87% Qualify for Down Payment Help

More than 68 million single-family and condo households, about 87 percent, would qualify for down payment assistance available in the county where they are located.

That’s why CAR, in partnership with Down Payment Resource, has made available a portal through which both members and prospective homeowners can research their eligibility for various down payment assistance program based on property information, household information, and other special circumstances such as military background. The Colorado REALTOR® Down Payment Program is a free tool that helps you discover properties and homeownership programs that fit a buyer’s personal situation. For a view of available down payment programs by area, Click here to visit CAR’s Down Payment Program page.

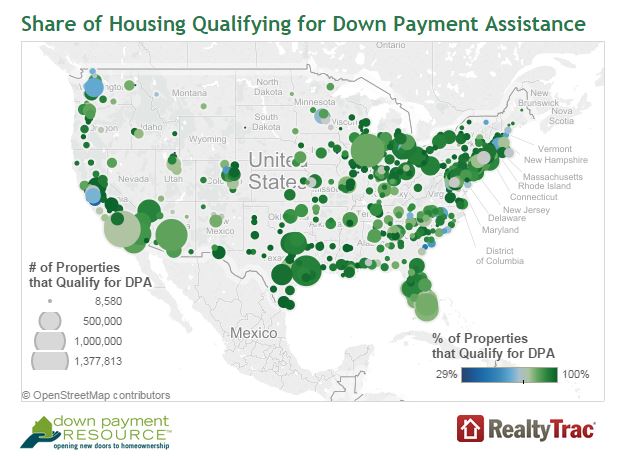

In a report released by RealtyTrac, more than 68 million (87 percent) of U.S. single family homes and condos in 1,792 counties with sufficient home value would qualify for a down payment program available in the county where they are located based on the maximum price requirements for those programs and the estimated value of the properties.

The report also highlighted the following:

- The average amount of down payment assistance across all counties is $11,565.

- At least one down payment program is available in all 3,143 U.S. counties, and more than 2,000 counties have more than 10 down payment programs available to prospective homebuyers.

- More than half of programs (54 percent) are Community Seconds, a second mortgage issued by an HFA or nonprofit organization with a very low or no interest rate. The payment on the second mortgage may be deferred or forgiven incrementally for each year the buyer remains in the home. In a typical scenario this could reduce the amount of cash needed to close from $20,000 to $200 (see infographic on our website).

- Other major program types:

- First mortgage loans with below-market interest rates or 100 percent financing.

- Mortgage Credit Certificates (MCCs) that provide up to $2,000 in annual tax credits for the life of the loan.

- Neighborhood Stabilization Program (NSP) loans and grants designed to revitalize communities that have suffered from foreclosures, high unemployment and other concerns slowing housing recovery.

See CAR’s Down Payment Program Page