Record breaking highs and lows challenge housing buyers statewide as supply disappears

ENGLEWOOD, CO – With the inventory of active listings down 40% to more than 70% in markets across the state compared to a year ago, potential home buyers are facing record-setting appreciation and median pricing in the face of all-time lows in active listings and months supply of inventory, according to the February 2022 Housing Reports from the Colorado Association of REALTORS®.

Despite a month filled with inflation concerns, a geopolitical crisis in Ukraine, and rising prices for basic commodities, the fundamental elements of supply and demand continued to dominate housing inventory and pricing statewide.

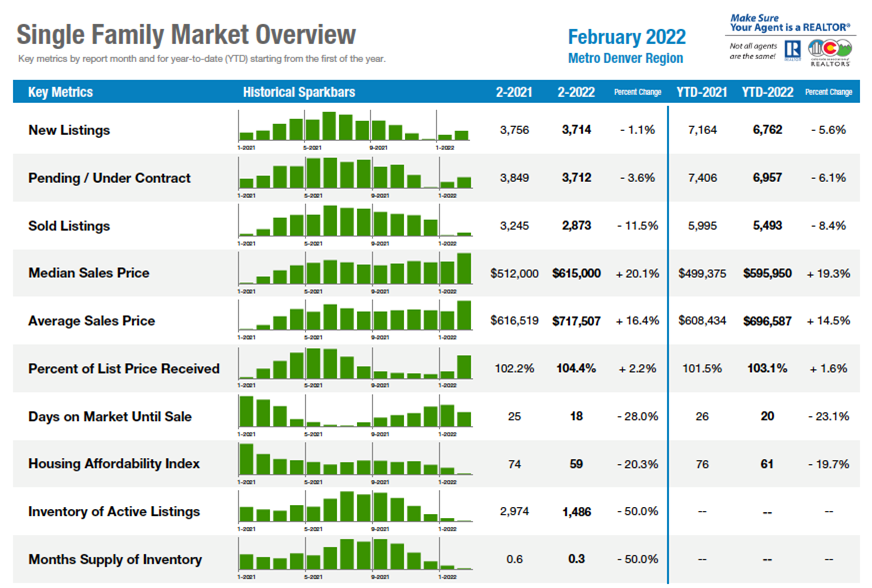

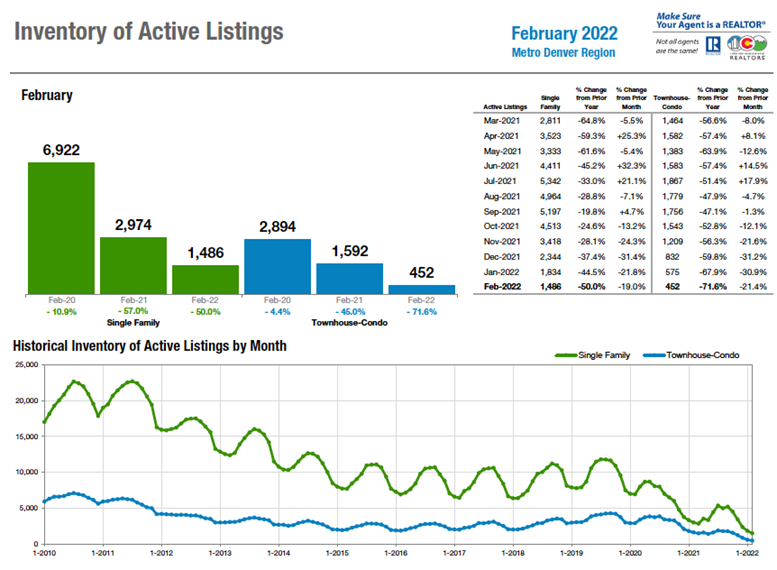

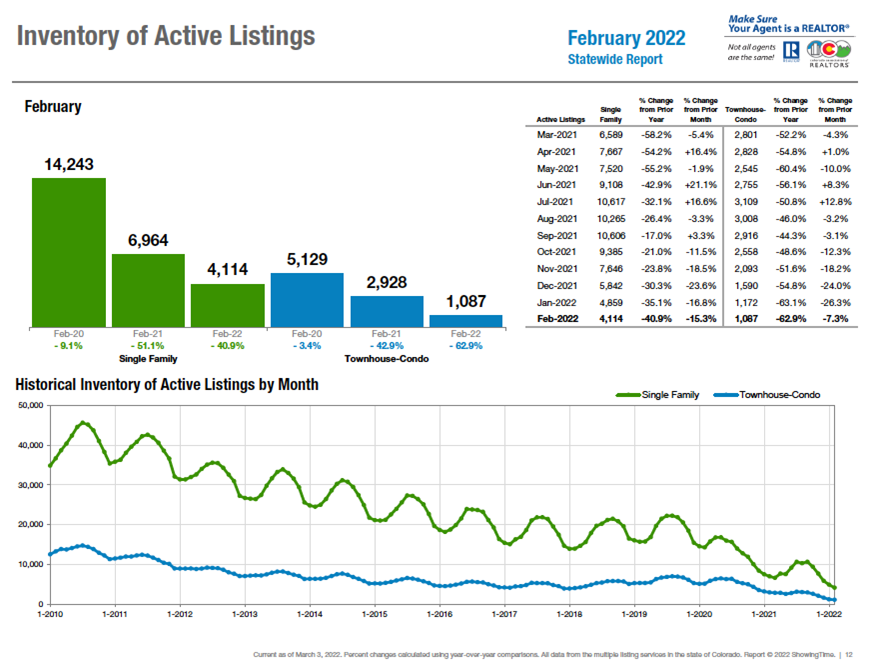

In the seven-county Denver metro area, there were just 1,486 single-family and 452 townhome/condo active listings at the end of February, down 50% and 71.6%, respectively from February 2021. Statewide, single-family active listings were off 41% from a year ago with just 4,114 total actives while the townhome/condo market saw just 1,087 actives in February, down 63% from a year ago.

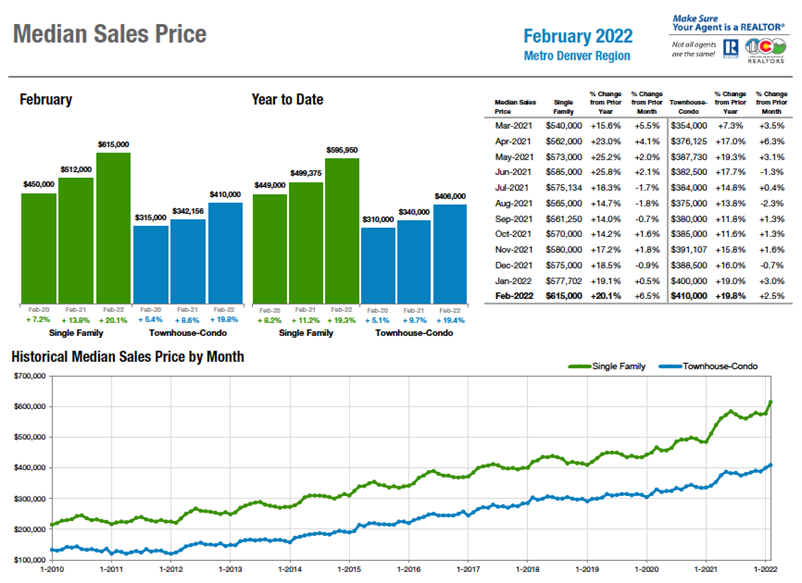

As a result, the percent-of-list-price received rose again in February, reaching as high as 106.3% in Denver County where, between January and February, the median price for a single-family home jumped from $575,000 to $659,000 – an increase of $84,000 or 14.6% in only 30 days. The median sales price continued its upward movement hitting a record $615,000 for a single-family home in the seven-county Denver area, up 20% from February 2021, and the townhome/condo market median price hit a new high as well at $410,000, also up 20% from a year ago.

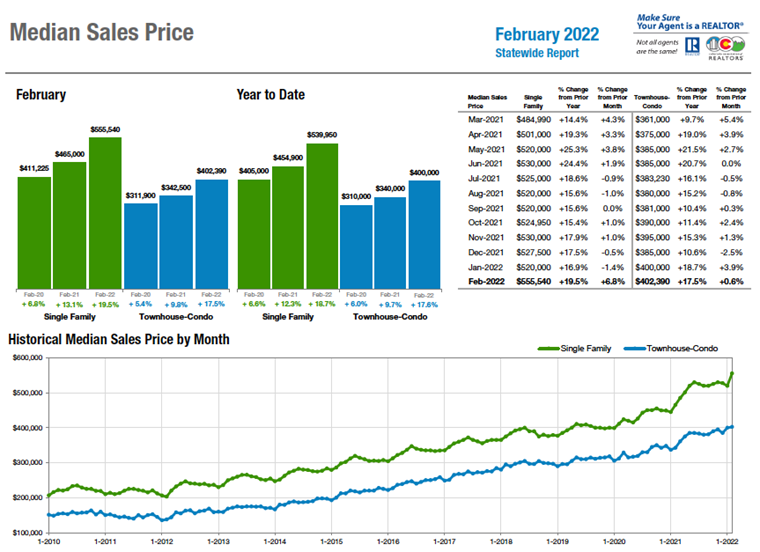

Looking statewide, the median price jumped nearly 7% from January to February and now sits at $555,540, a $90,000 increase over the same time last year. The townhome/condo market also tapped a new median pricing high in February at $402,390, up 17% from February 2021.

With diverse and local factors playing in across the state, here is a snapshot of select local market numbers and summaries:

- Aurora – An abundance of buyers with minimal listings result in a $795,000 median home price in the southeast part of the city (80016 zip code) where inventory is down 44% from a year prior and there are just 27 homes to choose from. As of March 8, there were 187 total active listings (single-family, condo/townhome) for the entire city of Aurora – the 3rd largest city in the state.

- Broomfield – There were 113 listings that came on the market in February however, most are under contract leaving just 15 active listings for buyers to compete for.

- Colorado Springs – February delivered a 13.5% decrease in new single-family listings year-over-year, pushing up prices along with appraisal gap coverages and escalation clauses. The one-year change in price was 16% and there was a 20.2% drop in active properties across all property types.

- Denver County – From January to February of this year, the median price for a single-family home in Denver County jumped from $575,000 to $659,000 – an increase of $84,000 or 14.6% in only 30 days – more than we saw during all of 2016. In addition, the listing-to-sold-price ratio also broke a record, month-over-month at 106.3%.

- Durango/La Plata County – The average sales price of a Durango single-family home was up 49% in February compared to the same time last year and now sits at just over $1 million, a new benchmark. Townhome and condo prices rose an astounding 70% with an average sales price of $630,000. Durango is emerging as the next and possibly last true resort town in Colorado. Historically, Durango has been viewed as a laid-back mountain town filled with ski bums and river rats. That perception has changed with the influx of affluent buyers looking for the next Telluride or Aspen.

- Estes Park/Larimer County – Compared to February of 2021, new, single-family listings are down 35% in Larimer County, with townhome/condos down even more at -44.6%. Year-to-date, single-family homes have received 102% of list price and townhome/condos are reaching even higher at 102.7% of list price. The $668,234 average single-family sale price is a staggering 27.5% higher than February 2021.

- Fort Collins/Northern Larimer County – The good news: In the first week of March, the Fort Collins market has seen a dramatic uptick in new single-family listings (over 90 in the first week of the month while there were just 144 for all of February). The bad news: Fort Collins has set a new monthly median price record of $625,000.

- Grand Junction/Mesa County – Compared to a year ago February, new listings fell 17.8% to 278, solds were also down to 241, and available inventory dropped 23.4% to a total 259 units at a time when we typically see the beginnings of spring inventory growth. Median price increased 24.2% year-over-year to $369,000, and the average price in February was up 29% to $416,048 compared to this time last year.

- Pueblo – Median price crossed over the $300,000 mark in February to $301,000, up 2% from 2021. Sellers are getting 100% of the list price and new construction remains strong, with 115 permits issued in the first two months of 2022.

- Steamboat Springs/Routt County – February delivered 35 active homes on the market – compared to 75 in February 2021 with just 23 active condo/townhomes – down from 82. There were 41% fewer single-family new listings and 51% less for multi-family than the same period a year ago. With fewer choices and still high demand, median price for the month was 15.1% higher for homes and 50.9% higher for condo/townhomes.

- Summit, Park & Lake counties – Last February, a single-family home in Lake County averaged $301,000. This year, the average single-family home is $546,167 – an amazing 81% increase. In Summit County, the average price is now $2.56 million. To put that into a little perspective, if you were to buy that home with 20% down ($513,000) and finance it at 3.5% for 30 years you would have a monthly payment, excluding taxes and utilities, of $9,224.

- Vail – The market continues to amaze with its growth in dollars and continued growth in the upper range of the pricing niches in spite of declines in pending sales, down 17.2%, closed unit sales, down 3.3%, inventory, down 43.5% and months supply, down 40%.

Taking a more in-depth look at some of the state’s local market data and conditions, Colorado Association of REALTORS® market trends spokespersons provided the following assessments:

AURORA

“Despite a recently released report that places Aurora as the 42nd Happiest Place in the United States, odds are, that assessment probably doesn’t apply to anyone looking to purchase a home here. Buyers are abundant and listings are few resulting in a $795,000 median home price in the southeast part of the city (80016 zip code) where inventory is down 44% from a year prior and there are just 27 homes to choose from. Also, in the southeast part of the city, zip code 80015 boasts a $603,000 median price with only nine listings available and inventory down 79% from 2021. If you are thinking maybe a condo or townhome might be an option, purchasing will still be very challenging with only three available listings in this zip code and a median price of $358,750.

“Other options include central Aurora (80013), with a few more listings and a median price of $540,000, or north Aurora with a median price of $421,000 and six available properties. Looking to the 80111 zip code, which encompasses parts of Greenwood Village, Englewood, and Denver, the median price jumps to $903,000 for a single-family home and $552,000 for a condo/townhome.

“Yes, real estate continues to be a good investment – not easy, but worth it in the long run. Low interest rates and 20%-plus appreciation should be the encouragement that buyers need to continue their quest for home ownership,” said Aurora-area REALTOR® Sunny Banka.

BOULDER/BROOMFIELD

“Preparation is the key in this market. In Boulder and Broomfield

counties, the listings continue to disappear, and the buyers are still coming

out of the woodwork to try to make a move before interest rates creep up even

more. With an inventory of about 14% less than what we had last month, the

competition is fierce. Buyers must be prepared to have their financing

completed, understand contracts, negotiations, and how to write a competing

offer. Sellers have to be prepared to understand the same and, more importantly,

have a place to go when their home sells quickly.

“There are many contract strategies and programs available that allow for people to buy before they sell, so the contingency issue has become a fairly minor one in this market. Buyers are understanding the need to let sellers rent back in order to let them find their new homes so the cycle can continue.

“Statistically, homes in these counties are selling in under 36 days (only 16 in Broomfield) as they go under contract within the first few days of listing and close shortly thereafter. Townhomes and condos are also seeing a surge in activity as they tend to be the more affordable option in an already expensive market. Homes have appreciated 25% since the same time last year. Most are selling for over list price, some as high as 20% over the asking price.

“With the help of a good REALTOR®, buyers and sellers that approach moving in this market are prepared and ready to go. However, Monday mornings can be a little bit of doom and gloom as the buyers who did not get an accepted offer lick their wounds and prepare to start again the next week,” said Boulder/Broomfield-area REALTOR® Kelly Moye.

COLORADO SPRINGS

“February was a blur of real estate frustration. We wrapped up 2021 and it appeared like the escalation clauses were less frequent and that appraisal gaps were not nearly as large. But February cursed us with a 13.5% decrease in new single-family listings year-over-year pushing up prices along with appraisal gap coverages and escalation clauses. The one-year change in price was 16% and we had a 20.2% drop in active properties across all property types. These stats are echoed across the nation right now. We saw an all-time low of 860,000 properties in February nationwide, down 17% from a year prior.

“I am never an agent to push someone into buying a home, or telling someone to rent, but I am a realist. Ultimately, it is up to the consumer to decide what is best for them after the education process. But despite interest rates going up, a war breaking out between Russia and Ukraine, and food prices and oil prices heading higher, real estate simply does not care. I think it would be safe to tell most buyers in our area, that if they are serious about buying a home they are going to have to consider coming in 10% above list price, depending on price point. A buyer will have to also offer appraisal gap coverage and escalation clauses. Oh, and their largest competition is likely a corporate buyer.

“As spring begins to feel very near, I am not optimistic the buyer in the Pikes Peak region is going to have a better chance this year than last at finding a home. It feels like corporate investors are actually acquiring more property. When we list a home, it is not uncommon to have one or two corporate offers on any home below $550,000. They are always cash, always aggressive, and typically very easy to work with. Sellers are going to be able to sell for absolute top dollar and will then have to figure out what they do once their home sells. Because once you are no longer a seller you are now a buyer or renter and nationwide, this housing problem is yet to see any relief,” said Colorado Springs-area REALTOR® Patrick Muldoon.

DENVER COUNTY

“It’s rare to have a month where we see something dull and unremarkable occur in the Denver real estate market – it simply doesn’t happen anymore. The fact is, there are simply no adjectives left to describe what’s happening and so, at the risk of sounding redundant and on the high-end of the cliche spectrum, I offer to you this descriptor; ‘record-setting.’

“From January to February of this year, the median price jumped from $575,000 to $659,000 for a freestanding home. That’s right, $84,000 or a 14.6% increase in only 30 days – more than we saw during the entire year of 2016.

“That’s only headline number one. The second, the listing to sold price ratio also broke a record, month-over-month at 106.3%. That means that, on average, the typical home sold for 106.3% of the asking price, the typical $550,000 house selling for $584,650 in January. Simply put, 2014-2019 never saw that number surpass 101% during even a single month.

“The final headline, and this is a good one, is that the median price for the townhome and condo market only increased by 3.5% – still, an incredible number. That’s right, while the freestanding category skyrocketed well above the clouds, the prices for attached homes saw a totally disjointed reaction to detached. Dissecting that a little, we must remember that a lack of demand for housing of that type is likely not the culprit, not by a long shot. Housing is housing is housing, and when you have gigantic increases in price in one sector, you’d have to assume that the people who can no longer afford that realm would be moving down their order of priority list in what they want their next home to be – turns out, not so. These homes are still selling for 103.2% of asking price, another record, so we can cross the lack of demand off the list. At 103.2% of asking, that says they still want these homes. So, what would the reason be? In your typical cluster of homes, you have comparables that you must work off of when accurately pricing the subject property. Because a condo, which is subject to, say, 200 identical units in the same building, it’s extremely difficult to say one is worth $200,000, $300,000 or even $400,000 more than another – the way a freestanding house can. It’s not that condos aren’t susceptible to price increases, it’s that they are rather capped in how much they can appreciate unless, say, 150 of the 200 were to go on sale at one time. The long story here is that while freestanding homes are hitting the heavens, condos are lagging, if you can call it that. Demand remains palpable, but one is able to flex far higher than the other.

“Many wonder why they would even engage in the

purchase real estate right now. Why pay top dollar and enter the madness when

you may not need a new home right now? The answer is rather simple;

while real estate is and has always appreciated in the long term, you can’t

ignore the prices of 2030, 2040 and 2055 when considering prices today. Houses

will be more expensive then – the same way 1990s real estate was rather a

bargain by today’s standards and thus, the eternal struggle; can you afford to

buy real estate? Can you afford not to?”

said Denver-area REALTOR® Matthew

Leprino.

DURANGO/LA PLATA COUNTY

“It is hard to tell what is climbing faster, gas prices or the average sales price in Durango where a single-family home rose 49% in February compared to the same time last year and now sits at just over $1 million, a new benchmark. Townhome and condo prices rose an astounding 70% with an average sales price of $630,000. Even with these huge increases, we are still seeing multiple-offer situations and above-asking price offers. Inventory levels are still hovering around a one-month supply, which is fueling the already ridiculously competitive market.

“Durango is emerging as the next and possibly last true resort town in Colorado. Historically, Durango has been viewed as a laid-back mountain town filled with ski bums and river rats. That perception has changed with the influx of affluent buyers looking for the next Telluride or Aspen. As the makeup of the town changes, locals are finding it more and more challenging to find affordable housing options. Durango, in contrast to other resort towns, is a real bargain for buyers looking to experience the Colorado dream. Change is inevitable and difficult, especially for the natives who have lived here for generations,” said Durango-area REALTOR® Jarrod Nixon.

ESTES PARK/LARIMER COUNTY

“Not much to say about this month beyond, ‘exhausting’. It feels a little like the hamster in the wheel, running and running but not really getting anywhere with buyers, specifically. Clients are searching, finding the perfect property as it pops up from our set prospect searches; we submit a showing request only to find out it’s under contract with five other offers already in the hands of the seller. We’re competing with cash offers and tight timelines that throw caution into the wind just to get something under contract. Educating our clients goes a long way to prevent disappointment and get them prepared for the battle ahead. Sellers aren’t free of the madness either. Put the property on the market, hopefully curb appeal is spot on, priced just right, bathe the dog, and now spend the weekend thumbing through 15-20 offers varied from low ball offer, over asking, cash, lender, or quick close, among the plethora of options.

“Compared to February of 2021, new, single-family listings are down 35% in Larimer County, with townhome/condos down even more at -44.6%. Of course, supply and demand work together and we see this directly in the average sales price and the percent of list price received. Year-to-date single-family homes have received 102% of list price. Townhome/condos are reaching even higher at 102.7% of list price. The $668,234 average single-family sale price is a staggering 27.5% higher than February 2021. Townhomes/condos are gaining, but not quite as quickly at an average sales price of $409,990, an 8.9% increase from February last year. With that being said, the median sales price here in Larimer County is still competitive and not over the statewide average, but right along with it for single- family homes at $580,000. Townhomes/condos in Larimer County are below statewide averages, at $389,900. Being located near a National Park and having a tourist destination like Estes Park within the County, I find this to be comforting that Larimer County, while thought of as expensive, isn’t that bad when looking at the averages. If you are looking to purchase in Larimer County, be ready to jump off the hamster wheel head first with your highest and best offer. Properties in our little paradise are going fast,” said Estes Park-area REALTOR® Abbey Pontius.

FORT COLLINS

“How do you sell what isn’t for sale? Many buyers, and many real estate brokers too, have adopted both old school and state-of-the-art new school strategies to entice current homeowners to sell their homes. Several friends complain about the number of calls, emails, texts, and junk mail they receive every week begging them to sell their home (giving the extended auto warranty folks a run for their money). The biggest challenge for potential sellers in this market is that, in spite of getting better than top-dollar for their current home, the uncertainty of finding a replacement home keeps the vast majority of potential home sellers on the sidelines. New construction can’t keep up with demand and it’s not just supply chain and labor shortages – shovel ready development is years behind current demand. Rental homes remain in tight supply and investors aren’t selling their Golden Geese. It is the literal definition of gridlock.

“Is there relief through higher interest rates? As of this writing, a 30-year fixed interest rate home mortgage is just above 4% – quite a jump from 2021 and pricing many buyers out of the market (or significantly lowering their purchasing power). In the near-term, this may put even greater pressure on the below median price point but may relieve some pressure in the above median price points. All-cash deals seem to dominate the competitive offer arena and new pre-purchase underwriting programs from lenders are giving financed buyers a cash-like ability to compete. In the long term, if interest rates continue to climb, it may pull enough buyers out of the market that sellers may need to adjust their sale price expectations.

“The really good news is that in the first week of March, the Fort Collins market has seen a dramatic uptick in new single-family listings (over 90 so far while there were just 144 for all of February). The bad news is that Fort Collins has set a new monthly median price record of $625,000. Contrary to T.S. Eliot’s opinion, March appears to be the cruelest month,” said Fort Collins-area REALTOR® Chris Hardy.

GRAND JUNCTION/MESA COUNTY

“Mesa County/Grand Junction continues to struggle with extremely low inventory and increasing prices. Comparing February 2022 to February 2021, new listings decreased 17.8% to 278, solds were also down to 241, and available inventory fell 23.4% to a total 259 units at a time when we typically see the beginnings of spring inventory growth.

“Prices continue to shut out many first-time homebuyers, as well as the more moderate-income workers in the area. Median price has increased 24.2% year-over-year to $369,000, and the average price in February was up 29% to $416,048 compared to this time last year. So far in 2022, all YTD cumulative totals are negative, except for prices. Even though interest have increased in the last month, it does not seem to be having much effect on the urgency of buyers to be the successful bidders on a home when it becomes available,” said Grand Junction-area REALTOR® Ann Hayes.

PUEBLO

“Two months into the new year and the housing market hasn’t changed much as prices are up and inventory is down. New listings in February were down 2.2% compared to 2021, but up 3.5% for the year. Pending sales are a good indicator of the housing activity, up 20.9% from 2021 and up 17.7% year-to-date. Listings are not active for very long with multiple offers and strong competition pushing prices up. It’s a tremendous challenge for first-time homebuyers, VA, and FHA buyers because of the extra requirements.

“Sold listings are up 13.5% from last February, and up 17.7% year-to-date. Median price crossed over the $300,000 mark in February to $301,000, up 2% from 2021. There just aren’t many homes under $150,000 in our market anymore so prices are skewed to the high side as sellers are getting 100% of the list price. New construction remains strong with 115 permits in the first two months this year,” said Pueblo-area REALTOR® David Anderson.

STEAMBOAT SPRINGS/ROUTT COUNTY

“Not many buyers were ‘feeling the love’ in February. The month revealed 35 active homes on the market – compared to 75 in February 2021 and 23 active condos/townhomes – down from 82. There were 41% fewer single-family new listings and 51% less for multi-family than the same period a year ago. With fewer choices and still high demand, median price for the month was 15.1% higher for homes and 50.9% higher for condo/townhomes. Naturally, pending sales were off with these declines in inventory, noting single-family down almost 55% and multi down approximately 46%.

“While the competitive market does not have buyers feeling warm and fuzzy; sellers, on average, received within 1% of their ask price when selling their home and multi-family owners received over 2.5% of asking price. We stayed consistent with a one-month supply of homes and about a two-week supply for condo/townhomes. Buyers are sometimes offering to pay for fees that traditionally have been a seller expense. Buyers ready to purchase may experience a longer delay than what they wanted as it is not uncommon for a buyer to have been looking for a home for a year in our market. This ‘waiting period’ ultimately is a learning time and when they do get a property under contract it is usually cause for a celebration.

“It is interesting to note that there are 58 properties that are under contract or that have sold in the past six months that are priced at a total price per square foot of $900 or more, with the average being $1052. When looking at the same period last year, there were only 14 properties with a similar average total price per square foot at $1074. We can anticipate that there will be more pricing like this, particularly with newer construction and properties located close to the ski base area. This sets the stage as new construction develops at Ski Time Square, as those numbers are sure to be surpassed due to location and costs of new construction,” said Steamboat Springs-area REALTOR® Marci Valicenti.

SUMMIT, PARK AND LAKE COUNTY

“What a difference a year makes. Last February, a single-family home in Lake County averaged $301,000. This year, the average single-family home is $546,167 – an amazing 81% increase.

“In Summit County, the average price is now $2,567,725. To put that into a little perspective, if you were to buy that home with 20% down and finance it at 3.5% for 30 years you would have to put down about $513,545, and the monthly payment, which doesn’t include taxes and utilities, would be $9,224.

“Current listings range from a single-family home in Park County for $269,900 to a single-family home in Breckenridge for $18.99 million,” said Summit-area REALTOR® Dana Cottrell.

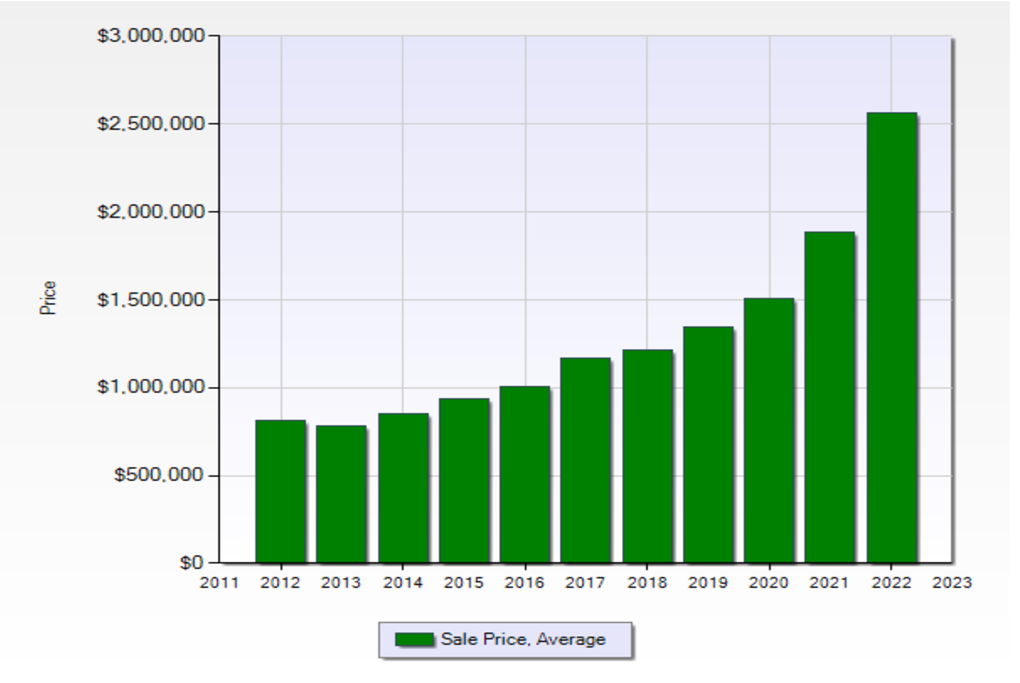

The chart below shows Summit County single-family average prices for the last 10 years including a nearly $680,000 price increase in the past year.

| Single Family | Average Price % Feb YTD 2022 vs 2021 | Average Price YTD 2022 |

| Summit County | 49% ↑ | $2,567,725 |

| Park County | 58% ↑ | $724,524 |

| Lake County | 81% ↑ | $546,167 |

| Townhouse / Condo | Average Price % Feb YTD 2022 vs 2021 | Average Price YTD 2022 |

| Summit County | 32% ↑ | $779,208 |

VAIL

“The Vail market continues to amaze with its growth in dollars and continued growth in the upper range of the pricing niches. This performance is happening in spite of declines in pending sales -17.2%, closed unit sales, -3.3%, inventory, -43.5% and months supply, -40%. Yes, there is appreciation on properties, but the true driver is growth in market share of the upper price points. No one was able to predict the market trend from July 1, 2020 through Feb. 28, 2022, as it has been outside any performance history.”

The chart below shows what is driving the performance:

February 2021 February 2022

Price Niche Unit Sales Unit Sales

< $1M 43 35

$1-$2M 18 22

$2-$3M 8 9

$3-$4M 9 7

$4-$5M 5 6

$ 5M + 8 10

Total Units 92 89 (-3.3%)

Total $ volume $183,257,035 $ 212,874,837 (+16.2%)

“Volatility in the price niches has been a constant over the aforementioned performance and has enabled continued dollar increases in spite of overall inventory decreases, which are less drastic than the higher niches. We just introduced a couple of new projects that will be starting construction soon. The pending sales and inventory will grow however, until they are completed, closed sales will not show the value of the new inventory. We still see properties with multiple offers and quick contracts in spite of all the commentary on potential slowdown in activity,” said Vail-area REALTOR® Mike Budd.

SEVEN-COUNTY DENVER METRO AREA SINGLE-FAMILY SNAPSHOT

STATEWIDE SINGLE-FAMILY SNAPSHOT

SEVEN-COUNTY DENVER METRO AREA

STATEWIDE

SEVEN-COUNTY DENVER METRO AREA

STATEWIDE

The Colorado Association of REALTORS® Monthly Market Statistical Reports are prepared by Showing Time, a leading showing software and market stats service provider to the residential real estate industry and are based upon data provided by Multiple Listing Services (MLS) in Colorado. The February 2022 reports represent all MLS-listed residential real estate transactions in the state. The metrics do not include “For Sale by Owner” transactions or all new construction. CAR’s Housing Affordability Index, a measure of how affordable a region’s housing is to its consumers, is based on interest rates, median sales prices and median income by county.

The complete reports cited in this press release, as well as county reports are available online at: https://coloradorealtors.com/market-trends/

###

CAR/SHOWING TIME RESEARCH METHODOLOGY

The Colorado Association of REALTORS® (CAR) Monthly Market Statistical Reports are prepared by Showing Time, a Minneapolis-based real estate technology company, and are based on data provided by Multiple Listing Services (MLS) in Colorado. These reports represent all MLS-listed residential real estate transactions in the state. The metrics do not include “For Sale by Owner” transactions or all new construction. Showing Time uses its extensive resources and experience to scrub and validate the data before producing these reports.

The benefits of using MLS data (rather than Assessor Data or other sources) are:

Accuracy and Timeliness – MLS data are managed and monitored carefully.

Richness – MLS data can be segmented

Comprehensiveness – No sampling is involved; all transactions are included.

Oversight and Governance – MLS providers are accountable for the integrity of their systems.

Trends and changes are reliable due to the large number of records used in each report.

Late entries and status changes are accounted for as the historic record is updated each quarter.

The Colorado Association of REALTORS® is the state’s largest real estate trade association representing more than 29,000 members statewide. The association supports private property rights, equal housing opportunities and is the “Voice of Real Estate” in Colorado. For more information, visit https://coloradorealtors.com.