Housing inventory hits the market as spring selling season approaches

Buyers and sellers itching to move face a market tug of war as affordability continues to challenge the sale

ENGLEWOOD, CO – January’s housing market delivered a much anticipated and welcome spike in new listings across the seven-county Denver metro area and in markets statewide, according to the latest Market Trends Housing Report from the Colorado Association of REALTORS® (CAR) and analysis from the Association’s spokespersons across Colorado. Despite a perceived itchiness from buyers and sellers to get in the game, markets are facing more of a tug of war thanks to higher interest rates, elevated median pricing, rising insurance premiums, property taxes and HOA fees as affordability challenges the ultimate sale, particularly for entry-level buyers.

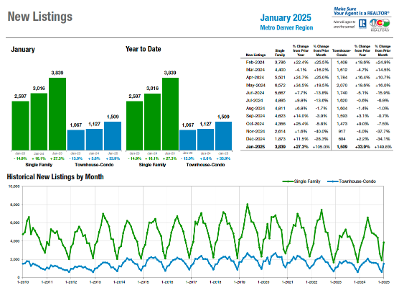

A total of 3,839 new, single-family listings hit the seven-county Denver metro area in January, up 105% from December and a 27.3% increase from a year prior. Condo/townhomes new listings also spiked just shy of 150% in the past month. The 1,509 new listings are up nearly 34% from January 2024.

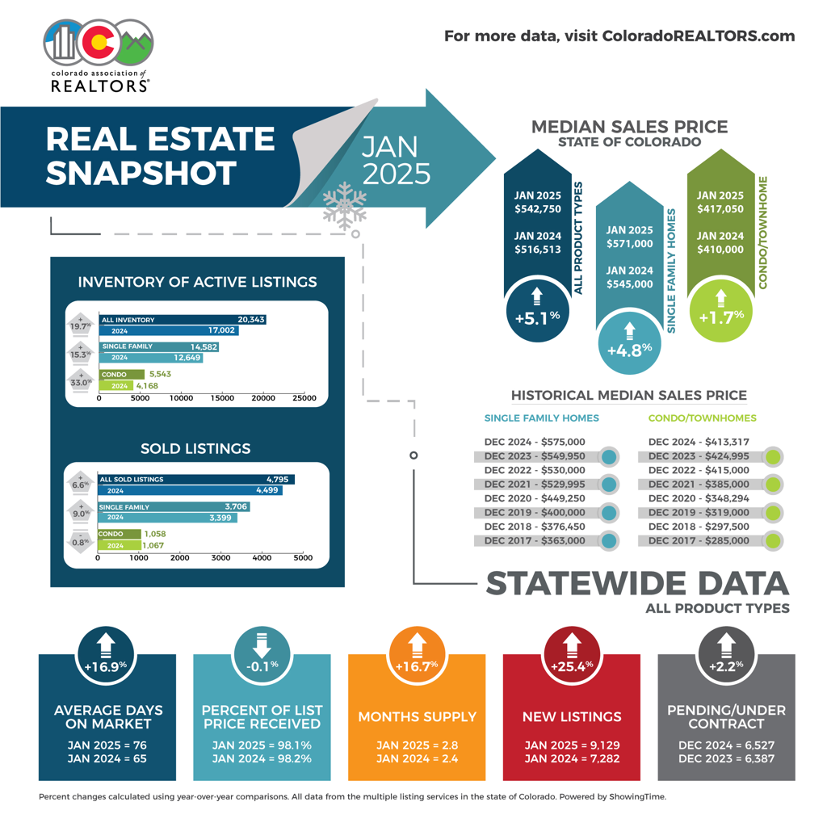

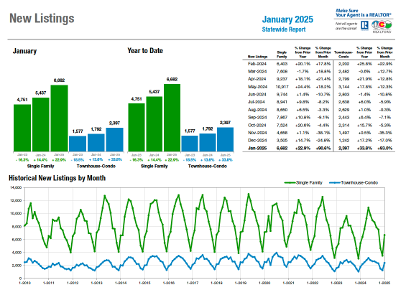

Statewide, the 6,682 single-family new listings were up more than 90% from December to January and were up just shy of 23% from a year ago. The 2,397 condo/townhome new listings in January represent a 93% increase in the prior 30 days and are up nearly 34% compared to a year ago.

Even with the significant increases in January inventory far outpacing the prior two January’s new listing numbers, median sales pricing remains steady in most markets.

“The situation is bittersweet,” said Colorado Springs-area REALTOR® Jay Gupta whose market delivered a record-high level of single-family and patio home inventory in January not seen since 2014. “As the saying goes, ‘Water, water everywhere, and not a drop to drink.’ This famous line from Samuel Taylor Coleridge highlights the irony and frustration of eager buyers who, despite desire and willingness to purchase, are being kept back by devastating inflationary economic conditions, affordability challenges, and tumultuous political turmoil blurring the future.”

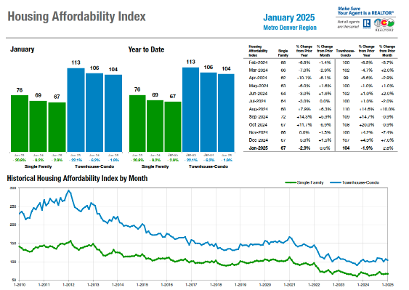

“The biggest obstacle remaining in the market is, of course, entry-level housing affordability. In particular, the condominium market segment has lagged behind single-family in nearly every metric of performance. The driving force behind these challenges has been ongoing increasing costs of ownership, such as insurance premiums, HOA dues, and property taxes,” said Denver-area REALTOR® Cooper Thayer. “Addressing entry-level housing is a top priority of real estate industry advocates, but solutions take time, and many entry-level buyers may continue to be priced out of the market this season.”

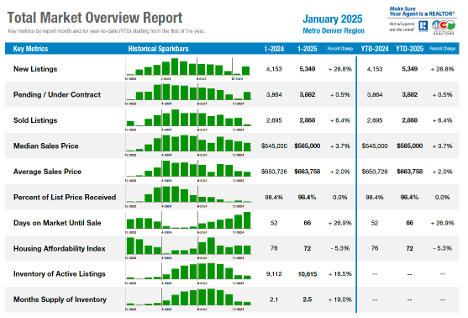

Total Market Overview – Seven-County Denver Metro

Total Market Overview – Statewide

HOUSING AFFORDABILITY – SEVEN-COUNTY DENVER METRO REGION

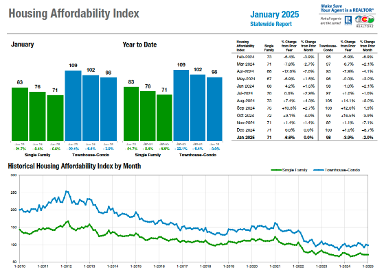

HOUSING AFFORDABILITY – STATEWIDE

NEW LISTINGS – SEVEN-COUNTY DENVER METRO AREA

NEW LISTINGS — STATEWIDE

LOCAL MARKET SUMMARIES

Taking a more in-depth look at some of the state’s local market data and conditions, the Colorado Association of REALTORS® Market Trends spokespersons provided the following assessments:

AURORA

“January may have been a cold month for our temperatures, but our housing market activity picked up with listings, pending sales, and closed sales all up as it appears that buyers and sellers are starting to get a jump on the spring selling season. Currently Aurora boasts approximately 1,390 available properties for sale with 570 pending and awaiting closing. We saw 338 properties close in the last 30 days.

“Southeast Aurora seems to have the largest available inventory with 136 active properties for sale and 80 pending in the 80016 zip code. Pricing is somewhat higher the further south you go where we have 89 active listings and 50 pending closing in zip code 80015. Moving to north Aurora, the inventory is much lower with only 77 active listings in zip code 80010 which includes the area near the CU Anschutz Medical Campus. In 80010 there 31 properties in a pending status. Zip code 80013 (central Aurora) has the highest available inventory with 191 properties for sale and 81 pending.

“It appears that buyers are ready, and inventory is there to meet the demand. It will be interesting to see how the next few months play out,” said Aurora REALTOR® Sunny Banka.

BOULDER/BROOMFIELD COUNTIES

“In Broomfield and Boulder counties, the year started out with a whisper. While many were hoping for a renewed energy after the first of the year, what we’ve seen is more of a cautious toe-dipping from buyers and continued reluctance from sellers. Broomfield County’s numbers are flat, no new listings and no appreciation since this time last year. For sellers who priced realistically, the average days on market is down to 48, and for those who didn’t, price reductions are accounting for over half of the listings on the market. Boulder County has seen a few more listings hit the market but with an average of 80 days on market, they are taking longer to sell.

“Both areas are seeing a surge in attached dwelling inventory due to several new home communities hitting the market. These more affordable units are geared towards first-time home buyers and the affordability of these properties are attractive to those who wish to live close to Boulder but not pay Boulder single-family home prices. The spring offers hope for more inventory but sellers need to be prepared to offer concessions to buy down the interest rate for interested buyers. The general feeling of the market is optimistic but cautious,” said Boulder/Broomfield-area REALTOR® Kelly Moye.

COLORADO SPRINGS

“Frustration in the housing market continues with no real winners. January delivered a mild win for sellers with total sold properties up 3.2%. But we stacked a lot of new inventory on the market, pushing active listings up 34.6%. Buyers saw a loss with the median price pushing up 5.7%. And so, it appears that 2025 is going to be the same sludge in housing that we dealt with all through 2024. Mixed data depending on price, higher interest rates across the board, and the wins will be on a case-by-case basis depending on buyer vs. seller motivation.

“Nationally, we saw the number of people receiving jobless benefits increase by 550,000 in the last two-and-a-half years. Continuing claims are running around 300,000 above 2019 levels. Hiring also fell to a low of 3.3%, also pre-pandemic levels. These numbers would show that the labor market continues to struggle. But it has not affected housing.

“Rates being higher for longer has not had the effect that most of us thought we would see by now. I fully expected housing to see some softening on prices. While we do see that in certain price points, it has not been the case overall. The industry is feeling it. REALTORS® and lenders are open to say that this is a very hard market. And that is grass roots. But from a 30,000-foot view, housing remains resilient, and the stagnant market of 2024 will continue into 2025,” said Colorado Springs-area REALTOR® Patrick Muldoon.

COLORADO SPRINGS

“In January 2025, the Colorado Springs real estate market saw a record-high inventory of single-family and patio homes in January since January 2014. Conversely, in January 2021 and 2022, we experienced the lowest levels of home inventory on record for January. This current surge in the inventory of available homes is an incredible opportunity for buyers to find properties that meet their preferences and to negotiate more favorable offers with motivated sellers. However, the situation is bittersweet; as the saying goes, ‘Water, water everywhere, and not a drop to drink.’ This famous line from Samuel Taylor Coleridge highlights the irony and frustration of eager buyers who, despite desire and willingness to purchase, are being kept back by devastating inflationary economic conditions, affordability challenges, and tumultuous political turmoil blurring the future,” said Colorado Springs-area REALTOR® Jay Gupta.

Other Key Highlights from the Colorado Springs Market include:

- Active Listings – Supply: In January 2025, there were 2,514 single-family and patio homes for sale in the Colorado Springs area, marking a slight month-over-month increase of 0.4% and a whopping year-over-year increase of 43.7%. This inventory level was the highest for January since 2015. The overall months’ supply of active listings stood at a healthy 3.6 months. For homes priced under $400,000, the supply was at 3.1 months; for homes priced between $400,000 and $600,000, it was at 3.2 months; for homes priced between $600,000 and $1 million, the supply was 4.5 months; and for homes priced over $1 million, it was 5.8 months.

- Sales – Demand: Last month, only 696 single-family and patio homes were sold in the Colorado Springs area, representing a significant decrease of 20.6% compared to the previous month and a smaller year-over-year decline of 4.2%. The monthly sales volume also decreased by 20.3% from the previous month, but there was a year-over-year increase of 9.4%. Year-to-date sales volume is down 10.1% compared to last year. However, compared to January 2015, 10 years ago, the monthly and year-to-date sales volumes have massively increased by 129.7%.

- Days on the Market: The average number of days on the market in January 2025 was 68, compared to 57 days last month and 54 days in January last year.

- Price Reductions: Last month, 36.4% of active listings in El Paso County and 28.5% in Teller County had price reductions.

- Sales by Price Range: Last month, 27.2% of homes sold were priced under $400,000, while 45.3% sold for between $400,000 and $600,000. Homes priced between $600,000 and $1 million accounted for 21.7%, and those over $1 million represented 5.9% of the sales. Comparing January 2025 to the previous year, there was a 10.4% decrease in the sale of single-family homes priced under $400,000. In contrast, the market saw a 1.3% increase in homes priced between $400,000 and $600,000, a 25.8% increase in homes priced between $600,000 and $1 million, and a 13.4% increase in homes selling for over $1 million.

- Average & Median Sales Prices: Last month, the average and median sales prices of single-family and patio homes reached historically high levels for January, at $548,541 and $482,250, respectively. The average sales price rose 5% year-over-year and 46.1% since January 2020, 5 years ago. Similarly, the median sales price climbed 7.2% year-over-year and 43.2% since January 2020

DENVER METRO (11-County)

“Market activity is starting to pick up pace across the Denver-metro area as we enter the annual spring selling season. Over 5,300 new listings hit the market in January, 28.5% more than the same month last year, and a sizable +115.2% increase from the month prior. Median sales prices declined slightly month-over-month to $565,000 in the metro area but remained elevated (+3.7%) over this time last year. Average time on market continued climbing to new 12-year highs, indicating buyers are taking a cautious approach to the market, constrained by new lower levels of relative inventory in contrast to market conditions over the past year. Market sentiment, however, remains very optimistic as it seems buyers are nearly fully acclimated to the ‘new normal’ of mortgage rates in the 6% range.

“In my ‘boots on the ground’ experience so far this year, it feels like buyers and sellers who have waited on the sidelines over the past few months are itching to move, and pent-up supply and demand are about ready to enter the market. Despite cooling activity over the past two years, driven by a lack of motivation, there’s an underlying sense of eagerness emanating from both the buy- and sell-side. Home prices have remained strong and resilient to economic factors, and consumer sentiment has been steadily improving. If market conditions continue to become more attractive in the coming months, we could be in for a wave of demand driving the Denver-metro market back to the competitive, fast-moving nature we’ve come to expect.

“The biggest obstacle remaining in the market is, of course, entry-level housing affordability. In particular, the condominium market segment has lagged behind single-family in nearly every metric of performance. The driving force behind these challenges has been ongoing increasing costs of ownership, such as insurance premiums, HOA dues, and property taxes. The ‘perfect storm’ of 30-40% jumps in these non-mortgage costs, combined with interest rates remaining elevated over the past few years, has built additional barriers to entry in the already limited stock of entry-level homes across the Denver metro region. Addressing entry-level housing is a top priority of real estate industry advocates, but solutions take time, and many entry-level buyers may continue to be priced out of the market this season,” said Denver County-area REALTOR® Cooper Thayer.

DURANGO/LA PLATA COUNTY

“With a virtually snowless winter, sellers have been chomping at the bit to list their homes and make a move earlier than is customary in Durango and La Plata County. Newly listed single-family homes are 124% higher in number this January over last, and condos/townhomes are 18% higher.

“Outside of the resort area, Buyers tend to be scarcer in the winter, but more serious-we have seen La Plata County single-family sales jump 18% over last January (32 vs. 27) and condos/townhomes are par with last year’s number of sales at 14.

“With just one month’s inventory to reflect on, it’s impossible to detect trends for 2025; instead, we have “just the facts, ma’am”. The median price of La Plata County single-family homes sold in January was $719,900 and in town Durango was $1,336,500. Month’s supply of inventory is higher in the county this January at 3.2 months vs. 2.7 last year for single-family and 3.6 for condos/townhomes vs. 3.4 in 2024, while the number has fallen in-town Durango single-family homes at 1.8 months inventory vs. 2.1 months. We hope for snow on the way to end our winter season and assist in bringing in spring break travelers in March,” says La Plata County-area REALTOR® Heather Erb.

FORT COLLINS

“The real estate market is in a tug of war – with itself. Like the mystical creature, the pushmi-pullyu, mortgage rates are in a seemingly endless tug-of-war as many economic factors indicate a lower mortgage rate would be appropriate (lower actual inflation numbers), while simultaneously, other economic factors (rosy jobs report, the new administration’s tariff announcements) drive them higher. The result is a mortgage interest rate that can’t seem to move off the 7% pivot point for more than a day or two at a time.

“The challenges of a pushmi-pullyu market are numerous. When you look at January sold numbers year over year, it shows a 21% improvement, but if you compare it to the number of sales in December – it has dropped 64%. The post-election enthusiasm was evidently short-lived. Neither buyers nor sellers feel like they have an upper hand, which really says we’re in a balanced market even though the months supply of inventory stands at just two months. Demand for housing is palpable but first-time buyers can’t participate with mortgage rates at this level. Many sellers won’t participate because they’re still enjoying historically low interest rates on the houses they currently own. But that hesitation may be wearing thin as new listings in January jumped over 13% year over year – more than double the new listings that came on in December.

“Another tug-of-war indicator is median price. Over the course of the last quarter of 2024, the median price in Fort Collins moved up and down like a washboard-riddled country road. October 2024 was $631,000, November dropped to $585,000, December popped up to $595,000, and last month we hit $600,000. Certainly not numbers that indicate an overall appreciating market but also not numbers that show a market in significant decline.

“One of the most curious things about a pushmi-pullyu is that for the animal to move in any linear fashion, half the animal would have to walk backwards so the other half could walk forwards. It took more than a little cooperation for the two-headed beast to move any significant distance in a single direction. It is analogous to the current state of our real estate market. Opposing forces creating a stagnating result. Perhaps as the thaw begins this spring, we’ll see movement in this otherwise stymied market,” said Fort Collins-area REALTOR® Chris Hardy.

GRAND JUNCTION/MESA COUNTY

“We’re experiencing a positive start to the year in comparison to January 2024 across Mesa County. New listings, pending sales and solds are all up from this time last year however, on the flip side, they are all down from December 2024. With only 160 sales in January, we still have a long way to go. Median pricing came in at $397,500, with the average price at $479,086. Days on market increased to 101, giving buyers more time, but it’s something sellers have to adjust to. Our most active price ranges remain $300,000-$500,000 but surprisingly, we saw strong January activity in the $700,000-$1 million range,” said Grand Junction-area REALTOR® Ann Hayes.

GUNNISON/CRESTED BUTTE

“It is hard to read anything into the January statistics in a small market like Crested Butte and Gunnison since January isn’t one of our biggest sales months and just one sale or the lack of one big sale can skew the numbers. For the entire Gunnison Crested Butte area, January 2025 had one less sale than 2024 (33 vs. 34) and the dollar volume was slightly down as well ($39.9 million vs. $45.6 million in 2024). The Gunnison area had the same number of sales each year with 13, but the dollar volume was down significantly ($7.3 million vs. $11.3 million in 2024) due to the fact that there were three sales over $2 million last year and only one that was just under $2 million this year. The area around Crested Butte was slightly busier this year with 17 transactions vs. 13 in 2024, but the dollar volume was more than double the amount we had in 2024 ($14.8 million in 2024 vs. $31.2 in 2025). Again, the difference is in the number of high-end properties that sold this year. This year, we had four sales over $3 million vs. just two in 2024 and of those, two were over $5 million vs. just 1 in 2024.

“While it can be tough to make any predictions for the year based on January sales, I can tell you that our inventory is down about 10% from last year, but we are seeing new properties come on the market and sell quickly if they are priced correctly. We also have more under contract right now than we did last year and in the first weeks of February, the activity level has increased – both in terms of buyers looking at properties and sellers putting their homes up for sale. People are tired of waiting for interest rates to go down to make their next move and so that could bode well for the Crested Butte and Gunnison real estate market in 2025,” said Crested Butte-area REALTOR® Molly Eldridge.

PUEBLO

“The Pueblo real estate market showed some positive numbers in January with new listings up 13.5% compared to January 2024 and overall inventory up just shy of 11%. Pending sales were up 10.7% compared to the same time last year as well. Our average days on market dipped slightly but remains right around three months. Looking to the percent-of-list-price received, we remained fairly strong at 97.5%. Sold properties in January fell 4.7% compared to a year prior and we did see our median pricing fall 4.7% to $305,000.

“We don’t anticipate any real growth over the next few months as buyers continue to wait for interest rates to stabilize in the low 6% range. Escalating home insurance prices aren’t helping sales either and insurance companies are implementing a lot more in the way of limits on what they will and won’t cover for roofing and much more.

“That said, we have seen some uptick in showings and the attitude of buyers and sellers is improving,” said Pueblo-area REALTOR® David Anderson.

SAN LUIS VALLEY

Looking at markets across the San Luis Valley, REALTOR® Megan Bello said, “Overall, home prices are climbing significantly in most areas, but inventory constraints and longer selling times suggest a shifting market dynamic.” She shared the following county summaries:

- Costilla County – saw a sharp increase in median home prices, rising 75% to $350,000, despite a slight decrease in inventory. However, homes are taking longer to sell, with days on the market increasing by 17.9%.

- Conejos County – experienced a dramatic 189.6% surge in median sales price to $347,500. However, new listings dropped by 60%, and homes are staying on the market much longer, with an increase of 244.1% in days until sale.

- Mineral County – had no recorded home sales in early 2025, marking a complete drop from 2024, when the median price was $400,000. Inventory has also been cut in half.

- Rio Grande County – had a strong 187% jump in median prices to $485,000, with an 80% increase in sold listings. However, homes are taking longer to sell, and inventory levels remain tight.

- Saguache County – saw a 70.8% increase in median prices to $316,000, while new listings tripled. However, sold listings declined slightly, and the market remains slow-moving.

- Alamosa County – showed a steady 28.8% increase in median prices to $335,000, with a rise in new listings but a small decline in sales. The market remains relatively stable compared to other counties.

STEAMBOAT SPRINGS/ROUTT COUNTY

“In Steamboat Springs, two single-family homes sold in January at an average sales price of $3,682,500. This activity represents five fewer transactions than 2024. The month did see an increase in new listings; 19 vs. 10. Eight of the new listings are currently under contract, with five of those residing in a new subdivision which has initial pricing in excess of $1.35 million. Multi-family units realized a 21.1% increase in transactions sold with a median sales price of $860,000. New listings were also significantly more for condos/townhomes than January of 2024; with about one third of those now pending. Months supply for Steamboat is hovering around four months.

“In the outlying Steamboat Springs communities, there was an insignificant number of new listings for Clark, Oak Creek, and Hayden – as well as sales. Inventory is very low with Clark having four homes for sale, Oak Creek six, and Hayden 13. Hayden inventory for multi-family is seven units and represents about a six-month supply. January realized one townhome sale which closed for $399,000 – an improvement over 2024 which did not realize a sale.

“Routt County is witnessing new developments at various stages in the planning phases as well as construction. In addition to the new housing development located between the west end and downtown Steamboat, the ski base area has two upper-end developments currently underway – each at different stages of construction. In Hayden, the first phrase of Prairie Run would feature a mixture of 135 units comprised of rental two-story apartments, townhomes, and live-work units. Most of the units offered for sale will be deed restricted. The area of Stagecoach has an Oak Creek address and is home to Stagecoach Reservoir and a State Park. Stagecoach in the 1970s was home to a short-lived ski resort. Applications for plans have been submitted to the Routt County Planning Department to develop a private ski resort along with hundreds of luxury homes. Another developer has an application in to subdivide about 40 acres of an 89-acre parcel into 89 single-family lots, 33 duplex lots and 40 multi-family units which would all be sold at free market pricing,” said Steamboat Springs-area REALTOR® Marci Valicenti.

SUMMIT, PARK, AND LAKE COUNTIES

“The resort market keeps chugging along like a mountain train – steadily climbing, but at a slower pace. Sellers are securing about 98% of their list price, yet properties are spending 25% more time on the market. Nationally, median sales prices went up 6% but in Summit and Park counties, they rose 19%, showing that buyers are still eager to hop aboard the ski train.

“One of the most striking trends is the shift in which price ranges are gaining traction. Comparing January 2025 to January 2024, multi-family home sales in the $2 million to $5 million range surged 300%, while single-family homes priced between $5 million and $10 million saw a 33.3% increase. Homes in the $1.5 million to $2 million bracket also experienced a remarkable 200% jump in sales,” said Summit-area REALTOR® Dana Cottrell.

Average Single-Family Home Sale Prices (January 2025):

Summit County $2,533,133 (24 sales, up from 15 in Jan 2024)

Park County $ 618,176 (11 sales, down from 18 last year)

Lake County $1,290,411 (1 sale, down from 3 last year)

Average Multi-Family Home Sale Price (January 2025):

Summit County $1,041,508 (55 sales, up from 46 last year)

“Among the 509 active residential listings in Summit, Park and Lake counties, the most affordable listing is a mobile home in Park County priced at $137,500, while the most expensive is a luxurious single-family home in Breckenridge, is priced just shy of $19 million. There are eight listings over $10 million,” added Cottrell.

January saw 92 sales with a wide range of price points:

· Lowest Sale: A mobile home in Dillon for $262,400.

· Highest Sale: A Breckenridge single-family home for $9.2 million.

Luxury buyers remained active with 51% of all sales surpassing the $1 million mark and nearly 47% of transactions closing in cash. With more sales, rising prices and an expanding inventory compared to last year, 2025 has started with strong momentum in the mountain real estate market. *These numbers exclude time share, deed restricted, land and commercial properties.

Luxury buyers remained active with 51% of all sales surpassing the $1 million mark and nearly 47% of transactions closing in cash. With more sales, rising prices and an expanding inventory compared to last year, 2025 has started with strong momentum in the mountain real estate market. *These numbers exclude time share, deed restricted, land and commercial properties.

TELLURIDE

“The Telluride regional market pulled back a little with 29 sales this January which is the exact same number that we had in January 2024 however, the dollar volume was down 37% to $52.22 million compared to $89.2 million in January 2024. What was also different was the volume was almost evenly dispersed across the town of Telluride, the town of Mountain Village, and the rest of San Miguel County. Telluride dollar volume was $20.57 million across nine properties, $14.65 million over nine transactions in the town of Mountain Village with the rest of San Miguel County having $16.99 million in 11 transactions.

“It’s too early to see if this is a trend. Our market is truly small which requires at least three months sales stats to spot a true trend,” said Telluride-area REALTOR® George Harvey.

VAIL

“We began the year with a similar trajectory to January 2024. There was a significant, 18.7% jump in listing inventory compared to 2024 and we have reached the highest level in recent years. However, the inventory is skewed to the condo/townhome sector which had a 40% increase with the single family/duplex segment increasing just 3.4%. This has created an inventory that is basically equal for each of the segments. The inventory of the condo/townhome segment is basically new and has a greater position in the lower pricing niches. Months supply of inventory hit 5.8 for single- family/duplex with condo/townhome at 4.3 months. The larger inventory has taken a certain level of urgency out of the buying process and, as a result, properties are staying on market for a longer period.

“Closed sales were down 3% for the month however, sales revenue was positive 4.5%. This follows the trend we experienced throughout 2024 and is driven by the continuing changes in market share in the different pricing niches:

2024 2025

Units $ Units $

<$1 mil 30% 10% 31% 8%

$1-$2 mil 35% 25% 37% 22%

$2-$3 mil 16% 17% 13% 13%

$3-$4 mil 5% 6% 7% 10%

$4-$5 mil 3% 5% 3% 6%

$5 mil + 11% 37% 9% 41%

“The two lower price niches cumulatively equal the unit percentage for the under $1 million niche pre COVID. The two highest price niches now represent three times their unit share pre COVID. This has been an evolving market performance for the post COVID period. The trend seems to be the new normal as macro-economic factors couple with availability of private land for future development. Thus, the market should find more predictability and less volatility going forward,” said Vail-area REALTOR® Mike Budd.

The Colorado Association of REALTORS® Monthly Market Statistical Reports are prepared by Showing Time, a leading showing software and market stats service provider to the residential real estate industry and are based upon data provided by Multiple Listing Services (MLS) in Colorado. The January 2025 reports represent all MLS-listed residential real estate transactions in the state. The metrics do not include “For Sale by Owner” transactions or all new construction. CAR’s Housing Affordability Index, a measure of how affordable a region’s housing is to its consumers, is based on interest rates, median sales prices and median income by county.

The complete reports cited in this press release, as well as county reports are available online at: https://www.coloradorealtors.com/market-trends/

###

CAR/SHOWING TIME RESEARCH METHODOLOGY

The Colorado Association of REALTORS® (CAR) Monthly Market Statistical Reports are prepared by Showing Time, a Minneapolis-based real estate technology company, and are based on data provided by Multiple Listing Services (MLS) in Colorado. These reports represent all MLS-listed residential real estate transactions in the state. The metrics do not include “For Sale by Owner” transactions or all new construction. Showing Time uses its extensive resources and experience to scrub and validate the data before producing these reports.

The benefits of using MLS data (rather than Assessor Data or other sources) are:

Accuracy and Timeliness – MLS data are managed and monitored carefully.

Richness – MLS data can be segmented

Comprehensiveness – No sampling is involved; all transactions are included.

Oversight and Governance – MLS providers are accountable for the integrity of their systems.

Trends and changes are reliable due to the large number of records used in each report.

Late entries and status changes are accounted for as the historic record is updated each quarter.

The Colorado Association of REALTORS® is the state’s largest real estate trade association representing over 25,000 members statewide. The association supports private property rights, equal housing opportunities and is the “Voice of Real Estate” in Colorado. For more information, visit https://www.coloradorealtors.com.