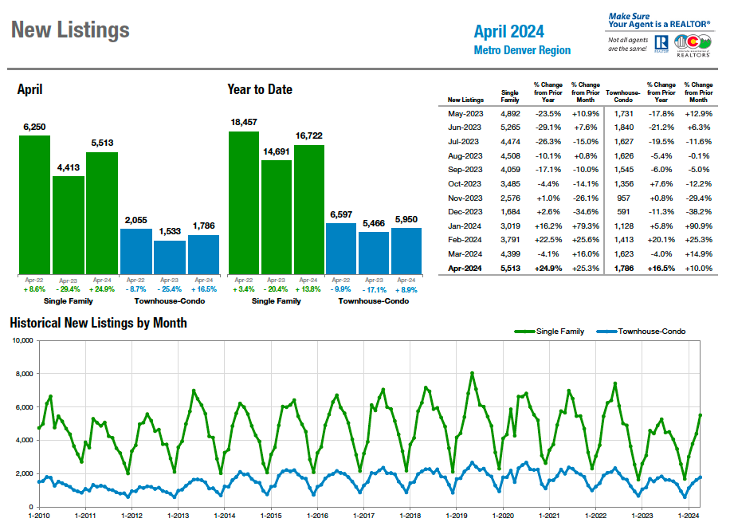

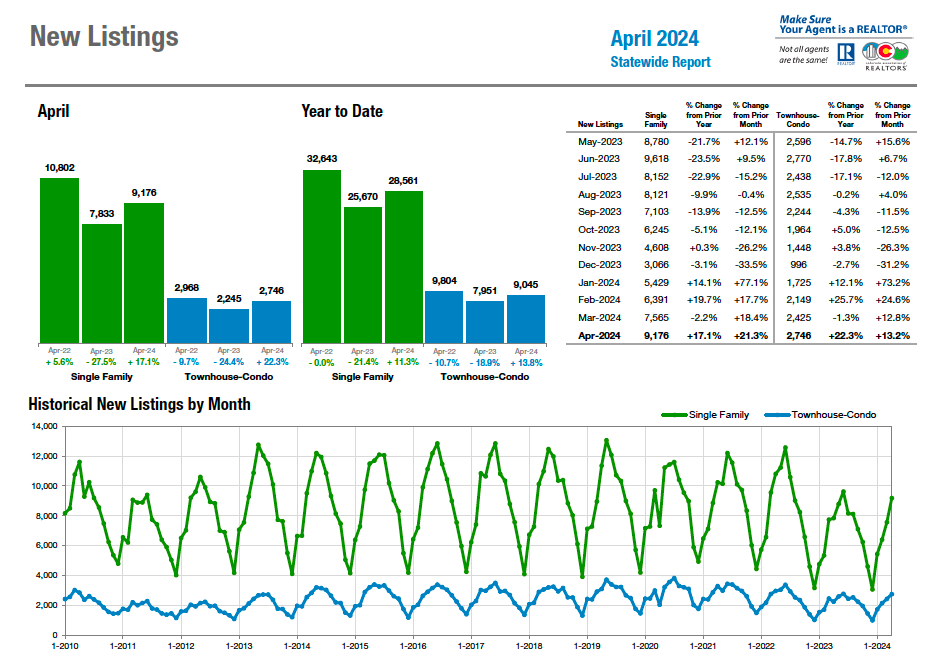

ENGLEWOOD, CO – A springtime jump in new listings across all property types helped deliver opportunities for buyers across the seven-county Denver metro area (+22.7%) and statewide (+18%) in April, according to the latest Market Trends Housing Report from the Colorado Association of REALTORS® (CAR) and analysis from the Association’s spokespersons across the state.

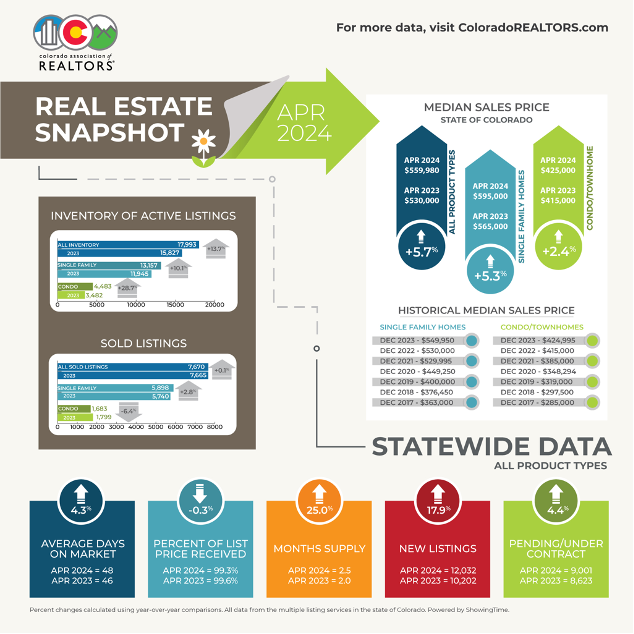

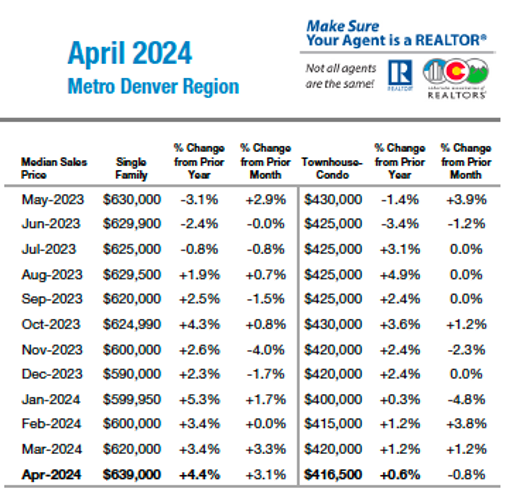

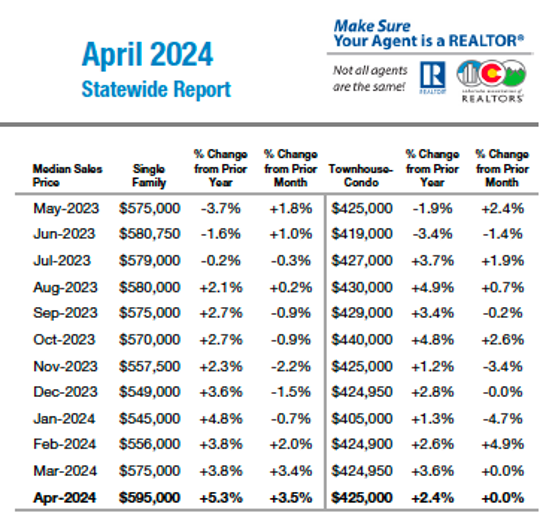

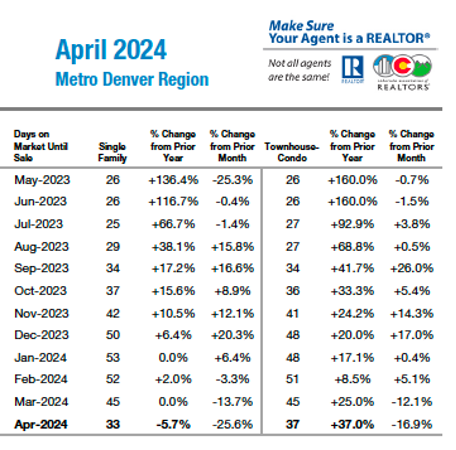

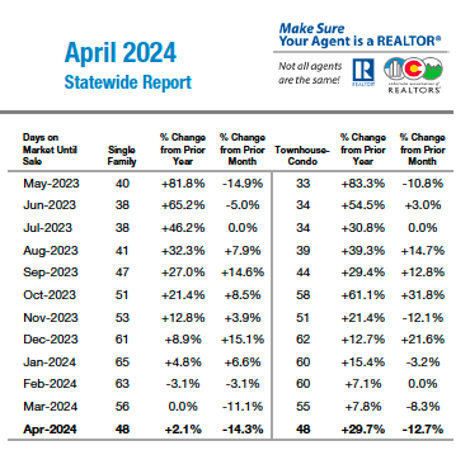

Although not at the same volume, sold properties and those pending/under contract also rose nicely in April, driving down the average days on market and keeping median pricing on the rise. Single-family homes in the Denver-metro area rose 3.1% from March to April to a median of $639,000 while condo/townhomes dipped slightly over the past month to $416,500. Statewide, median pricing for single-family homes rose 3.5% to $595,000 while condo/townhomes stayed flat at $425,000.

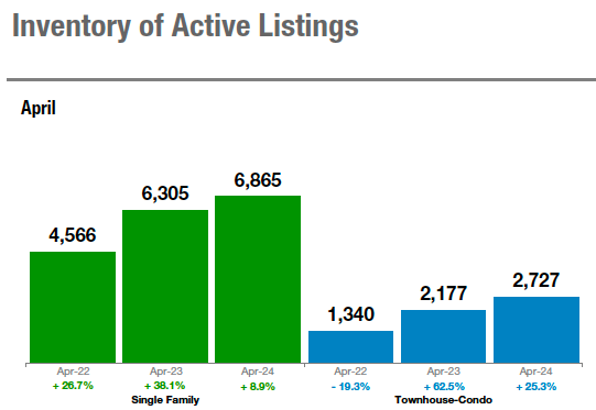

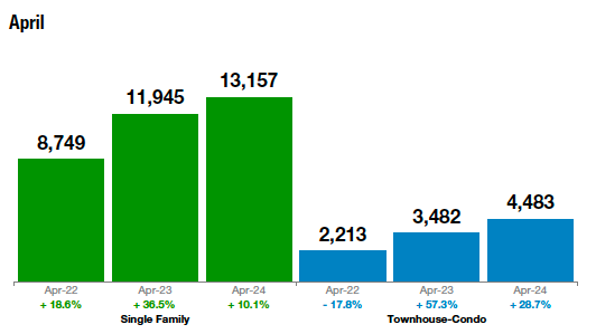

The inventory of active listings increased approximately 6% for all property types in the Denver-metro area, and around 5% statewide. Sellers continue to receive asking price for those homes in good condition and accurately priced.

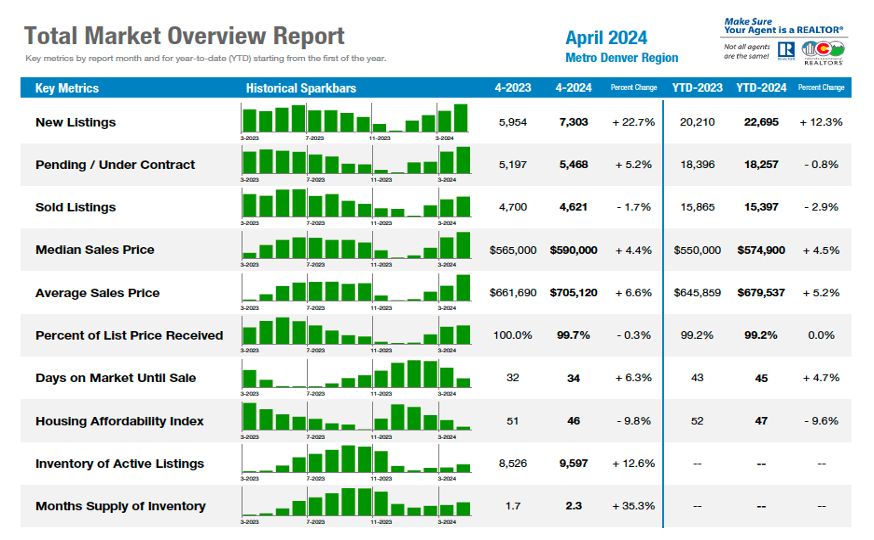

Seven County Denver area Total Market Overview (single family and condo/townhome):

Statewide Market Overview

New Listings – Metro Denver

New Listings – Statewide

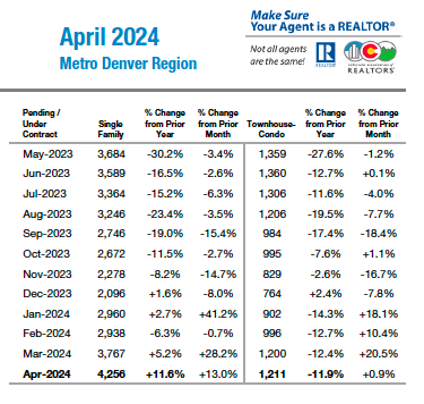

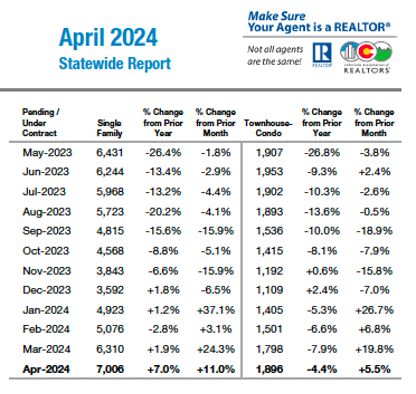

Pending/Under Contract – Metro Denver

Pending/Under Contract – Statewide

STATEWIDE SUMMARY

Taking a more in-depth look at some of the state’s local market data and conditions, the Colorado Association of REALTORS® Market Trends spokespersons provided the following assessments:

BOULDER/BROOMFIELD

“Where did the buyers go? In Boulder and Broomfield counties, the tables are finally starting to turn. What has been a seller’s market for the past 5 years is showing signs of adjusting to the other direction. Sellers who waited for interest rates to come down have finally decided it’s time for a move, regardless of today’s rates.

“In Boulder County, we are relishing in 25% more listings on the market. The increased inventory is a welcome reprieve but buyers who so desperately wanted choices are still sitting on the sidelines. The lack of movement in the rates, the upcoming election, and other general areas of economic uncertainty have created a pause in the buyer demand. With few showings and longer days on the market, prices have been pressured down by 4% since the beginning of the year.

“In Broomfield County, listings are also up a more modest 8% but sales activity is sluggish with fewer homes selling than at this time last year. Due to decreased buyer demand, prices are 6.7% less than they were at this time last year. It’s taking about 60 days on average to sell and as those days increase, sellers become more motivated, and prices decrease. The savvy buyer will recognize the situation and hop in while this market is experiencing a shift. Sellers are willing to pay concessions to buy down the interest rate, lenders are offering free refinance opportunities when rates decline. With more homes on the market and motivated sellers, this is an opportunity for buyers we haven’t seen in years,” said Boulder/Broomfield-area REALTOR® Kelly Moye.

COLORADO SPRINGS

“The market is giving us mixed signals. On one hand, values went up 5.2% in April which might lead you to believe things are great in the Pikes Peak region. But we need to address the elephant in the room. What is selling is upper end homes. This gives an appearance of price increases despite the 6.6% drop-in units sold and a 23.5% increase in active listings. I believe this is beginning to signal a market shift. One that, in other areas of the country, is also beginning to show up. Properties coming to the market and yet, not selling. Buyer demand remains low. We are seeing 2012/2013 levels of sales, based on units sold. There is really a disconnect now and the numbers are not showing what is really going on.

“If you purchased a home in 2022 prior to rate hikes, your home likely has declined in value since that time. We are seeing homes sold that year hit the market under the price it sold for two years ago. Most areas are below our peaks locally. A new listing that hit the market this week at $399,900 actually sold for $430,000 in the first quarter of 2022. This is happening across the region. Rates are a driving force in this area, along with rental prices being far more aggressive than buying the same home. Rentals also are sitting longer, and rental prices are continuing to soften. If we were in October, we would write this off as seasonal. But we are in the springtime market, and this does not feel like a springtime market.

The national economy is not as strong as what we continue to hear. But we are in an election year, and we would expect the fluff. The job market is probably not as strong as the Federal Reserve says. Inflation and daily costs continue to burden the consumer. Loan delinquencies continue to rise on credit cards, car loans and even non-QM loans. The average person does not feel comfortable and consumer confidence at the grass-root level shows this. Buyers are nervous, which shows in the loan application rates sitting at 1995 levels. Read the headlines and you start to see that April posted falling numbers for full time jobs, again. It isn’t that homes are not available, they are not affordable. And that continues to be an issue locally. Until confidence and affordability come into the market, I expect that monthly we may see lower and lower sales and more housing inventory come into the market. Once something big goes wrong, the Fed will be lowering rates at breakneck speed. And if history rhymes, it will be too little too late,” said Colorado Springs-area REALTOR® Patrick Muldoon.

COLORADO SPRINGS

“The number of single-family/patio homes for sale in the Colorado Springs area in April 2024 was 2,139, representing a 14.5% increase month-over-month and a whopping 34.5% year-over-year, and the highest level of inventory in April since 2016. Overall months’ supply of active listings was at 2.2 months, for homes priced under $400,000 at 1.8 months, homes between 400,000 and $600,000 at 1.8 months, homes priced between $600,000 and $1 million at 2.8 months, and 5.2 months for homes priced over $1 million.

“There were 959 sales of single-family/patio homes in April 2024, compared to 941 in the previous month and 1,090 in April last year, representing an increase of 1.9% month-over-month and a 12.0% decrease year-over-year. The monthly and year-to-date sales volumes were down 6.7% compared to last year. However, looking back 10 years to April 2014, the monthly and year-to-date sales volumes are up 143.7% and 159.4%, respectively. The 40 average days on the market compared to 56 days last month and 39 days in April last year. Last month, 37.8% of the El Paso County active listings in the Pikes Peak MLS had price reductions.

“Last month, the average sales price was $564,715 compared to $527,629 in the previous month and $532,254 in April last year, representing an increase of 7% month-over-month and 6.1% year-over-year. The median sales price was $490,000 compared to $470,000 in the previous month and 459,000 in April last year, representing an increase of 4.3% month-over-month and 6.8% year-over-year. The average and median prices reached record high levels in April 2024 compared to any April previously.

“From an analysis of the single-family/patio homes sold by price range, last month, 23.8% of the homes sold were priced under $400,000, 46% between $400,000 and $600,000, 24.4% between $600,000 and $1 million, and 5.8% over $1 million. Year-over-year in April 2024, there was a 24.4% drop in the sale of single-family homes priced under $400,000, a 15% decline in homes priced between $400,000 and $600,000, a 15.3% increase in homes priced between $600,000 and $1 million, and a 23% increase in homes priced over $1 million.

“So sadly, inconceivable affordability challenges due to a staggering combination of high-interest rates, record-high home prices, and inflated cost of living remain the most daunting barriers for Colorado Springs-area homebuyers,” said Colorado Springs-area REALTOR® Jay Gupta.

CRESTED BUTTE/GUNNISON

“The real estate market in the Crested Butte and Gunnison area in 2024 continues to outpace 2023. Through April, sales are up 8%, but dollar volume is up a whopping 75%. A lot of this activity is centered in the Crested Butte area with sales up 28% and dollar volume up 80%. The Gunnison area continues to remain steady with the number of sales actually down 25% and dollar volume up 11%. While better than last year, the number of sales remains historically low and at a level not seen since 2011. Given that the number of properties for sale is less than half of what was on the market in 2011, it is unlikely that we will exceed that year in the end.

“Looking ahead to our busy summer season, there will be more properties to choose from than last year. The number of properties for sale is up 38% from this time last year and the number of properties that have come on the market in the last month is more than double what we saw in April 2023. Historically, summer is when the most properties are for sale so it seems likely that this trend will continue.

“The stats above indicate prices are up overall. Some of this is because we have more properties at the higher end of the market for sale and selling. Buyers continue to be cautious. Turnkey properties and those that have been updated are selling quickly if they are priced right. Properties that need work will linger on the market as buyers know it can be challenging to find people to do the necessary work. It is important for sellers to have information about recent sales when they are deciding to sell their property and what the asking price should be. Buyers need to consider the interest rates, housing needs and income potential as they move ahead with a purchase,” said Crested Butte -area REALTOR® Molly Eldridge.

DENVER COUNTY

“Elevated interest rates, rising insurance costs, and higher property taxes haven’t appeared to faze buyers and sellers here in the Mile High City. Last month, the Denver-metro area remained one of the hottest housing markets in the country, fueled by financial stability, economic resiliency, low housing supply, and an unwavering attraction to Colorado’s high quality of life. The significant mismatch between our limited supply and excess demand has continued to perpetuate a moderate-to-strong seller’s market so far this year.

“Sellers looked to capitalize on their advantageous market position in April, posting 1,500 new listings, a near-two-year high for Denver County. Median close prices also favored sellers, improving 15% year-over-year to $625,000, just shy of April 2022’s all-time record of $650,000. Sales pace has rapidly improved recently, with the median time listings spent on the market in April reaching a 10-month low of just 8 days. However, high levels of new listings have hindered overall market velocity. In April, the supply of inventory reached 2.2 months, a historically high figure compared to the previous 10-year April average of about 1.6 months.

“While sellers reap the benefits of a strong market, buyers aren’t necessarily flawed in remaining optimistic. Higher inventory will generate a more competitive environment, awarding homebuyers with negotiating power. I expect moderate movement towards a more balanced market as the year continues, which could accelerate in the event of rate cuts. For now, consumers are still buying homes despite affordability challenges, and Denver’s real estate market earned a mostly clean bill of health for April,” said Denver County-area REALTOR® Cooper Thayer.

DOUGLAS COUNTY

“Encouraged by moderate price increases in 2024 thus far, long-time Douglas County homeowners are beginning to realize massive equity gains in their homes. Median close prices reached $700,000 in April, a 2.8% increase year-over-year. Buyers, however, have slowed down spending as they seek remodeled, high-quality listings to make their purchases worthwhile. The result is a split market, with ‘turnkey’ homes selling quickly and often receiving multiple offers, while homes requiring updates or repairs struggle to attract attention amongst higher inventory.

“Sellers can be stubborn on price, and understandably so. It’s difficult to accept offers that may be perceived as ‘below market value,’ especially as prices have slid down approximately 4% over the past two years. For the average single-family home in Douglas County, that’s around $30,000. Top dollar is still attainable but, differentiating a listing from the two-plus months of inventory on the market, has become a more daunting challenge and risky investment.

“The newest data shows homes are still receiving near-asking price offers on average, and the median time on the market last month was just 9 days. While activity is not outpacing the previous three years, the Douglas County real estate market is showing impressive resilience as economic and political uncertainty remains a prominent concern of the industry. Despite the unknowns, the underlying lack of supply compared to excessive demand will likely continue to provide this stability, regardless of challenges stemming from macroeconomic conditions,” said Douglas County-area REALTOR® Cooper Thayer.

DURANGO/LA PLATA COUNTY

“Amid evolving market conditions, the real estate landscape in La Plata County continues to demonstrate its resilience and adaptability. Year-to-date statistics reveal interesting trends shaping the housing market, offering a mix of challenges and opportunities for buyers and sellers.

“Key statistics in the single-family homes segment: New listings have increased by 16%, indicating a vibrant market for prospective buyers. However, the number of sold listings has slightly declined by 14%, reflecting some hesitancy in the selling process. Despite this, home prices have seen a significant uptick of 9.2%, with the median price now at $785,000, showcasing the value and desirability of properties in the region.

“Challenges have surfaced in rising inventory levels for sellers, with 84 townhouses/condos currently on the market. This is a 121% increase compared to the previous April but adding to the options available for homebuyers and investors. The monthly inventory supply for townhouses and condos has risen from 1.7 to 4.3 months. This shift reflects a changing market dynamic, potentially offering buyers more negotiating power.

“As the market prepares for a robust selling season in the coming months, the increased inventory is expected to provide local residents with more housing options. With historically low interest rates keeping sellers on the sidelines the previous few years, the hope is that those waiting will take advantage of the current market conditions and move within the locality.

“In conclusion, La Plata County’s real estate sector remains dynamic and full of opportunities. Despite certain challenges, the market continues to evolve, presenting a fertile ground for those looking to invest, purchase, or sell properties in the area,” said Durango-area REALTOR® Jarrod Nixon.

FORT COLLINS

“The decision to sell a home is generally not one made on a whim. Experience has revealed that the decision to sell a home and uproot all the inhabitants (and their possessions) is made well in advance of the home being listed on the multiple listing service. The decision is borne out of the relationship (or gap) between a homeowner’s current situation and their desired situation. Evidently, many homeowners have decided their current situation is far less attractive than their desired situation and have decided to sell. All this is to say that the current data showing the number of homes coming on the market in April was up more than 24% is a lagging indicator of decisions made a month or more in advance.

“At the beginning of the year, it appeared mortgage interest rates were stabilizing and for a moment were coming down from the 8% highs of late 2023. This may have been enough for some homeowners and investor owners to take off their ‘golden handcuffs’ of an ultra-low, fixed-interest rate and cash in on the equity they have built in the post-pandemic run-up in valuation. The additional inventory has been welcomed by buyers who are in urgent need of housing and have the wherewithal to navigate the current interest rate and loan qualification process. This shows up in the data with a year-over-year increase in home sales of more than 6% and pushing the median price in the Fort Collins area to over $627,000 – a level not seen since last June.

“Right now, however, with interest rates having crept back up over 7%, the housing market, now flush with new inventory, is falling a bit flat with buyers who aren’t as comfortable with the news that interest rates may not be coming down any time soon. Months’ supply of inventory is up over 2 months now and buyers have the luxury of not only shopping but actually negotiating with sellers who need to sell by securing seller cash concessions in the form of mortgage interest rate buy-downs, down payment assistance, or both. As mentioned in previous reporting, this concession is generally not illustrated in the list price to sale price ratio which for April was sitting just over 100% and since the appreciation trend in most market segments has been positive, appraisal issues have not been as big an issue as they can be in a leveling or negative appreciation market.

“The decision to sell is generally not predicated on a single data point and turning back from deciding to sell is a bit more difficult than a buyer deciding to wait and see. Buyers are rarely in the driver’s seat during the height of the spring and early summer selling season but once again, due to the volatility in the mortgage rate market, we are quickly reaching parity where a near-balanced market also balances negotiation dynamics between seller and buyer,” said Fort Collins-area REALTOR® Chris Hardy.

FREMONT COUNTY

“The Fremont County real estate market for April of 2024 compared to April of 2023 shows new listings on the market increased 18.4% while new sales were down 36.8%. This gives current buyers a slightly higher number of listings to choose from. The median price range April 2023 vs April 2024 was down 2.5% at an even more affordable price of $314,000. The year-over-year median price weighs in at $317,000. Fremont County’s current inventory is up 11.3% from April of last year leaving us with a total of 4 months of inventory. Our average days-on-market is 89 days.

“Year over year, new listings are down slightly (0.6%) while sales are down 17.9%. Sellers are receiving an average of only 2.7% less than what they listed the property for in final sales contracts.

“Fremont County’s affordably low $300,000 median price range brings retirees from the Colorado metro areas and other surrounding states. In the higher end local market, a buyer can live happily ever after in a newer 3,200 square-foot home with walk-out basement and mountain views all on public utilities with high-speed internet, half acre, or larger lots all for an affordable price in the low $600,000s. Local listings and sales increase from May through August each year. We anticipate this to be the case for the next few months,” said Fremont County-area REALTOR® David Madone.

GLENWOOD SPRINGS/GARFIELD COUNTY

“The real estate market in Garfield County has experienced a slight shift this April, with new listings showing a modest rise of 5.6% compared to the same period last year. This translates to an additional four homes entering the market. More notably, the number of sold listings has surged 63%, indicating a robust increase in sales activity with 54 homes sold compared to 33 in the previous April. Despite this uptick in sales, the median sale price has seen an unusual dip of 17.4%, settling at $640,000, down from $775,000 in April 2023. In contrast, the average sale price has edged up slightly by 0.7%, with this April’s figure at $966,747 compared to $959,931 last year. The market also observed a lengthening in the days on the market, with homes now taking an average of 70 days to sell, up from 58 days. Concurrently, the inventory of single-family homes has contracted, decreasing to 141 homes from 153 at the end of last April, suggesting a continued tight market that could influence future pricing and sales trends.

“In the multi-family sector, new listings saw a notable decrease, dropping from 28 to 16 when comparing the last two Aprils. Despite this reduction, pending sales experienced a modest increase of 11%, equating to two additional listings. A considerable surge was observed in the number of sold multi-family units, which spiked 120%, resulting in 22 properties sold compared to 10 in the previous year. Interestingly, this increase in sales volume did not impact the median sale price, which remained constant at $474,750. However, the average sales price witnessed a significant reduction of 24.3%, falling from $768,550 to $581,445. This suggests that while more units were sold, they were at lower price points on average. The market also saw a faster turnover, with the days on market decreasing sharply from 90 days in April 2023 to just 20 days in April this year. The month ended with a 1.8-month supply of active listings, a decrease from a 21.7% months’ supply, indicating a tighter market with fewer available properties. This set of data points to a market that is rapidly evolving, with buyer behavior reflecting an urgency to purchase despite fewer options and lower average prices,” said Glenwood Springs-area REALTOR® Erin Bassett.

GRAND JUNCTION

“Finally, Mesa County is seeing some positives. Pending and solds are both up from a year ago, and some of the inventory that has been sitting on the market for a while is finally finding a buyer. Some sellers have reduced prices to generate an offer, others having been offering buydowns on interest rates. However, this increase in activity has not dampened the median or average price, which are both up, median to $411,225 and average to $451,140. A worrisome sign is that active inventory is down 6.7% to 556. This is a time of year when historically we have had a big bump in inventory, which so far has not happened. As we move into the late spring and then summer months, we will hope for more inventory to give buyers more choices,” said Grand Junction-area REALTOR® Ann Hayes.

PAGOSA SPRINGS

“The first four months of 2024 mirrored 2023 with slight reflections (some gains). While new listings were up 4.3% in April, the year-to-date number is 36.3% over 2023. The 2024 Pagosa Springs winter months did not have the epic snowfall of 2023. Consequently, more homes are coming on the market earlier this spring and creating more inventory (mostly in higher price points). The coming months will bring even more higher priced homes on the market as those sellers come out of winter hibernation and prepare their homes for sale with updates and maintenance. Because of new inventory, pending sales were up slightly in April 2024 (103), compared to 2023 (97). April solds were down only one at 27. However, 2024 year-to-date sold listings sit at 81 (up from 79 in 2023). Other mirroring year-to-date numbers include:

Median Sales Price up 1.5% at $537,000 ($530,000 in 2023)

Average Sales Price up 9.4% at $674,968 ($618,313 in 2023)

Days on Market up 15.7% at 147 (127 in 2023)

Home prices are holding or tracking higher than last year and will affect the number of pending sales and sold listings in the coming months. The biggest inventory gains were in price points $500,000-$700 and $1-2 million.

Active homes under $499,00 (Mostly Condo | Manufactured Home) 28

Active homes $500,000-699,000 (Median-Average Price) 33

Active homes $700,000-$999,999 30

Active homes $1 million-plus 56

“Interest rates and higher home prices appear to factor into the increased inventory, as days on market increased to 140 days in April. Financing for higher priced homes with interest rates around 7% creates a hefty mortgage payment for homeownership. Historically, Pagosa Springs has been a big second home market with attractive pricing compared to other Colorado resort communities. That is still true however, second-home buyers appear more discerning, especially when a mortgage is part of their home purchase scenario. Also affecting the second home market are higher short-term rental fees, and other related fees such as new, higher short-term rental water rates, insurance, and more restrictions. Current short-term rental owners are frustrated and reconsidering their investment by placing homes on the market. Many are simply cashing out of the real estate wealth achieved and going to more welcoming short-term rental communities out of state. The unfortunate result is not adding much to the inventory in homes priced under $700,000. Markets with lack of new construction see much slower inventory gain in moderate home prices. Affordable housing is still a crisis,” said Pagosa Springs-area REALTOR® Wen Saunders.

PUEBLO

“With the exception of the 12.4% year-over-year increase in new listings, the Pueblo real estate market produced negative numbers in April. Year to date, our new listings were down 12% compared to the first 4 months of 2023. Pending sales were up 13.2% from 2023. The big decline was in our sold category which fell 18.7% compared to April 2023 and was down 12.8% year to date. Active listings were up 10.7% in April to 673 however, buyers just aren’t out there looking. For those that are, lenders are seeing more and more who can’t qualify with interest rates still in the 7% range.

“For those properties that are selling, we see a 98.3% of list price received – in line with where we were last year. Average days on market remains at about three-plus months. Our builders pulled 43 permits in April, a big jump from the 14 we saw in March. We had 61 lots sell in the first four months of 2024 with 197 lots still active,” said Pueblo-area REALTOR® David Anderson.

SAN LUIS VALLEY

“Alamosa County: We are seeing an overall influx of listings in Alamosa County, up a whopping 80% this year from last year. Closed sales are down 25% from last April, but overall for the year, they are up 20%. The Median Sales Price dropped 17.4% from $302,500 to $250,000.

“Conejos County: We saw a similar pattern in Conejos County with new listings up 200% from last April. Closed sales are also up 100%, and the Median Sales Price went up 47.4% from $134,000 to $197,000.

Costilla County: Unlike Alamosa and Conejos County, we saw a dip in listings from last year, down 8.3%. Closed sales remained the same from last year, and the median sales price increased from $215,000 to $297,000.

“Rio Grande County: Like nearby Costilla County, Rio Grande County also saw a 20% dip in listings from last April to now. They also saw a 300% increase in closed sales. The median Sales Price fell 8.6% from $550,000 to $502,500.

“Finally, Saguache County had a 28.6% increase in listings from last year and a 50% decrease in closed sales. The median sales price fell from $370,000 to $194,500,” said San Luis Valley-area REALTOR® Megan Bello.

STEAMBOAT SPRINGS AND ROUTT COUNTY

“We have all experienced a market where Buyers may be sitting on the sidelines whether it’s for health, economic or political reasons. More recently buyers may have hit the pause button hoping to see a lowering of interest rates. While interest rates have certainly impacted buyers looking in Routt County, buyers are often on the sidelines more in wait of inventory. April showered in 17 single-family listed compared to 5 last year and 46 multi-family listed compared to 14. The appetite for supply is still good with basically the equivalent of 17 homes and 42 condos/townhomes consumed during this period. Days on market for homes were 68 days vs 75 with multi-family experiencing a 40.6% reduction of only 38 days compared to 64 the same time last year. Year-to-date homes are receiving 97.4% of their list price which is up 2.3% while condos/townhomes are receiving 98.4% (up .5%). Months’ supply of inventory is around two months for both.

“In the bedroom communities of Steamboat including Hayden, Oak Creek (Stagecoach) and Clark, new listings were not higher than last year. Months’ supply for Hayden and Oak Creek hovers around 1.5 months with each town having six homes for sale. The Stagecoach area is home to a State Park and reservoir. This location is experiencing new construction resulting in an inflated impact on days on market and increase on average sales price for the Oak Creek area to $1,114,745 for the nine homes sold year to date. Single-family homes in the Hayden area have realized 14 homes year-to-date averaging a sales price of $495,188 with the median at $518,000.

“Now into May, new listings for Steamboat, Oak Creek and Clark are tracking slower than May 2023 while Hayden has a little more activity. For those wanting to purchase this summer, the choices may not be as plentiful as one might wish,” said Steamboat Springs-area REALTOR® Marci Valicenti.

SUMMIT, PARK, AND LAKE COUNTIES

“The real estate market in the picturesque mountains and valleys of Summit, Park and Lake counties continues to offer a diverse and dynamic landscape, providing both buyers and sellers with a range of opportunities amidst evolving market conditions.

“Compared to last year, there has been a substantial 55% increase in new listings, signaling growing confidence among sellers in the market. Additionally, sales have seen an uptick, with a 15% increase showing sustained buyer interest in the region. Cash sales made up 45% of those transactions.

“Despite the overall positive trend, there have been some fluctuations in pricing. Sale prices for single-family homes are up compared to April 2023, but the average price has fallen 6% since last month. However, year-to-date, prices have risen 14%. Multi-family property prices jumped up to the highest level in the last year, with a 38% increase in prices from last April and a 24% rise year-to-date. Multi-family prices are up 20% from the previous month.”

Average sale price by county April 2023 vs. April 2024:

Summit County: 2023 2024

o Single Family $1,933,587 $2,187,603

o Multi-Family $ 800,402 $1,012,367

Park County:

o Single Family $ 751,667 $564,213

Lake County:

o Single Family $ 389,750 $ 470,250

“Out of the 522 active residential listings (up 23% from last month) in Summit, Park and Lake Counties, the least expensive property is a single-family home in Park County for $195,000 and the most expensive is a newly listed single-family home in Breckenridge for $19,995,000. Out of the 122 sales in April, the lowest was a single-family home in Park County for $140,000 and the highest was a single-family home in Breckenridge for $8,600,000. 54% had a sales price over $1 million and 45% of sales were cash. These numbers exclude deed restricted, affordable housing, land and commercial,” said Summit-area REALTOR® Dana Cottrell.

TELLURIDE

“April witnessed robust real estate sales activity in San Miguel County with 44 sales totaling $85 million. Year-to-date, total dollar volume reached $330.68 million and the number of sales totaled 148. There continues to be a downward trend in the number of sales, dropping 25% in the first four months of 2024. That being said, the average sales price year-to-date in San Miguel County has surged 17% compared to 2023 and now averages $2.2 million per transaction.

“The Mountain Village continues to dominate the overall market, comprising 38.5% of the county’s total dollar amount of sales. This trend is largely due to the larger inventory available in the Mountain Village as compared to the town of Telluride. However, the Mountain Village is the only market segment that has seen a decrease in the average sales price year over year decreasing from $2.2 million year to date in 2023 to $1.6 million in 2024,” said Telluride-area REALTOR® George Harvey.

VAIL

“April was an interesting month in the Vail market throughout the valley. We had a spur month for snowstorms and unique market performance. New listings for the month were positive 33.3% which brings the year-to-date performance to plus 18.8%. The increase in listings spurred our pending sales positive 33.3%, a strong performance for the time of year. The pending performance brought our year-to-date numbers to a positive 18.8%. Actual closed sales were positive 6.9% in units however, the dollar performance was positive 51% for the month. The chart below will show the reason for this jump in dollars. Due to the strong pending performance the new listings increase only generated a 2.9% increase in active inventory and months’ supply increased from 3.6 months to 3.8 months. The new listings were predominately new product from the condo/townhome.

“The market niche swings shown in the chart below highlights the cause for the disparity in the difference between dollar and units performance,” said Vail-area REALTOR® Mike Budd.

| 23-Apr | 24-Apr | YTD 23 | YTD 24 | |||||

| Mkt Share | Mkt Share | Mkt Share | Mkt Share | Mkt Share | Mkt Share | Mkt Share | Mkt Share | |

| units | $’s | units | $’s | Units | $’s | Units | $’s | |

| <$1 Mil | 36% | 11% | 19.50% | 5% | 38% | 11% | 29% | 7% |

| $1-$2 Mil | 19% | 13% | 35% | 16% | 24% | 14% | 34% | 21% |

| $2-$3 Mil | 18% | 20% | 14.30% | 12% | 12% | 13% | 12% | 13% |

| $3-$4 Mil | 15% | 25% | 11.70% | 13% | 12% | 19% | 10% | 15% |

| $4-$5 Mil | 3% | 6% | 4% | 6% | 7% | 13% | 4% | 7% |

| $5 Mil + | 8% | 26% | 15.60% | 49% | 7% | 29% | 11% | 36% |

| 100% | 100% | 100.00% | 100% | 100% | 100% | 100% | 100% |

SEVEN-COUNTY DENVER METRO AREA – Median Sales Price

STATEWIDE – Median Sales Price

SEVEN-COUNTY DENVER METRO AREA – Inventory of Active Listings

STATEWIDE – Inventory of Active Listings

SEVEN-COUNTY DENVER METRO AREA – Days on Market Until Sale

STATEWIDE – Days on Market Until Sale

The Colorado Association of REALTORS® Monthly Market Statistical Reports are prepared by Showing Time, a leading showing software and market stats service provider to the residential real estate industry and are based upon data provided by Multiple Listing Services (MLS) in Colorado. The April 2024 reports represent all MLS-listed residential real estate transactions in the state. The metrics do not include “For Sale by Owner” transactions or all new construction. CAR’s Housing Affordability Index, a measure of how affordable a region’s housing is to its consumers, is based on interest rates, median sales prices and median income by county.

The complete reports cited in this press release, as well as county reports are available online at: https://coloradorealtors.com/market-trends/

###

CAR/SHOWING TIME RESEARCH METHODOLOGY

The Colorado Association of REALTORS® (CAR) Monthly Market Statistical Reports are prepared by Showing Time, a Minneapolis-based real estate technology company, and are based on data provided by Multiple Listing Services (MLS) in Colorado. These reports represent all MLS-listed residential real estate transactions in the state. The metrics do not include “For Sale by Owner” transactions or all new construction. Showing Time uses its extensive resources and experience to scrub and validate the data before producing these reports.

The benefits of using MLS data (rather than Assessor Data or other sources) are:

Accuracy and Timeliness – MLS data are managed and monitored carefully.

Richness – MLS data can be segmented

Comprehensiveness – No sampling is involved; all transactions are included.

Oversight and Governance – MLS providers are accountable for the integrity of their systems.

Trends and changes are reliable due to the large number of records used in each report.

Late entries and status changes are accounted for as the historic record is updated each quarter.

The Colorado Association of REALTORS® is the state’s largest real estate trade association representing approximately 28,000 members statewide. The association supports private property rights, equal housing opportunities and is the “Voice of Real Estate” in Colorado. For more information, visit https://coloradorealtors.com.