How to Overcome the Biggest Obstacle to Home Ownership

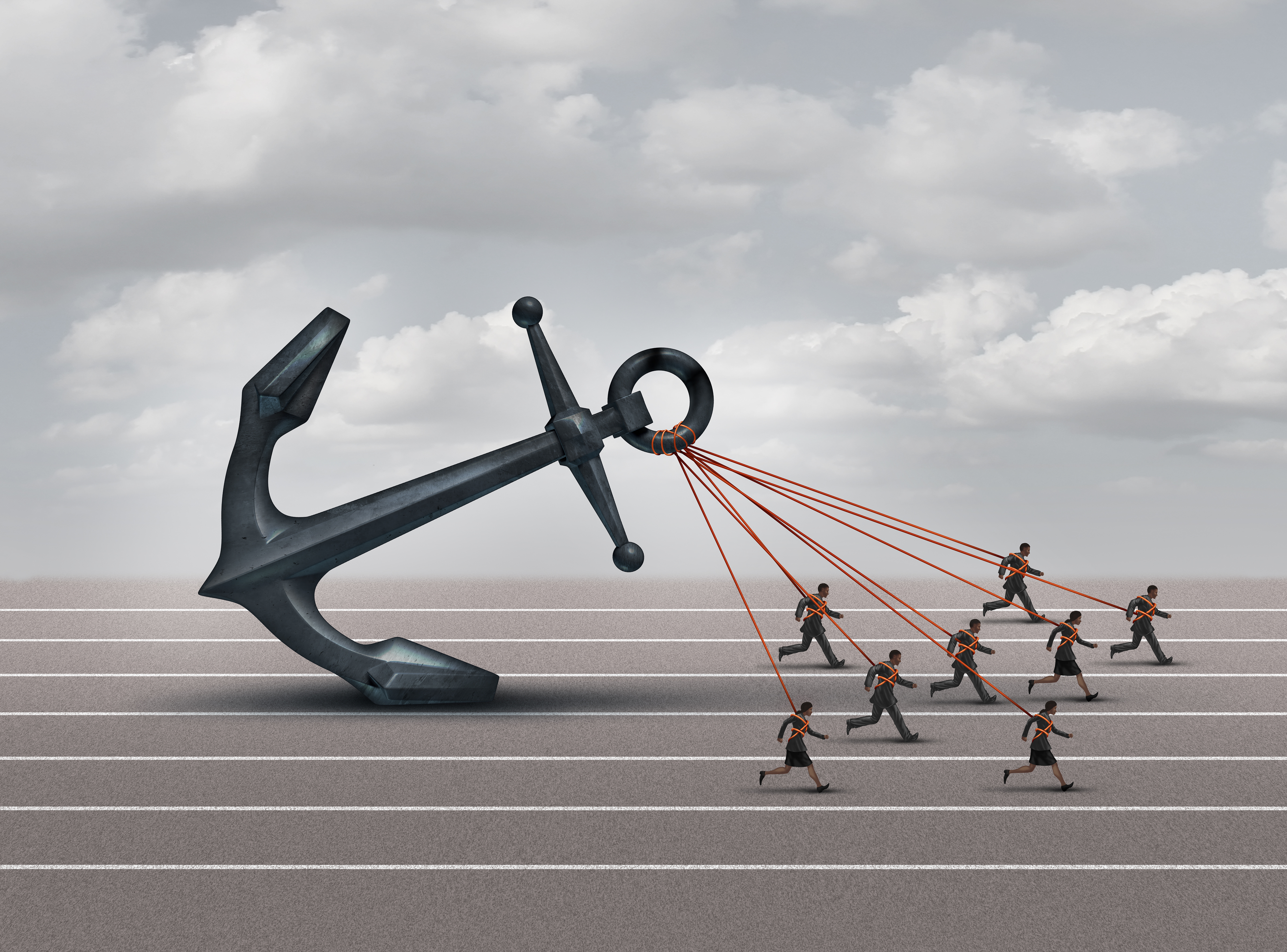

Raising enough cash for a down payment is often the biggest hurdle for homebuyers. According to some estimates, it can take up to 15 years for people to save towards the purchase of a home, especially with conventional mortgages, which require anywhere between 5 to 20 percent down. If you’re trying to buy a $400,000 house, that could equate to $80,000 in cash you...