Buyers Impersonate Pac-Man Gobbling Up State’s Housing and Driving Active Inventory to a New Record Low

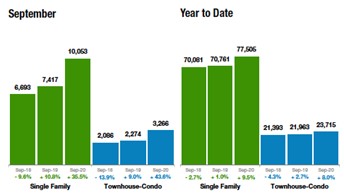

ENGLEWOOD, CO – Oct. 12, 2020 – Forty years after the release of the iconic Pac-Man video game, and a doubling of the state’s residential population to 5.8 million, Colorado house hunters have created their own version of the hungry, energy seeking video character, gobbling up available housing while frantically maneuvering through the residential market maze – all while trying to beat the competition chasing the same real estate prize. The continued strong demand and dwindling supply has pushed the inventory of active listings down more than 54% (9,804 homes) statewide compared to a year ago, according to the latest monthly housing data from the Colorado Association of REALTORS® (CAR).

In the seven-county Denver metro area, active listings for single-family homes are down nearly 60% (4,656 homes) from September 2019, Both the state number and Denver-metro number reflect new record lows since CAR began tracking the figure a decade ago.

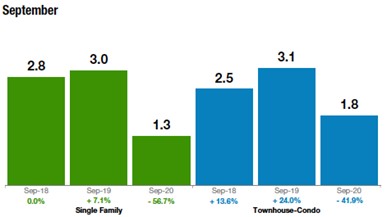

Despite the strongest September in the past 5 years for new listings (12,630), another very active month for pending/under contract properties, along with a September record for sold listings (13,039) kept the median sales price relatively flat but still up more than 12% statewide to $450,000 from a year prior. In the Denver metro area, the median sales price is up more than 13% from a year prior and now sits at a record high $493,500. The combination of factors drove the months supply of inventory for single-family homes to just 1.3 months statewide and just one month in the Denver metro area, again, both record lows.

While the challenges faced by house hunter Pac-Man across Colorado are significant, the successful navigation of the maze continues to energize the local and state housing markets.

Taking a look at some of the state’s local market conditions, Colorado Association of REALTORS® market trends spokespersons provided the following assessments:

AURORA

“The best question for this housing market would be, where are all the listings? The Aurora, Centennial and Parker markets will teach buyers and agents that we must have patience in the home-buying process. Buyers must have everything in place regarding their financing and be prepared to pay more. Currently, inventory in Centennial is down 70% from Sept. 2019. That is a huge reduction in home choices. Consequently, home prices are up over 8% and days on market are down to 14 days. The median price is $525,500, an increase of 8.4% over last year.

“Aurora is experiencing about the same with inventory down 55% and prices up to a median for the entire City of Aurora, of $415,000 which reflects an 8% increase over last year. The various zips codes are showing a slight variance; 80018 shows inventory down 73.8%, with a median price of $435,000, while 80016 reflects inventory levels down 76.8% and a median price of $442,000.

“The market is very competitive right now with the inventory levels so low. The upside is that interest rates are low, and there are new listings coming on the market every day. Buyers should not give up. It is challenging however, the more open you can be with your choices of price, location and other amenities, the better chances that the buyers will be able to get a winning offer,” said Aurora-area REALTOR® Sunny Banka.

BOULDER/BROOMFIELD

“Memo to homeowners: if there

was ever a time to sell your house, this is it. Consumer confidence has always

been a key indicating factor of the strength of a real estate

market. Apparently, consumers are feeling downright wonderful about the

market and are buying up every home that is listed. Compared to last year

at this time, Boulder County has 6% fewer listings on the market but 23% more

sales. Prices have risen nicely through all of the uncertainty this year,

with a healthy appreciation of 13% since this time last year. The month’s

supply of inventory has dipped from what we already thought was an incredibly

lean 3 months to under 1.5 months. If not another home were listed, all of

the houses would be sold in about 45 days. Now, that’s a seller’s market.

“Townhomes and condos are flying off the shelves, too. We are seeing more inventory in this sector of the market as people require more space for working from home and want to move up to single-family homes. First-time buyers anxious to hop in the game are scooping them up quickly and we now only have 2.5 months of inventory in these types of properties. Prices have increased 14% and keep going up.

“It is worth noting that we typically see a waning market in the fall and this year, our spring market has been pushed into the fall. That means that we are in essence, comparing two different markets even though they are at the same time of the year. However, the bottom line is that, in spite of an uncertain world, people seem to need the stability and safety of home. Renters want their own place and those who need more space are clamoring to do it while interest rates are low,” said Boulder/Broomfield-area REALTOR® Kelly Moye.

COLORADO SPRINGS/PIKES PEAK AREA

“Irrespective of the absurdly low supply of active listings of single-family/patio homes in the Colorado Springs area housing market, September 2020 was a stellar month with the highest level of monthly and year-to-date sales, monthly and year-to-date sales volumes, as well as the highest level of average and median sales prices, compared to any September on record. Year-over-year, the home sales activity realized a more than 29% increase in monthly sales, a 5% increase in year-to-date sales, over 51% surge in the months’ sales volume, a 17 % increase in the year-to-date sales volume, 17% increase in the average sale price, and over 18% increase in the median sale price. The average sale price soared to $431,293, and the median sale price escalated to $385,000. All of this while, distressingly, active listings shrunk by more than 52%.

“Looking back 5-years and comparing single-family/patio homes sales in September 2015 with September 2020, the active listings have plummeted by 69%. However, monthly sales have risen by over 51%, year-to-date sales by 25%, monthly sales volume skyrocketed 144%, year-to-date sales volume soared 82 percent, median and average sales prices climbed more than 60%.

“Last month, 76.3% of single-family homes sold were priced under $500,000, 19.6% were between $500,000 and $800,000, and 4.2% were priced over $800,000. Year-over-year, there was over 40% drop in the sale of single-family homes priced under $300,000, primarily due to the inventory shortage, while over 103 percent increase in homes priced between $400,000 and $600,000, over 119% increase in homes priced between $600,000 and $1 million, and a gigantic over 262% in homes priced between $1 and 2 million.

“It is a fact that, even in a high demand real estate market, buyers generally purchase properties offering competitive values. Unsurprisingly, over 20 percent of the El Paso and Teller County active listings in the Pikes Peak MLS had price reductions. Sadly, pathetically low inventory and affordability challenges due to ever-soaring prices continue to be the most problematic aspect of the Colorado Springs-area housing market, especially for first-time homebuyers. Though the current level of escalated prices presents an overwhelming challenge for our local buyers, for buyers from the Denver area, our housing prices are still very attractive. As a result, there is an increasing interest among Denver buyers in our Colorado Springs listings,” said Colorado Springs-area REALTOR® Jay Gupta.

“Many think that fall brings a slowing down of the housing market. As September wrapped up, kids went back to school, or didn’t, we once again realized that housing is not seasonal in the Pikes Peak Region. It appears that it is not going to cool down as the weather changes. Even as new listings increased, we doubled down and had even more homes go under contract. And all price points were once again up. Which could be a copy and paste each month here.

“Nationally, we continue to get bad news across the board. New unemployment claims continue to be high and the retail industry, restaurants, movie theaters, airlines, hotels and more are getting crushed. At some point, all of this will have to balance out. If we do not see a correction in the employment side at some point, we will have to see a correction on the housing side. The two cannot run independent of each other forever. Low interest rates have arguably added to the higher prices and yet we’re not calling this inflation? Yet, the items we need the most have risen in price but are not included in the government’s inflation numbers. From housing to groceries, Americans are feeling the pinch of inflation.

“Gold and silver are great indicators of inflation and/or economic stability and we’re seeing both rise in value lately. Even after they pull back, they begin their rise again. This could be the canary in the coal mine. Add to that FHA, VA and Conventional loans continue to see very high delinquencies. FHA is now posting a 17.4% delinquency, which is catastrophic. Regardless of what we try to forecast, the fact is, housing continues to surprise most. And, with interest rates low, demand high, and the Front Range being a destination place for many who move, our housing continues to be on very solid footing,” said Colorado Springs-area REALTOR® Patrick Muldoon.

DENVER COUNTY

“In a ‘normal’ year (one wonders what that means anymore), we see spring rise, summer simmer and fall begin to cool with respect to real estate productivity. Traditionally, we peak in the ‘dark at 9 p.m.’ months then slide ever so slowly into moderate territory. However, like the rest of 2020, things are a little different this year. This fall, we remain just as hot as the peak months and while a little challenging due to lingering demand, that certainly doesn’t mean that homes aren’t selling. In fact, they are selling and smashing through records as they do.

“September saw a 9.7% increase in single-family homes coming to the market vs. September 2019 – condos and townhouses even better at 11.9%. Most would assume that more properties means more inventory – they would be partially correct. While 39% more single-family homes sold in Denver during September over the previous year, the ‘month’s supply’ dropped a whopping 44% to just 1 month, further demonstrating that 10% inventory bumps don’t come close to catching up with demand.

“The pause we all felt during the early Covid months could be the culprit with demand lingering well-past cooling months or, the lifestyle-type shift resulting from Covid could be the driving force behind our Indian summer. Whatever the factor or factors may be, Denver, and indeed the entire Metro, have still never been more desired places to be,” said Denver-area REALTOR® Matthew Leprino.

DENVER METRO

“Looking at the September statistics for the metro-Denver region, one item in particular stands out which is the months supply of inventory. As in prior months, we have commented about the low inventory or lack of inventory throughout metro Denver and this statistic drives home the point. The months supply of inventory fell from 2.7 in September 2019 to just one month supply this past September. It’s amazing and commendable to the metro area home buyers and sellers, as well as our REALTOR community, that we’ve been able to transact real estate with such low inventory. The pending/under contract numbers continue to soar with single-family homes increasing just shy of 30% and townhouse-condos increasing 32.7% compared to a year ago. Closed sales are now following close behind with sold listings for metro Denver up 26.2%. As affordability in the region continues to be a challenge, low interest rates are offering great opportunity,” said Denver-area REALTOR® Karen Levine.

DURANGO/LA PLATA COUNTY

“As with many areas across Colorado, Durango and La Plata County are seeing an astronomical surge in pending sales coupled with a severe lack of inventory, possibly breaking records in September. New residential listings are down 15% YTD; while pending residential sales are up 29% YTD, they rose year-over-year 131% in September. Overall, residential sales are up 11% YTD and 40% for the month. Sales of $2 million-plus single- family homes, which have never been a large segment of our market, are up 400% on a rolling 12-month basis.

“Active listings were down 60% and the month’s supply of inventory was down 63%, both when compared to 2019. The surge is strongly related to low rates, and we are seeing many multiple offer situations, leading to over- asking price contracts and prices that will not appraise. Although median and average prices are up, Durango remains the most affordable ski town. Clients are getting more emotional and stressed during the sales process, leading to more challenges between buyers and sellers,” said Durango-area REALTOR® Jarrod Nixon.

ESTES PARK

“Larimer County is hopping and showing no sign of a seasonal slowdown. Maybe it is built up momentum from earlier in the year that is just now coming forth. COVID slowed sales and new listings dramatically – almost to a hault, but in reality, only a pause to gain the energy now being released. Inventory is still very tight and demand is high. However, this is not a singular issue to our market, it’s being seen across the state.

“Sold listings are up dramatically at 43.4% for single-family homes. Townhouse-condos had an increase of 12.1% as well over September last year. Year-to-date there has been an overall increase of 7.7% in single- family homes and a 6.3% increase in townhouse-condos. New signs are hitting the yards slightly more with a 4.2% increase for single-family homes. Townhouse-condos are popping up much more at a 12.1% bump from this time last year. New listings are averaging less than last year-to-date, keeping inventory low still – a negative 2.5% for single-family homes and a larger drop of 7.5% for townhouse-condos. If the energy build up can continue into winter with the force seen in September comparisons it can be a good year.

“Low inventory and competitive mortgage rates are also driving up home prices. While we are not seeing offers consistently over asking, they are fetching 99.9% for single-family homes and 99.3% for townhouse-condos this September compared to September 2019. Average sales price is going up exponentially in single-family homes at a 16% increase to $538,476. Townhouse-condos are increasing, but not much, 2.4% to an average of $334,537. Does this trend show signs of a struggling housing class? More listings in townhouse-condos as finances wane? Are incredibly low mortgage rates allowing folks to reach for a home otherwise unattainable?

“Larimer County is a hustling, bustling place to be for real estate. So far this year has shifted and changed the energy in the region and it will be interesting to see how the market is shaped during the next few months,” said Estes Park-area REALTOR® Abbey Pontius.

FORT COLLINS

“The market numbers for Fort Collins tell an interesting story of supply and demand. The short version is that housing inventory is in limited supply and demand for housing is high. Basic economic theory claims when these two elements are in this type of opposition, prices go up. Our market as a whole is certainly demonstrating that with a September 2020 median sales price in excess of $485,000 and an average sales price over $550,000. Half-a-million dollars for a single-family home.

“But let’s put this in a bit of perspective. With interest rates for 30-year-fixed mortgages hovering just above 2.5%, clearly, the purchasing power for home buyers is at an all-time high. Consider this: in 1999 when we bought our first home, we paid $143,000. With 5% down and an 8% mortgage, our principal and interest payment was $996. That same house today would likely sell for $325,000. With 5% down and a 2.875% mortgage, the principal and interest payment would be $1281. While $281 a month is a 29% increase in monthly expenses, it’s a 227% increase in sales price. Clearly, the up-side of home ownership is the added financial security of an asset that appreciates in value over time.

“The underlying story for the Fort Collins market is the virtual disappearance of homes for sale under $300,000 (down more than 68% year-over-year) and the extremely limited number of homes for sale in the $300s and $400s (down 70% and 49% respectively, year-over-year). This dearth of inventory is forcing buyers to push the limits of what they can afford and allowing sellers to ask more for homes they purchased several years ago for substantially less. Thankfully, the low interest rates enable buyers to absorb a bit of this increase in price.

“At the other end of the spectrum, the number of houses sold over $700,000 has increased by nearly 35% in the last 12 months. How can this be when we’ve had a full six months of pandemic-induced economic recession? The answer seems to be that homeowners, as a statistical cohort, remain employed and working remotely compared to those who rent. Laborers, hospitality workers, and other hourly positions have taken the brunt of employer lay-offs, force reductions, and full-on business closures. Without additional stimulus to support these workers, the rental market may see a spike in rental delinquencies which, in turn, could force investment property owners to miss mortgage payments. Much of how this particular cascade effect plays out remains to be seen in the coming months as our nation goes to the polls to decide which leaders will take us forward,” said Fort Collins-area REALTOR® Chris Hardy.

FREMONT AND CUSTER COUNTIES

“The fall colors show a change is coming but the real estate market remains much the same as past months. Custer County’s year-over-year listings are lower by 14% with sales up 25%. Comparing September 2019 to this year, we see listings down 42% and sales up 82%. Each month the median and average sales price continues to increase, always because of little to no inventory that continues to make things difficult for buyers. The good news for sellers is that property values continue to increase, showing year-over-year appreciation of more than 20%.

“Fremont County real estate continues on a similar path, with year-over-year listings down 9.3% and sales up 2.7%. Year-over-year median sales prices are up 11.5% and year-over-year average sales prices are up 16.4%. Fremont County’s months supply of inventory in September 2019 was 3.8 months, today it is only 2 months. All of that is still good news for those selling. If you are buying, you must be fit and nimble to win the race,” said Fremont and Custer County-area REALTOR® David Madone.

GLENWOOD SPRINGS/GARFIELD COUNTY

“After a hectic summer with very little inventory and incredible price increases, September in Garfield County is seeing an increase in availability. It seems sellers have been waiting for the sweet spot in sales price to list their homes and the sweet spot has been found. New listings were up 30% for single-family homes but decreased a little over 4% for townhomes and condos, most likely due to buyer’s fear of losing out on what little inventory is available. Most inventory is scooped up within days of coming on the MLS and we are seeing more and more ‘sold prior to MLS’. Pending sales increased 39% for single-family homes and over 118% in the townhome-condo properties. Median sales price for all of Garfield County rose 31% to nearly $600,000 for single-family homes and $333,000 in the townhome-condo sector. Our days on market continues to hold at around 65 with a 2.1 months supply of inventory for single family while the townhome supply slips to 1.5months and 43 days on market,” said Glenwood Springs-area REALTOR® Erin Bassett.

GOLDEN/ARVADA – JEFFERSON COUNTY

“With new listings up 1.3% over last year at this time in Jefferson County, it was the 26.7% increase in solds that drove the median sales price up a whopping 16.1 percent, now at $535,050. Inventory is off nearly 64% with average days on market dipping to just 21. Homes that do come on market are typically gone within days. Fall has not slowed our market as we have seen in past years, this year it is going strong and most likely will continue strong through the end of the year. With record low interest rates, buyers are out in droves.

“Looking at the townhomes/condo market, new listings rose 29.2% from this time last year while sold listings rose just shy of 24% driving the median sales price up 5.8 percent to $314,000 year over year. Inventory is down 41% percent and average days on market dipped to just 16. More townhome/condos are entering the market than single-family homes however, buyers still need to view those properties and act quickly as they won’t be on the market for long,” said Golden/Jefferson County-area REALTOR® Barb Ecker.

GRAND JUNCTION/MESA COUNTY

“Mesa County, like most of the state, is experiencing heavy real estate activity. September 2020 compared with September 2019 has dramatic differences. New listings are down 12.8%, active listings are down 47.6%, but pending sales are up 16.6%. We are seeing multiple offers, and also some listings are allowing showings for a few days, and then all offers being reviewed on a specified date. As a result, median sales price is up 16.1%, and average is up 13.3%. We do still see quite a bit of fallout as more people become affected by the restrictions of COVID-19 on their employment. As mortgage rates continue to be as low as they are, it is anticipated that strong activity will continue,” said Grand Junction-area REALTOR® Ann Hayes.

PAGOSA SPRINGS

“Like most of Colorado, Pagosa Springs has shattered sales records (home, condo and land) with sold listings up 60% with 93 sales while active listings fell 66.2%. With winter coming and October sales trending to reduce inventory to a sluggish and historically low one-month supply, we are navigating through a thick forest with a big low inventory beast abound. Buyers are pushed to the reality of a high comfort level price point to achieve living in the atmosphere of a rural mountain community. Life style versus price is the new hunt and lifestyle is winning.

“Especially in a competitive, low-inventory environment, buyers should be ready to make their best offer at time of contract. Today’s buyers should consider ways to improve their offer, such as waiving certain contingencies, paying seller closing cost items, or accepting a closing timeline that fits the seller’s needs. With low interest rates, buyers can somewhat recover payments in a higher price point but need to wrap their head around their housing wants and needs. Patience and kindness also provide strength to their buying goal.

“Sellers with second homes in Pagosa Springs (traditionally 65% of homes purchased) are spending more time than ever in them as they discovered a haven for multi-generations. With remote school and work, second-home owners are now making these properties their home base. Some sellers have placed their out-of-state homes for sale and are making Pagosa Springs their permanent home. Unfortunately, that factor does not tame the low inventory beast. Other buyers are purchasing land with intentions to build in a few years. Land buyers are also experiencing multiple offer and higher than asking price scenarios. With over 60% of land in Pagosa Springs being federal, state, or tribal land, the inventory beast will also roar its ugly head there too. The demand will be there. The real question is whether the houses, condos and land will be there. The inventory beast has set the hunting frenzy to become slower. The new beast in the forest will shift from inventory to price,” ,” said Pagosa Springs-area REALTOR® Wen Saunders.

PUEBLO

“September delivered another great month for buyers and sellers throughout the Pueblo market as new listings were up 7.6% from September 2019 to 2020 and down just 3.7% year-to-date. All other categories were up including pending sales up 25.2% September 2019 to 2020 and 9.6% year to date.

“Sold listings were up 14.7% over September 2019 and year-to-date we sit up 4.6%. The average sale price rose 19% September to September and 9.4% year to date. The Sept 2020 percent of sale price to list price was 100.1%. I do not remember that ever happening before.

“Days on market dropped to 69 days from 73 days. Total active listings dropped year-over-year more than 50%, from 524 to 261. This gives our market a little over one months supply of inventory. New construction, 62% of which is in Pueblo West is also increasing however, builders cannot build new homes fast enough to keep up with demand,” said Pueblo-area REALTOR® David Anderson.

STEAMBOAT SPRINGS/ROUTT COUNTY

“We’ll never forget March 14, 2020 when Colorado ski resorts were shut down in an emergency order and the ripple effect that occurred thereafter – even Mother Nature obeyed and for two weeks we received no snow. The days of quarantine seemed to drag, and we anxiously awaited June 1 to see restaurants and lodging re-open and for life to slowly return to Steamboat – and return it did. Even with almost all of the normal summer events cancelled, people came. Golf, tennis, pickleball, biking, tubing, boating, camping, hiking all became more popular than ever and having your own place in Steamboat and its surrounding communities became a priority for many. Third quarter has historically produced the most sales volume for our market; however, with the fears of Covid, no one could have forecast the upshot that July would kick off. As predicted, new listings were up in September – however, we certainly did not anticipate the margins they would increase by. Single-family listings were up a whopping 140% – registering year-to-date listings at 402 compared to 397 last year. New listings for townhouse-condos were up 73.8% which narrowed the gap to within -1.9% of new listings for 2019. With these increases, it is not surprising that pending sales were up 112% for single-family and 63.2% for multi-family.

“In 2019, Routt County experienced 37 sales of residential properties priced at $2 million and up. Currently, 43 properties in this price range have closed at an average sales price of $3.13 million with an additional 23 under contract. This surge seems telling that having a larger home with a home office and space for multi-generations to congregate has not lost its appeal.

“Even with the increased listings over the past two months, there is not enough inventory to meet demand. Some buyers are getting frustrated with lack of inventory, lack of days on market and/or multiple offer situations. New lending restrictions will be coming into play for condos with short-term rentals, effective in December which will have an impact. Given the current market conditions, we have three recommendations: 1. Be actively engaged with a full-time broker, 2. Don’t expect to find the perfect property and 3. Remember the proverb, ‘If at first you don’t succeed, Try, try, try again,’” said Steamboat Springs-area REALTOR® Marci Valicenti.

SUMMIT, PARK AND LAKE COUNTY

“After all of the leaf peeping, you can feel the cool nip in the evening air letting you know snow is just around the corner and it’s time to get your skis tuned. In Summit, Park and Lake counties we are working with many buyers that want to own a part of the magic in this part of our state. We see this desire to own in the high country through our real estate stats which are impressive, even to long time brokers who have seen it all.

“Summit County’s average single-family home price rose 23.5%

and condo prices were up 18.9% in September, year-over-year. Although inventory is low, we have had an increase in sales (94.7%) giving more buyers a chance to enjoy our

traditionally slower fall shoulder season. Buyers are looking to secure

their ski area property before the snow flies, but they have to be prepared

with pre-approvals and financing. As always, sellers need great visuals and

virtual tours to showcase their property,” said

Summit-area REALTOR® Dana Cottrell.

TELLURIDE

“The Telluride market continues to set records. September’s one-month sales were $182.6 million which broke the August monthly sales record of $125 million. Third quarter sales of $373 million were higher than the annual sales numbers for 2010, 2011, 2012 and 2013. The lack of inventory in the Town of Telluride and Town of Mountain Village has been driving home and vacant land sales 30-45 minutes out of town on the surrounding mesas. We are seeing homes that have been on and off the market in these rural areas sell quickly, sometimes above asking prices. Normally, sales start slowing near the end of September when the trees have lost their leaves and the golf courses close for the season. What we call ‘off season’ from about October 5 or so until Thanksgiving is when the tourists are gone and locals leave for their vacations. However, the last two weeks have been just as busy for properties contracting as in August and September. Simply put, in my 37 years of practicing real estate in the Telluride regional market, I’ve never seen anything like this. So far, increased asking prices of 10-15% above just six months ago hasn’t phased buyers. Inventory gets smaller and smaller by the week,” said Telluride-area REALTOR® George Harvey.

VAIL

“The 3rd quarter of 2020 has been amazing, but September was the apex of the current trend. Single- family/duplex sales were positive 60.5% and condo/townhomes were plus 35% versus September 2019. Pending sales for the month were plus 108.3% for single-family/duplex and condo/townhomes were up 114% compared to September of last year. The ongoing trend of inventory decline continued with single family/duplex negative 55.3% and condo/townhomes down 19.5%. The inventory declines continues to drive the months supply figures down to 3.3 months for single family/duplex – negative 60.7% — and condo/townhomes minus 16.9% versus 2019.

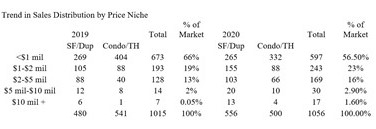

“Sales dollars for September represented a 140% increase over the same month in 2019, and transactions were positive 48.5%. The market has now exceeded September year-to-date in 2019 by 30.6% in dollars and 4% in units. We would never have projected this performance after the hit in the first half of the year. The chart below shows the shift in market niches that drove the market. However, the inventory levels are critical as the inventory in the highest transaction niches are at some of the lowest levels we have seen.

“Historically the under $1 million niche has represented between 65%-75% of the transactions in our market. The upper price points are driving the dollar performance year to date and, based upon inventory, should maintain the trend,” said Vail-area REALTOR® Mike Budd.

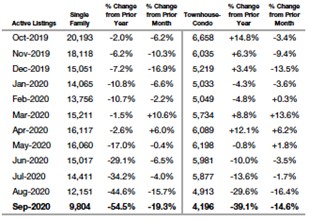

Inventory of Active Listings – Statewide

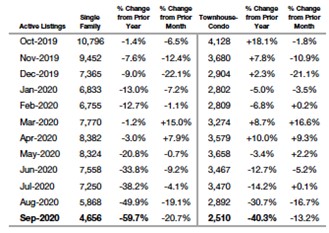

Inventory of Active Listings – Denver Metro area (Adams, Arapahoe, Boulder, Broomfield, Denver, Douglas and Jefferson counties)

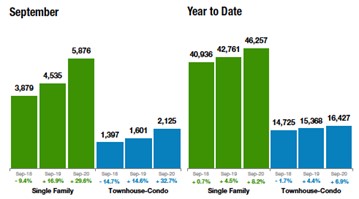

Pending/Under Contract – Statewide

Pending/Under Contract – Denver Metro area (Adams, Arapahoe, Boulder, Broomfield, Denver, Douglas and Jefferson counties)

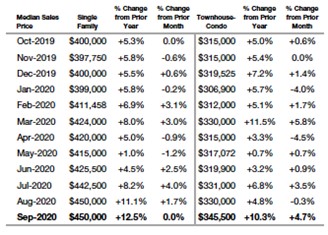

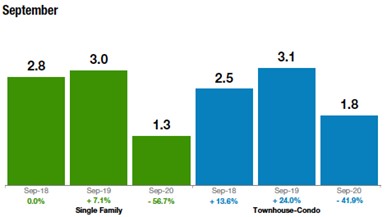

Median Sales Price – Statewide

Median Sales Price – Denver Metro area (Adams, Arapahoe, Boulder, Broomfield, Denver, Douglas and Jefferson counties)

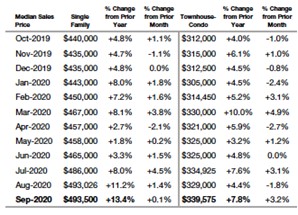

Months Supply of Inventory – Statewide

Months Supply of Inventory – Denver Metro area (Adams, Arapahoe, Boulder, Broomfield, Denver, Douglas and Jefferson counties)

The Colorado Association of REALTORS® Monthly Market Statistical Reports are prepared by Showing Time, a leading showing software and market stats service provider to the residential real estate industry and are based upon data provided by Multiple Listing Services (MLS) in Colorado. The September 2020 reports represent all MLS-listed residential real estate transactions in the state. The metrics do not include “For Sale by Owner” transactions or all new construction. CAR’s Housing Affordability Index, a measure of how affordable a region’s housing is to its consumers, is based on interest rates, median sales prices and median income by county.

The complete reports cited in this press release, as well as county reports are available online at: https://coloradorealtors.com/market-trends/

###

CAR/SHOWING TIME RESEARCH METHODOLOGY

The Colorado Association of REALTORS® (CAR) Monthly Market Statistical Reports are prepared by Showing Time, a Minneapolis-based real estate technology company, and are based on data provided by Multiple Listing Services (MLS) in Colorado. These reports represent all MLS-listed residential real estate transactions in the state. The metrics do not include “For Sale by Owner” transactions or all new construction. Showing Time uses its extensive resources and experience to scrub and validate the data before producing these reports.

The benefits of using MLS data (rather than Assessor Data or other sources) are:

- Accuracy and Timeliness – MLS data are managed and monitored carefully.

- Richness – MLS data can be segmented.

- Comprehensiveness – No sampling is involved; all transactions are included.

- Oversight and Governance – MLS providers are accountable for the integrity of their systems.

- Trends and changes are reliable due to the large number of records used in each report.

- Late entries and status changes are accounted for as the historic record is updated each quarter.

The Colorado Association of REALTORS® is the state’s largest real estate trade association representing more than 27,000 members statewide. The association supports private property rights, equal housing opportunities and is the “Voice of Real Estate” in Colorado. For more information, visit https://coloradorealtors.com.