A step toward normalcy but no reason to celebrate yet June numbers reflect dramatic changes and complexities of massive, highly reactive housing market

https://coloradorealtors.com/market-trends/regional-and-statewide-statistics/

ENGLEWOOD, CO – Despite a massive influx of new inventory hitting the Denver metro and statewide housing markets over the past month, fears of inflation, rising interest rates and a host of other key variables are changing conditions for both buyers and sellers alike, according to the June 2022 Market Trends Housing Report from the Colorado Association of REALTORS®.

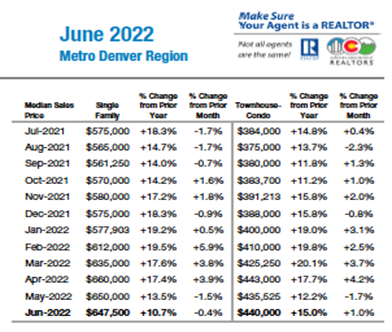

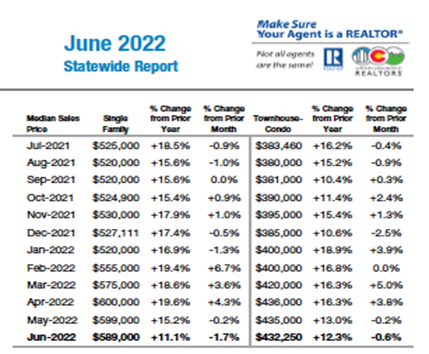

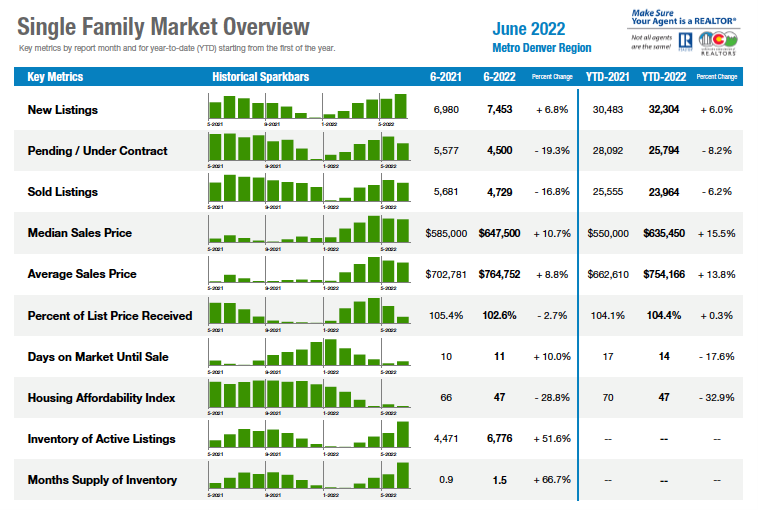

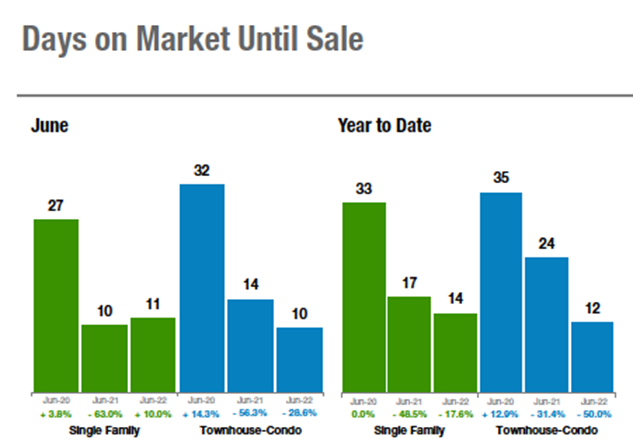

The inventory of active listings for single-family homes and townhome/condos in the Denver-metro area rose 44% between May and June to 6,776 and 1,695, respectively. Statewide, single-family inventory of active listings jumped 46% from May to June to a total of 13,014 units and was up 52% for townhome/condos at 2,998. The spike is reflected in the months supply of inventory that rose more than 47% in the prior month for single-family homes in the metro Denver-area to 1.5 months. Statewide, that number grew to a 1.7-month supply for single-family homes, up 54.5% from May. In the condo/townhome market, the percentage increases were similar – 47% in metro Denver and 50% statewide – to one month and 1.2 months, respectively. While helpful, those figures are still well off the four-to-six-month supply that would be considered a balanced market.

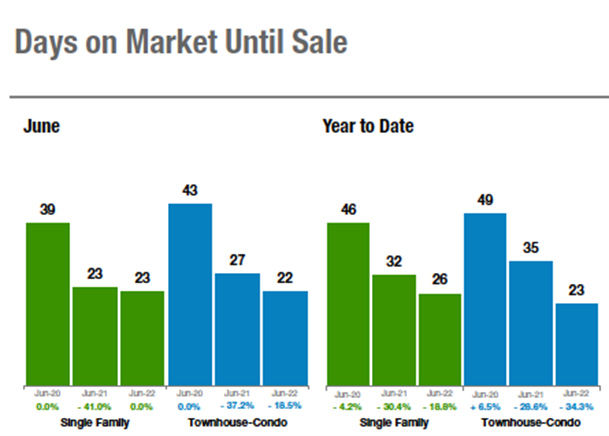

“As fears of inflationary pressures reach households through the grocery store and gas pump, home buyers have adopted a more cautious attitude,” said Douglas County REALTOR® Cooper Thayer. “The market this June looks vastly different from last year, with inventory doubling and, on average, lasting nearly a week longer on the market.

But REALTOR® professionals across the state warn that the refreshing, long-overdue improvement for prospective buyers in June wasn’t quite enough to set off a celebratory fireworks show in July.

“When a hospital patient has their breathing tube removed, we’d never exclaim ‘all better’ in jubilation at their recovery. We wouldn’t jump up and down and declare them fully in the clear and most certainly, the miraculous change of events wouldn’t suggest a full recovery is imminent,” said Denver-area REALTOR® Matthew Leprino. “We must be excited, but cautious and similarly, we should approach the life support apparatus that the Denver real estate market has been on with the same caution and pause.”

While sellers have been pushed to price reductions in many market and across select price points, rising interest rates, uncertainty and the strength of median pricing has pushed some buyers to consider different revised price points, product types and/or move to the sideline until the picture becomes a little more clear.

Despite the challenges, median pricing for all product types in markets statewide held strong.

“Regardless of what the numbers tell us, the reality is there are still large numbers of buyers driving demand for housing in spite of key variables that include summer travel, inflation, rising gas prices, and rising interest rates. Navigating this volatile housing market and economy takes patience, practice and perseverance,” said Fort Collins-area REALTOR® Chris Hardy.

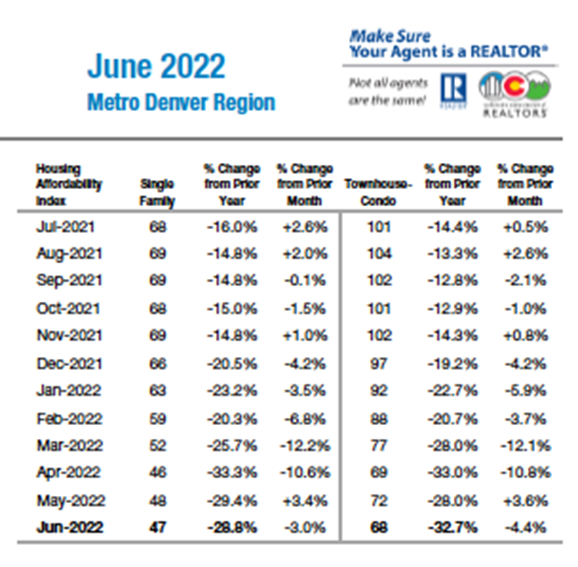

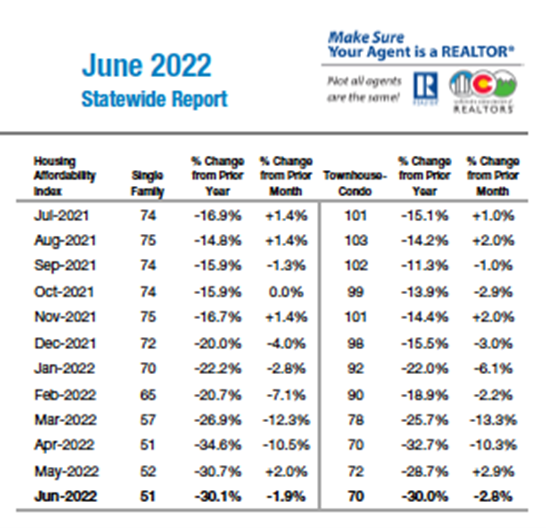

Although the CAR Housing Affordability Index (HAI), a measure of how affordable a region’s housing is to consumers based on interest rates, median sales price, and median income by county, improved slightly in May, those minimal improvements were all given back in June due to market’s overall pricing strength versus the inflation and interest rate increases.

With diverse and local factors playing out across the state, REALTORS® across the metro area and state shared these highlights:

- Aurora – We are experiencing a dramatic change as a majority of our zip codes have 50% or more inventory than we did in June 2021. In fact, Centennial inventory is up 148% over last year with solds down 13%. Aurora inventory is up 39% over 2021, and sold listings down 16.7%.

- Boulder/Broomfield counties – Rising interest rates reduced buyer’s purchasing power in the last few months and we have seen a shift in our market. Homes are staying on the market longer, with fewer bidding wars, and buyers are now able to negotiate some concessions and conditions in their contracts. However, the Boulder and Broomfield markets are running strong and make no mistake, we are still in a seller’s market.

- Colorado Springs – For buyers who sat on the sidelines, whether on purpose or because they could not swing the insane real estate market, it is going to pay off. As a follow up to the May market report, which stated, ‘May would be the month the market changed,’ we are seeing that prediction play out.

- Crested Butte – The first half of 2022 felt quite a bit slower than the previous 18 months. It is tough not to compare to 2021, but we really should think of 2021 as an anomaly rather than the new normal. The question about the market’s strength will really be answered in the coming weeks and months as we see if this new influx of inventory is absorbed by buyers as has been the norm in recent months or if prices need to be reduced

- Denver County – Recent changes to lending have turned the market in Denver to a time of rest and recuperation for the first time in recent memory. For sale homes last the weekend, buyers are able to contemplate their moves before acting and, in many instances, pricing strategies for sellers no longer contemplate a flurry of offers. Though the median price still increased 2.7% over May, now $750,000, the inventory has nearly doubled in the same timeframe.

- Douglas County – This is a vastly different market with inventory doubling in June, and on average, lasting nearly a week longer. Single-family homes made a significant -4.7% decline in median sales price, driven by a more balanced mix of supply and demand. While we have seen buyers gain negotiating power as the number of showings and offers have decreased on listings, the data indicates we haven’t left the seller’s market quite yet.

- Durango/La Plata County – Buyers hit the pause button in June with just 58 single-family homes sold compared to 105 in June 2021. While this appears to be a massive shift in the market, remember that 2021 was an exceptional year for real estate, fueled by historically-low interest rates and unprecedented buyer demand. When we see the deceleration in sales from 2021, it is important to remember that 2021 was an anomaly.The slowing buyer pace, not an inventory oversupply, is causing the softening of the market.

- Estes Park/Larimer County – We heard about the multiple offers, frenzied buyers, the absolute craziness happening in the front range and metro areas. It took a while for that madness to really hit in the high country like Estes Park, but when it did, it did. We’re starting to see some signs that are posted in the yard for longer than a blink of an eye, and even a few price reductions.

- Fort Collins/Northern Larimer County – Boom-Stall-Boom. June housing numbers illustrate the complexity of a massive and highly reactive housing market. Northern Larimer County with a steadily appreciating market – nearly a 25% year-over-year bump up in median price to $635,000 and the highest number of sales in one month so far this year at 273 homes sold. On the flip-side, list-price to sale-price averages dropped a bit from the year-to-date high of nearly 6% over asking price to just under 4% over asking price.

- Glenwood Springs/Garfield County – REALTORS® on the street can feel a difference in the frenetic pace we have experienced since COVID changed our world in spring 2020. We are seeing more price reductions, back-on-market listings and open houses. Sellers continue to be the winners in this market, and it remains to be seen if the rising interest rates along with inflation will have any effect on our communities in the near future.

- Grand Junction/Mesa County – Mesa County is feeling the impact of rising interest rates and prices. Comparing June 2022 to June 2021, there are some significant changes in activity. Active listings are up 34.6% to 576. Buyers are getting more inventory to choose from, and as a result, we are seeing a little softening in asking prices. We have steady growth in people moving to the area, so if rates can stabilize and prices become a little more reasonable, activity should be a little slower, but steady.

- Jefferson County/Golden – We are still very much in a seller’s market however, not like we were a few months ago. New listings, inventory, days on market and months supply all increased in June. The new median sales price for a single-family home is $720,000 an uptick of 14.9%.

- Pagosa Springs/South Fork – This market has evolved into a rodeo. Buyers are purchasing as if they appear to have wrapped their heads around higher interest rates and at prices still higher than last year. The average sale price jumped from $553,472 (June 2021) to $660,285 (June 2022), almost 20% higher than last year. Continued interest rate gains have forced buyers to consider other options such as condo, manufactured or land purchases, or were simply priced out of their price points.

- Pueblo – We’ve enjoyed an historic three-year run where we saw homes appreciate 15% to 20% per year, amid declining inventory that created multiple offers on most every home sold. Yet, as we know, nothing stays the same for long. In June 2022, new listings were up 15.6% over the same time last year, and are up 17.8% year to date. Pending sales are off 2.6% from last June, but remain up 5.5% year to date.

- Steamboat Springs/Routt County – Aggressive list pricing over last year’s pricing is being met with price reductions. Buyers pumping their brakes on purchasing are creating a better opportunity for buyers staying on course, with a little more opportunity for negotiation. Today’s buyers will likely be re-financing in about a year or so for lower interest rates and will have capitalized on modest 2022 appreciation.

- Summit, Park & Lake counties – The housing market in Summit and Park counties seemed to hit a wall overnight. Sales are down a massive 42%, pending sales are down 55% and active listings are up 35% compared to June 2021. So far, this is a flattening of the market. Although it feels like an incredibly fast shift, we were experiencing growth that we simply couldn’t maintain.

- Telluride – The market is slowing down in the number of transactions and many listing are pulling back asking prices about 10%. Inventory of homes and condominiums in Telluride and the Mountain Village is increasing yet sales are still strong — $91,549,400 across 43 sales in June for a record average sale price of $2,190,055.

- Vail – June 2022 is the start of a new market direction away from the volatility of the last three years. We seem to be trending toward a more stable market similar to that of 2019. From a market perspective, that is positive and more predictable.

Taking a more in-depth look at some of the state’s local market data and conditions, Colorado Association of REALTORS® market trends spokespersons provided the following assessments:

AURORA

“The fact is, we are experiencing a dramatic change in the Aurora and Centennial housing markets as a majority of our zip codes have grown 50% or more in inventory than we had in June 2021. In fact, Centennial inventory as a whole is up 148% over last year with solds down 13%. Aurora inventory is up 39% over 2021, and sold listings down 16.7%. Inventory in 80016 is up 84% and median price is up 7.6% from 2021. Sold listing are down 22%. Overall, prices are still up about 10% over last year with most of the price gain seen earlier this year prior to the interest rate adjustment.

“The numbers reflect what REALTORS® are seeing in Adams and Arapahoe County where home sales have slowed, there is more inventory, fewer, if any bidding wars, and generally pricing is not exceeding list price. It is clear that sellers are realizing now might be the highest price they will get for their real estate in the near future and home prices are seeing some adjustments as the interest rate increase. The price you may have received in March, isn’t likely to be the price you would get today.

“All of this said, good homes, in good condition, priced right are still seeing interested buyers. That crystal ball may be a little cloudy as we see our market move through these changes,” said Aurora-area REALTOR® Sunny Banka.

BOULDER/BROOMFIELD

“With rising interest rates, buyer’s purchasing power has been reduced, and in the last few months we have seen a shift in our real estate market. REALTORS® are reporting that homes are staying on the market longer with fewer bidding wars, and buyers are able to negotiate some concessions and conditions in their contracts. However, the Boulder and Broomfield markets are running strong and make no mistake, we are still in a seller’s market.

“In Boulder, the median sales price is up 13% since January, homes are still selling for an average of 6% over list price, and the average days on market continues to hang under 30 days. This is no buyer’s market. True, our inventory is up a bit giving us 1.8 months of listing supply, well under the four months needed to create a ‘balanced’ market.

“Broomfield’s prices continue to rise, as well, with the median price up 9.5% for the year. Buyers are loving homes in Broomfield as the average days on the market is only 10 days and homes are selling for 5% over list price. Townhomes and condos are the highlight of this market with 16% appreciation since January. Several brand new, luxury townhome communities have been built and are selling as fast as they can build them.

“From someone who is ‘boots on the ground’ every day, I can report that buyers do have a little more time to think about a purchase, they don’t have to remove every contingency and those with low down payments actually have a shot at getting a home. But, this is still a seller’s market, and as buyers get used to higher rates, it appears our markets will remain strong,” said Boulder/Broomfield-area REALTOR® Kelly Moye.

COLORADO SPRINGS

“Patience is a virtue, they say. And for the buyers who sat on the sidelines, whether on purpose or because they could not swing the insane real estate market, it is going to pay off. As a follow up to my May market report, where I stated ‘May would be the month the market changed,’ we are seeing that prediction play out. June had a 100.9% increase in active listings year over year, and I predict that is just the beginning. What we are witnessing in real time, we will all look back at and realize was the slow leak of a once over-inflated real estate market balloon across the Front Range. Sure, we have a 10.3% median price increase on all properties year over year. So, you can make a great argument in this snapshot that it is just a balancing of the market. But you can also feel the change. Every week the active properties increase, pending properties decrease and, as we enter each new weekend, the inventory is increasing.

“How did we get here? For the first time in history after the ’08 collapse, the Fed played a game called quantitative easing. This kept interest rates artificially low for an extended period of time which brought about bubbles throughout the economy. As the FED decided to end that and move into the new quantitative tightening, bubbles across the economy have begun to deflate. First, we saw the stock market begin to drop, then we have watched crypto implode, and then another leak began and it sounds like a real estate leak. We already had an affordability crisis here in the Pikes Peak Region. Once we pushed rates up it cost the average buyer looking at a $500,000 home about $90,000 in purchasing power. Put another way, the $500,000 home now was unattainable to that buyer unless it dropped about 20% in value. We continue to hear that because of low inventory, housing should remain strong. But, if demand falls, does inventory matter? In reality, inventory across the country is rising. So, is there even an inventory issue, anymore? Let’s check in on the rest of the items that make a buyer pause and not buy a home. We have data that shows low consumer confidence, high inflation, groceries at highs, gas at highs and the Atlanta Fed predicting a -2.1% GDP growth for the second quarter meaning we may already be in a recession. None of this bodes well for housing.

For the first time in many years, I can finish my monthly summary in a different way. Buyers, you finally have inventory hitting the market that you have not seen in years. The inventory is not selling as fast and sellers are price dropping, accepting concessions, and most sellers know that the market has shifted and they are being reasonable. Sellers, for years I have stated it was your market. You continued to get multiple offers, above list and with escalation clauses, appraisal gaps and insane values. But your time has now come to an end. With a balancing of the market you will have to price right, prepare for longer days on market, slower showings and buyers that are not nearly as motivated as they were just three months ago. And, as inventory continues to rise and the overall economy is shaky, there is room for home values to continue to pull back. Moving through the end of the year, unless something miraculous happens, there is no good economic news on the horizon. With plenty of bad news likely coming as the overall United States economy continues to grind to a halt, housing is at risk,” said Colorado Springs-area REALTOR® Patrick Muldoon.

CRESTED BUTTE

“The Crested Butte market during the first half of 2022 felt quite a bit slower than the previous 18 months. It is tough not to compare to 2021, but we really should think of 2021 as an anomaly rather than the new normal. 2021 was by far the busiest year ever with more than double the number of transactions we had in 2019 and about 50% more than we had in 2018 and 2017. The number of sales during the first two quarters of 2022 is the second highest in recent years, but is more in line with what we saw in 2018 and 2017 and is down 46% from 2022. Dollar volume is down about 30% vs. 2021, which is to be expected with the extreme lack of inventory and lower number of sales. However, the dollar volume of sales for the first six months of 2022 is still almost double 2019.

“Inventory reached the lowest level in February and March this year and is coming back up. Early summer is typically a busy time for new properties to be listed for sale and that is certainly happening this year. However, we are still below inventory levels from last June/July by about 20%. Listing prices are significantly higher across the board and sales prices continue to rise although, we have started to see price reductions and properties lingering on the market. Days on the market for single-family homes are on the rise while condo sales continue to be strong, even with high prices.

“It is great for buyers to have more to choose from then we had this winter, but there is a lot of caution right now with interest rates rising, the stock market falling and real estate prices seeming to level off. The days of listing your property and having multiple offers in hours or days have passed and sellers need to be intelligent about their pricing in order to capture one of the fewer buyers who are in the market. The question about the market’s strength will really be answered in the coming weeks and months as we see if this new influx of inventory is absorbed by buyers as has been the norm in recent months or if prices need to be reduced,” said Crested Butte-area REALTOR® Molly Edlridge.

DENVER COUNTY

“When a hospital patient has their breathing tube removed, we’d never exclaim ‘all better’ in jubilation at their recovery. We wouldn’t jump up and down and declare them fully in the clear and most certainly, the miraculous change of events wouldn’t suggest a full recovery is imminent. We must be excited, but cautious, and similarly we should approach the life support apparatus that the Denver real estate market has been on with the same caution and pause.

“Much as the opposite of a boil is a freeze, there is a whole lot of gray area in between. Recent changes to lending have turned the market in Denver to a time of rest and recuperation for the first time in recent memory. Homes on market last the weekend, buyers are able to contemplate their moves before acting, and in many instances, pricing strategies for sellers no longer contemplate a flurry of offers.

“Though the median price still increased 2.7% over May, now $750,000, the inventory has nearly doubled in the same timeframe. Increasing from just 0.6 months worth of absorption, we now sit at 1.1 – the highest since August 2020. At the same time, June in Denver resulted in a six-year low of ‘solds’, a direct cause of the increased inventory. Fewer buyers bought in Denver this June than any time over the previous six months but that simply does not equate to an ‘all clear’ diagnosis. With a 13.6% year-over-year median increase, an average sold-to-list price ratio still north of 100%, 103.7% in June, this small step forward hasn’t necessarily translated to an overnight miraculous recovery – yet.

“In the very slow machine that is public confidence, affordability and indeed, inventory, it’s too soon to tell if this particular patient gets to go home this week. Like urgent-care medicine, your REALTOR® would now say, let’s simply take it ‘day by day,’” said Denver-area REALTOR® Matthew Leprino.

DOUGLAS COUNTY

“As fears of inflationary pressures reach households through the grocery store and gas pump, home buyers have adopted a more cautious attitude, returning the Douglas County real estate market a step towards normalcy. The market this June looks vastly different from last year, with inventory doubling and, on average, lasting nearly a week longer on the market. Last month, single-family homes made a significant -4.7% decline in median sales price, driven by a more balanced mix of supply and demand.

“While we have seen buyers gain negotiating power as the number of showings and offers have decreased on listings, the data from June indicates we haven’t left the seller’s market quite yet. Mortgage rates have continued to rise to their highest levels since the Global Financial Crisis in 2008, and median closed prices are over 36% higher than at the beginning of the pandemic. We have become so acclimated to a hyperactive market that last month, when the average list-to-close price percentage was 101.5% (it’s historically between 99-100%), we considered it a much ‘cooler’ market.

Interestingly, while the single-family market in Douglas County continues to slow down, the townhouse/condo market accelerated, likely due to buyers being priced out of single-family homes. Average days on market for townhouse/condo listings was just nine days, significantly lower than the single-family figure at 15 days. Townhouse/condo listings also saw a slight increase in median sales price, rising to $531K.

“Even if we aren’t quite in a balanced market yet, the seller experience is likely going to become more normalized as the year goes on, especially compounded by the natural seasonal slowdown in the market. For buyers, while interest rates can often be a deterrent, it’s important to remember that they are more prone to change than the value of a home. Monthly payments may seem high now, but it’s certainly not the worst time to invest in real estate,” said Douglas County-area REALTOR® Cooper Thayer.

DURANGO/LA PLATA COUNTY

“In June, buyers hit the pause button. Only 58 single-family homes sold compared to 105 in June 2021. While this appears to be a massive shift in the market, remember that 2021 was an exceptional year for real estate, fueled by historically-low interest rates and unprecedented buyer demand. If we compare June 2022 to pre-Covid June 2019, we find a similar number of sold units (75). Looking back, 2018-2019 were very strong years for real estate. When we see the deceleration in sales from 2021, it is important to remember that 2021 was an anomaly.

“The slowing buyer pace, not an inventory oversupply, is causing the softening of the market. Currently in La Plata County, 188 units are listed compared to 525 in 2019. A balanced market has six months’ worth of inventory. In June 2022, La Plata County had just 2.7 months of inventory, and in 2019, it had 8.3 months of inventory.

“The good news for buyers is that the slower pace of sales means more options and less competition. Buyers are becoming more patient and are willing to wait for the right property at the right price. Interest rates have also priced some buyers out of the market and reduced purchasing power for others. The condo/townhome market remains robust with just under two months of inventory as a result of these factors. The average price in June was just over $500,000 compared to the average single-family home at $772,000.

“Sellers need to be cautious when pricing their homes. The days of putting a sign in the yard and naming their price may be gone. Homes that are priced correctly and in the right location are still selling over the asking price. Appreciation YTD is above 20% compared to 3.5% in 2019 and is expected to be in double digits in 2023 as well,” said Durango-area REALTOR® Jarrod Nixon.

ESTES PARK/LARIMER COUNTY

“Things normally roll downhill, but here in Larimer County it seems things are beginning to roll uphill. We heard about the multiple listings, frenzied buyers, the absolute craziness happening in the front range and metro areas. It took a while for that madness to really hit in the high country like Estes Park, but when it did, it did. The stats for June 2022 are showing a similar market, and it has continued for now. July may tell another story. With the heightened mortgage rates and sellers pinning high prices on the new listings, it seems there are a few price reductions to be seen and longer days on the market.

Townhome/condos are already showing a slowdown and effects of the rising mortgage rates. In June 2022, days on market jumped 29.5% from an average of 78 days, to 101 days. Is this the tip of the iceberg to a slowdown in the real estate market? There is still no indication of having more inventory or prices plummeting. Townhouse/condos have fewer new listings year to date at a drop of 21.4%, sold listings are down justifiably, 15.4% compared to June 2021. Townhome/condo prices are going up – the average sales price is up 13% from June 2021, from $386,678 to $437,060. Percent of list price received increased to 104.3%.

“Single-family homes are not seeing the immediate impact from the rising interest rates. The average sales price climbed 20.5% year over year, and is up 18.2% from June 2021. New listings ticked up from June 2021 by 0.2%, but are still down 6.7% year to date. Days on market is tight with an average of 28 days, a 28.2% drop from June 2021. Percent of list price has increased year to date to 103.4%, but compared to June last year, it is down to 102.8%, compared to 103.7%. Average sales price is up 20.5% year to date with single-family homes at $673,787, when the average in 2021 was $559,126.

“Will look forward to seeing the July stats to determine how the summer is panning out. We’re starting to see some signs that are posted in the yard for longer than a blink of an eye, and a few price reductions too,” said Estes Park-area REALTOR® Abbey Pontius.

FORT COLLINS

“Boom-Stall-Boom. This month’s housing numbers illustrate the complexity of a massive and highly reactive housing market. From one perspective, the northern Larimer County housing numbers show a steadily appreciating market with a nearly 25% year-over-year bump up in median price to $635,000 and the highest number of sales in one month so far this year at 273 homes sold. On the flip-side, list-price to sale-price averages dropped a bit from the year-to-date high of nearly 6% over asking price to just under 4% over asking price. Likewise, the number of newly added listings for sale for the month jumped 20% from May for a total of 412 homes. A shift in the market is certainly afoot – but how do we make sense of divergent statistics? This is where the variables that drive housing sales create tremendous complexity.

Variable Number 1: Interest Rates: Everyone is tired of hearing about the Fed raising rates, soft-landings, possible recession, ongoing inflation, blah-blah-blah. The driving factor for housing is the 30-year mortgage rate, now hovering just under or just over 6% (double what it was in January 2022). This variable alone has driven buyers either completely out of the home buying market or driven their purchase power downward. The net effect of this variable is creating a stall or at the very least, a lull in the sales of some homes. At the very least, it is shifting demand to lower price points.

Variable Number 2: Summer Travel: Even with gas prices soaring, potential home buyers are out and about, widely dispersed and perhaps taking a break from the non-stop search for the right home, at the right price and in the right location.

Variable Number 3: Great houses at great prices get great amounts of attention and offers. Just because there’s some dispersal of buyers on vacation and recreational pursuits doesn’t mean there’s not competition for good homes. It’s just a little less intense. Where there may have been a dozen or more buyers for every home on the market under $600,000 in April and May, there are still multiple buyers looking at these homes and competitive offers, and pricing run-ups still happen – just at a somewhat lower rate (see the shift in list-price to sale-price ratios above).

Variable Number 4: Over-priced homes coming on the market need price reductions to attract offers. We have seen an uptick in the number of homes that see list-price adjustments after being on the market for a short period of time with no offers. In the current market, most homes sold go under contract within five-to-seven days after listing. This is called Days-To-Offer or DTO. When a home doesn’t receive an offer within that time frame, the ‘market’ (buyers currently looking to buy) has spoken that either the house’s location, condition or both don’t match up with the asking price. Sellers may be reluctant to drop the price of their home because they’ve seen all the amazing stories of multiple offers and tens of thousands of dollars over-asking. This variable is where the biggest shift is occurring in the market and completes the boom-stall-boom rhythm of the housing market we’re currently experiencing.

“Regardless of what the numbers tell us, the reality is there are still large numbers of buyers driving demand for housing in spite of summer travel, inflation, rising gas prices, and rising interest rates. Some houses will take longer to sell. Some houses will have multiple offers and sell very quickly. Navigating this volatile housing market and economy takes patience, practice and perseverance,” said Fort Collins-area REALTOR® Chris Hardy.

GLENWOOD SPRINGS/GARFIELD COUNTYY

“The June market in the Roaring Fork and Colorado River valleys did not see a huge change. Although agents on the street can feel a difference in the frenetic pace we have experienced since COVID changed our world in spring 2020. We are seeing more price reductions, back-on-market listings and open houses. New listings continued their downward trend with a 15.7 % decline in single family and an 18.6% drop in townhomes and condos. The median sale price continues to rise, albeit slower than the last 24 months, with single-family homes up 12.8 % coming in at $668,500 and townhome-condo properties up 4.1% coming in at $359,000. The lack of inventory has kept the days on market in a continual decrease down 37.5% for homes and 44% for multi-family properties. Our showstopper community in the local market is once again Carbondale where the median sale price for a single-family home was up 49% over last June at $1,975,866 and townhome-condos came in at 128% increase to $1.3 million. Sellers continue to be the winners in this market, and it remains to be seen if the rising interest rates along with inflation will have any effect on our communities in the near future,” said Glenwood Springs-area REALTOR® Erin Bassett.

GRAND JUNCTION/MESA COUNTY

“Mesa County is feeling the impact of rising interest rates and prices. Comparing June 2022 to June 2021, there are some significant changes in activity. The impact of average and median price both being over $400,000 (median $409,500 and average $441, 211) has affected sales, down 26.7% to 332, and pendings down 14.1% to 305. However, there is a bright side. Because of slowing activity, total active listings are up 34.6% to 576. Buyers are getting more inventory to choose from and, as a result, we are seeing a little softening in asking prices. Mesa County is experiencing steady growth in people moving to the area, so if rates can stabilize and prices become a little more reasonable, activity should be a little slower, but steady,” said Grand Junction-area REALTOR® Ann Hayes

JEFFERSON COUNTY/GOLDEN

“Our changing market is directly related to the increases in the interest rate. Yes, we are still very much in a seller’s market however, not like we were a few months ago. New listings, inventory, days on market and months supply all increased in June. The new median sales price for a single-family home is $720,000, an uptick of 14.9%. If a home is in a prime location or the home has all the bells and whistles, sellers are still getting multiple offers. However, over the last several weeks, there are plenty of homes that are sitting on the market and not selling the first weekend they hit the market. In fact, there are several listings with reduced prices to improve activity and sales. If we see additional interest rate increases in the coming weeks, we will watch as buyers who cannot afford to buy the same type of home that they once could may step to the sidelines and see what happens later in the year.

“Looking at the condo/townhome market, new listings, inventory, monthly supply and days on the market also increased. The median sales price for condo/townhomes hit $435,000 an uptick of 14.5% and right in line with single-family homes. Predictions are that interest rates will rise again before the end of this year so now may be a better opportunity to maximize that buying power,” said Jefferson County-area REALTOR® Barb Ecker.

PAGOSA SPRINGS/SOUTH FORK

“This market has evolved into a rodeo. At the end of the ride, you know the result – favorable or substandard. And then there is the next ride. In Pagosa Springs and South Fork, May through July have been historically heavy listing months, due to weather. This year, April and May were snowy and then some rain, making mud. Listings came in late but at a strong pace this year. Even with that scenario, listings were up only about 4% in June. Overall, new listings are down 0.5% to date.

“Buyers are purchasing as if they appear to have wrapped their heads around higher interest rates and at prices still higher than last year. The average sale price jumped from $553,472 (June 2021) to $660,285 (June 2022), almost 20% higher than last year. Continued interest rate gains have forced buyers desiring to stay under the median and average sales prices to consider other options such as condo, manufactured or land purchases or were simply priced out of their price points, which together with low inventory, created sold listings down at 17.6% (284 units-2021 and 234 units-2022). Months supply of inventory is up 65.4% (from 2.6 to 4.3 months). Listings are continuing to enter the market, as sellers are cashing out their real estate wealth before their window completely closes.

“Pagosa Springs and South Fork are desirable southwest Colorado locations and still creating a strong seller market. Conversations with lenders indicate home loan demand is now roughly half of what it was a year ago and shows some buyers are being priced out of the home purchase market. However, now the cash buyers are appearing more often in home previewing. Homes under the average to median sales price are demanding higher prices per square foot at historic dollars due to their price point. Some buyers are previewing homes beyond their comfort price points with hopes of a 10-15% or more price discount. With 98.4% of list price received, these buyers’ hope are not the current reality as sellers are rejecting offers simply to respond to the next reasonable offer. Sellers seem to be holding out for the right buyer and not slashing prices significantly, understanding their home will sell and be on the market longer.

“Typical of the resort housing market, days on market is at 87 days. With the highest equity in their homes than ever before, sellers are not so quick to part with their real estate wealth. This market rodeo continues whether you are a participant or spectator. Enjoy the ride,” said Pagosa Springs-area REALTOR® Wen Saunders.

PUEBLO

“The Pueblo housing market has changed and our June numbers make that clear. We’ve enjoyed an historic three-year run where we saw homes appreciate 15% to 20% per year, amid declining inventory that created multiple offers on most every home sold. Yet, as we know, nothing stays the same for long. In June 2022, new listings were up 15.6% over the same time last year, and are up 17.8% year to date. Pending sales are off 2.6% from last June, but remain up 5.5% year to date.

“The big change is in sold listings, which are down 10.4% year to date. Our median price is up 5% from last June to $315,000 and is up 16.7% year to date. Although our percent-of-list price received dropped 2.4%, it remains just a tick above full asking price at 100.1%. With a nice increase in active listings compared to a year ago, we have still seen many listings reduce their price due to the increasing interest rates that are having an impact on buyer activity. New building permits also dropped in June to 44, the second fewest in a month so far this year, and lot sales have slowed with prices also dropping.

“The good news for buyers is less competition and more homes to see and consider with a little bit of time on their side,” said Pueblo-area REALTOR® David Anderson.

STEAMBOAT SPRINGS/ROUTT COUNTY

“Could history be about to repeat itself? With high inflation, talks of a looming recession seem probable. So, what has history taught us with regards to recessions? Perhaps one of the most intuitive is that a recession does not equal a housing crisis. The United States has had six recessions since 1980; in four of the six, housing appreciated. Higher mortgage interest rates are a method used by the Feds to slow inflation and Routt County has felt the slow down just like everywhere else. The pattern has been for interest rates to spike going into a recession followed up by lower interest rates that help to stimulate the economy coming out of the recession.

“Lack of inventory is still the primary culprit for a seller’s market as the U.S. Census reports 14 straight years of single-family housing units below the 50-year average. Locally, months’ supply is pretty much where it was last year, far short of the six-month supply needed for a balanced market. Currently, houses have 2 ½ months’ supply which is a full month more than the last several months. Multifamily sits at a supply two weeks greater than last year at 1.5 months – also one month more than recent months. New listings are up approximately 7% for both single- and multi-family dwellings. Pending contracts were down 24% and 45%, respectively with sold listings up slightly for homes (3.3%) and condos/townhomes seeing almost 29% fewer transactions – creating more months’ supply. Average sales prices YTD are up slightly (2.3%) at $1.58 million for houses, with multifamily still strong with a 40.5% gain over last year and an average price of $1.13 million. Even with what has felt like a ‘pause’ button pressed, days on market for single-family homes were basically the same as last year (34 days) while multifamily was 54.8% less at 14 days. Rest assured there is still a demand to buy.

“Aggressive list pricing over last year’s pricing is being met with price reductions. Buyers pumping their brakes on purchasing are creating a better opportunity for buyers staying on course, as there is less competition which affords more opportunity for negotiation. If we are recession-bound and if history repeats itself, today’s buyers will likely be re-financing in about a year or so for lower interest rates and will have capitalized on modest 2022 appreciation,” said Steamboat Springs-area REALTOR® Marci Valicenti.

SUMMIT, PARK AND LAKE COUNTY

“The housing market in Summit and Park counties seemed to hit a wall overnight. Sales are down a massive 42%, pending sales are down 55% and active listings are up 35% compared to June 2021. So far, this is a flattening of the market.

“Although it feels like an incredibly fast shift, we were experiencing growth that we simply couldn’t maintain. This slow down must be compared to that fast growth. Buyers frustrated from the competition and losing out on properties, and buyers who got concerned over rising prices, interest rate hikes and threat of inflation have left the market for a while, but not all have left. Now there are more properties available to buy but the average sold price for residential property went up 16%, and days on market went down 15%. So, properties are selling faster and for more in June 22 vs June 21.

“Months supply of inventory is an indicator that the market is leveling. In June 2021, there was a two-month supply and this June there is 3.7-month supply, an 85% change. In a level market, I would price a listing based on past sales, check out what is under contract and what is active and base the price on that data. Last year I would look at what was pending, and price a bit higher based on what was actively being sold. Setting the listing price by pushing the price higher than the last sale was over. There were about seven price drops a day reported over the last week. Once again, change is the name of the game. Will this market shift be a levelling, or will there be a shift to a buyer’s market?

“Residential active listings in the Summit MLS range from a low-price, single-family home in Park County for $149,900 to a high price, single-family home in Breckenridge for $18.99 million. The lowest priced sale in May was a single-family home in Park County for $282,500 and the highest was a single-family home in Breckenridge for $4.2 million. This excludes deed restricted, affordable housing. In Summit County an average priced home is now $2,275,858, down about $78,000 from last month, but up 25% compared to YTD 2021,” said Summit-area REALTOR® Dana Cottrell.

TELLURIDE

“The Telluride market is slowing down in the number of transactions and many listing are pulling back their asking prices about 10%. Inventory of homes and condominiums in Telluride and the Mountain Village is increasing. That said, sales are still strong. Dollar amount of sales in June was $91,549,400 with only 43 sales. That is a record average sales price of $2,190,055.

“I think our affluent buyers are watching the stock market drop about 20% this year and are being a little more cautious with their spending. However, we recently had a home that is being built on the golf course in the Mountain Village that sold twice while under construction. I don’t remember that ever happening in my 39-year career real estate practice here. The spread was about $2 million from first contract to second contract,” said Telluride-area REALTOR® George Harvey.

VAIL

“The month of June 2022 has started what I believe will be a new market direction away from the volatility of the last three years. We seem to be trending toward a more stable market similar to that of 2019. From a market perspective, that is positive and more predictable. In June 2019, we had 115 closed sales, June 2021 had 176, and June 2022 had 126 sales. Looking year-to-date, 2021 closings were 823, versus 637 in 2022, a 22.7% decline year over year. This may seem overly aggressive but the trend each month is more in line with 2019 or pre-COVID performance. Inventory is positive 10.6% and the slow climb to historically normal is slow but steady. Pendings are relatively steady in spite of lower-level inventory which is predominately in key price niches of the past. The months supply of inventory continues to increase, albeit slowly, and is 2.8 in June versus 1.8 in May.

“A more subjective and less quantifiable forecast brings macro market factors such as inflation, mortgage rates, gas, less speculation, short-term rental market control, and recession or no recession. Anecdotally, the Fourth of July weekend was less crowded in the Vail Resorts which seems to be attributed to travel costs that we will continue to monitor over the summer season,” said Vail-area REALTOR® Mike Budd.

SEVEN-COUNTY DENVER METRO AREA

STATEWIDE SNAPSHOT

SEVEN-COUNTY DENVER METRO AREA

STATEWIDE

SEVEN COUNTY METRO DENVER AREA – HOUSING AFFORDABILITY INDEX

STATEWIDE – HOUSING AFFORDABILITY INDEX

The Colorado Association of REALTORS® Monthly Market Statistical Reports are prepared by Showing Time, a leading showing software and market stats service provider to the residential real estate industry and are based upon data provided by Multiple Listing Services (MLS) in Colorado. The June 2022 reports represent all MLS-listed residential real estate transactions in the state. The metrics do not include “For Sale by Owner” transactions or all new construction. CAR’s Housing Affordability Index, a measure of how affordable a region’s housing is to its consumers, is based on interest rates, median sales prices and median income by county.

The complete reports cited in this press release, as well as county reports are available online at: https://coloradorealtors.com/market-trends/

###

CAR/SHOWING TIME RESEARCH METHODOLOGY

The Colorado Association of REALTORS® (CAR) Monthly Market Statistical Reports are prepared by Showing Time, a Minneapolis-based real estate technology company, and are based on data provided by Multiple Listing Services (MLS) in Colorado. These reports represent all MLS-listed residential real estate transactions in the state. The metrics do not include “For Sale by Owner” transactions or all new construction. Showing Time uses its extensive resources and experience to scrub and validate the data before producing these reports.

The benefits of using MLS data (rather than Assessor Data or other sources) are:

Accuracy and Timeliness – MLS data are managed and monitored carefully.

Richness – MLS data can be segmented

Comprehensiveness – No sampling is involved; all transactions are included.

Oversight and Governance – MLS providers are accountable for the integrity of their systems.

Trends and changes are reliable due to the large number of records used in each report.

Late entries and status changes are accounted for as the historic record is updated each quarter.

The Colorado Association of REALTORS® is the state’s largest real estate trade association representing more than 29,000 members statewide. The association supports private property rights, equal housing opportunities and is the “Voice of Real Estate” in Colorado. For more information, visit https://coloradorealtors.com.