Rising interest rates and inflation magnify market slowdown

Sellers, still looking to cash in, face a more patient buyer pool

ENGLEWOOD, CO – Rising interest rates and inflation are helping to magnify what is typically a fall season slowdown, according to the October 2022 Market Trends Housing Report from the Colorado Association of REALTORS®.

New listings for metro-Denver single-family homes fell just over 25% from September to October and are down nearly 22% from a year ago. Statewide, the numbers are very similar, down more than 20% from a month ago, and down 21.6% from October 2021. While a fair volume of active listings remain on the market thanks to a pool of sellers still hoping to cash in on the near record-high pricing of the past year, a much more cautious, patient buyer pool is setting new parameters for contracts and closings, including price reductions and concessions not seen since early in the pandemic.

“Stuck. That’s how REALTORS® describe this market. Sellers are stuck in the prices of the past and buyers are stuck with the fear of what the future may hold,” said Boulder-area REALTOR® Kelly Moye. “Sellers are learning to price to 2021 numbers and buyers are learning to leverage motivated sellers by requesting concessions to buy down their interest rate. Both seem to be working to keep the market rolling in what typically would be a slow time of year.”

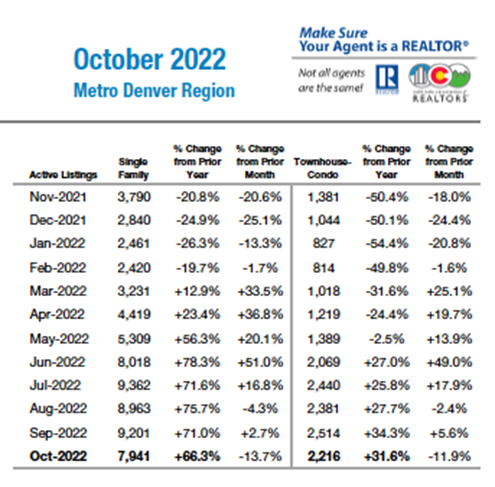

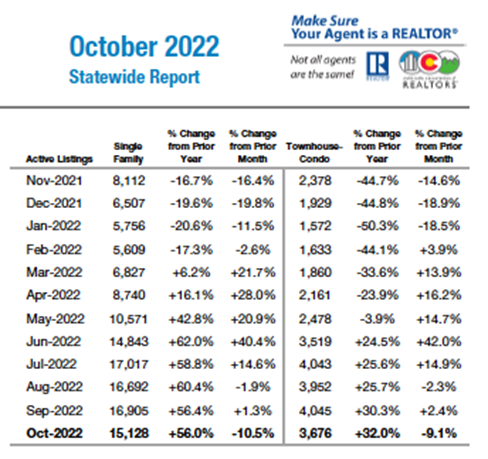

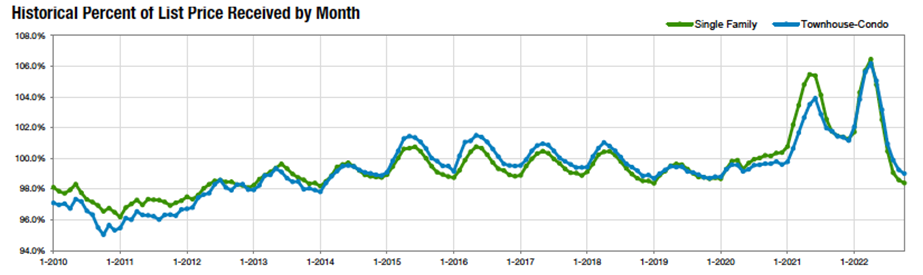

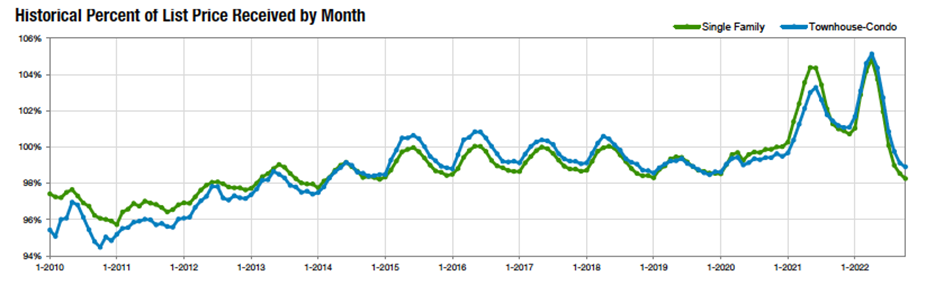

Active listings for single-family homes in the seven-county Denver metro area are up more than 66% from a year prior and up 56% statewide. Townhome/condo active listings are also up, 31.6% in Denver metro, and 32% statewide from October 2021. The 32 average days on market for Denver metro single-family homes represents a 100% increase from this time last year, while statewide, the average 42 days on market is a 50% increase over the same time last year. Pricing concessions are reflected in the percent-of-list-price received category, down approximately 3% across the state to just over 98% of asking price.

“Buyers are weighing four key economic concepts—scarcity, supply and demand, costs and benefits, and incentives in their decision making. The rise in interest rates has eliminated some would-be buyers who may now feel caught in a rental trap where they realize no financial nor non-financial benefits,” said Steamboat Springs REALTOR® Marci Valicenti. “Current interest rates are at 30-year historical averages – however, rapid interest increases, along with inflation are unsettling to many. Sellers that wantto successfully sell in existing market conditions, will likely find themselves pricing more according to condition and location to sell, as buyers are perceiving value before they will buy.”

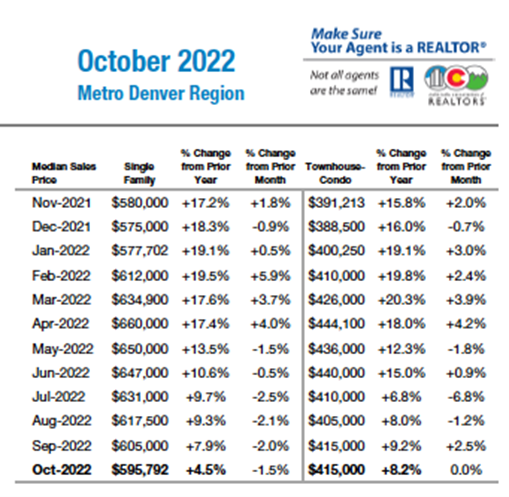

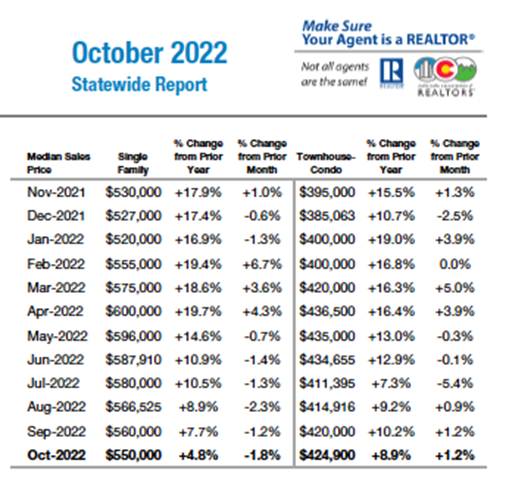

Despite the season and the economic complexities, median pricing for the townhome/condo market has held steady at $415,000 in the Denver metro market, off just 7% from its April 2022 record high. Statewide, townhome/condos median pricing sits at $424,900 in October, off just shy of 3% from an April 2022 high of $436,500. For single-family homes, the median price of $595,792 is up 4.5% from a year prior however, it is down 10% from its April 2022 record high. Statewide, the October median price of $550,000 is a nearly 5% increase over October 2021 however, it is down 9% from its record high of $600,000 in April of this year.

Denver Metro Single-Family Snapshot:

Statewide Single-Family Snapshot:

REALTORS® across the metro area and state shared these highlights (expanded summaries of each market are included in the following pages):

- Aurora – In looking over Adams and Arapahoe counties, and specifically Aurora and Centennial, the numbers are very similar: Inventory up, days on market up, number of under contract and sold listings down and the price up approximately 5% over last year in most zip codes. It is very clear that we are not seeing the same market that sellers enjoyed in the first quarter of this year.

- Boulder/Broomfield counties – Stuck. That’s how REALTORS® describe this market. Sellers are stuck in the prices of the past and buyers are stuck with the fear of what the future may hold. Sellers are learning to price to 2021 numbers and buyers are learning to leverage motivated sellers by requesting concessions to buy down their interest rate. Both seem to be working to keep the market rolling in what typically would be a slow time of year.

- Colorado Springs – With a sharp decline in year over year sales (-35.2%), inventory rose a whopping 108% over this time last year. Buyers are just not feeling any rush locally. They have disengaged and those that are left are very patient. So patient that, combined with sellers not catching on that their market left back in May, days on market rose 146.2%.

- Crested Butte/Gunnison – Sellers are still receiving close to their asking prices (around 97%), but the number of days on the market continue to creep up. Inventory is growing compared to our low point of March 2022 but remains historically low. We are not in the solidly seller’s market that we were in 2021, but we have not swung to a buyer’s market either.

- Denver County –October shows us time and time again that fall is a transformative time. As interest rates jumped again last week, the price of borrowing is likely to stay on a path upward and with that, a lessened demand. Where there is demand, there is stability and although the overall rate of price appreciation is slowing, the presence of demand almost certainly predicts stability.

- Douglas County – The single-family market throughout the county continued its slowdown in October, with a significant decrease in both the number of transactions (-54% month-over-month) and median sales price (-0.5% month-over-month). Average days on market continued to rise as well, increasing three days to 37 last month. The pattern my team has noticed over the past few months is that quality is more important than ever.

- Durango/La Plata County – Since October 2021, sold listings are down 17%, and new listings are down 11%. Supply remains low because sellers with low-interest mortgages are reluctant to sell and take on a new higher rate mortgage. As inventory remains low, we should not expect significant price drops like what we saw during the last housing market downturn. La Plata County’s median home price for October 2022 was $750,000 compared to $412,500 in October 2019.

- Estes Park – It has been quite a while since a listing has sat so long on the market, and I am not talking about a $2 million property, but rather a $299,000, two-bedroom condo that would have gone under contract in 3 hours just six months earlier. Now, it’s been 60 days and showings here and there, but nothing in hand to provide to the seller as motion towards close.

- Fort Collins/Northern Larimer County – Bad news: Sellers are not getting as much for homes as they were earlier in the year. Median price has continued to decline and was at $575,000 down from the peak of $633,947 in May of this year. Interestingly, $575,000 is still 12% higher than October 2021. The good news: housing prices in most segments of the market have either stabilized or are starting to come down incrementally as compared to the meteoric rise experienced in the first half of 2022.

- Glenwood Springs – Despite interest rate hikes, buyers seem to be optimistic the market is changing to their benefit. Not so quick though, as the statistics still show a seller’s market due to a lack of inventory. New listings were down 16.5% in the single-family market and 56.5% in multi-family. Pricing has continued to hold with the single-family median home price coming in 3.7% higher than last year to settle at $674,000.

- Grand Junction – Sellers are getting creative in what they offer as incentives, with some even offering seller financing substantially under the mortgage market rate. Other sellers are holding back, as new listings are down 27.3%, with only 280 new listings in October.

- Pueblo – October was the third straight month the Pueblo housing market has been down by what would be defined as bigger numbers. New listings were down 7.1% from October 2021 to October 2022. The big drop is in the pending sales category, down 37.7% from this time last year, with solds down 40.5% October to October.

- Steamboat Springs/Routt County – Buyers are weighing four key economic concepts—scarcity, supply and demand, costs and benefits, and incentives in their decision making. The rise in interest rates has eliminated some would-be buyers who may now feel caught in a rental trap where they realize no financial nor non-financial benefits. Current interest rates are at 30-year historical averages – however, rapid interest increases, along with inflation are unsettling to many. Sellers that wantto successfully sell in existing market conditions, will likely find themselves pricing more according to condition and location to sell, as buyers are perceiving value before they will buy.

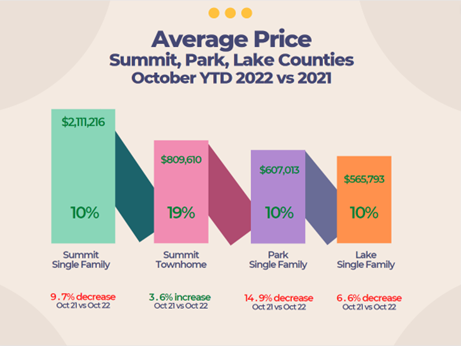

- Summit, Park, and Lake counties – The market, like the weather, is cooling but not cold enough to keep enthusiasts away. Sales have decreased 46%, and there are about 42% more listings to choose from. With approximately four months of inventory supply, we statistically remain in a seller’s market – still well short of the six months needed for a balanced market.

- Telluride – The number of sales in October at 40, was the lowest number of October sales since 2011. Yet the average sales price in San Miguel County is up 29% as compared to 2021, year to date. The Ski Ranches subdivision had its highest priced home sales ever at $14.85 million, double the previous highest home sale there. Total sales for October in the Telluride market area came in at more than $90 million.

- Vail – The market trend has continued, albeit with a couple of more dramatic changes. October 2022 compared to 2021 had a significant decline with transactions down 49% and dollar volume down 44%. Several factors contributed to this scenario, the rising mortgage rates, our more traditional seasonal softness, and macro-economic factors.

Taking a more in-depth look at some of the state’s local market data and conditions, the Colorado Association of REALTORS® Market Trends spokespersons provided the following assessments:

AURORA

“’Congratulations to my buyers for going under contract! We got a big price reduction and $18,000 in Concessions!’ This message was found on Facebook and is one of many posts with a similar message.

“In looking over Adams and Arapahoe counties, and specifically Aurora and Centennial, the numbers are very similar: Inventory up, days on market up, number of under contract and sold listings down, and the price up approximately 5% over last year in most zip codes. It is very clear that we are not seeing the same market that sellers enjoyed in the first quarter of this year. Arapahoe County has a $572,500 median price for single-family residential and $358,000 for condos. Adams County shows inventory up 78%, with a median price of $550,000 for single-family residential, $395,000 for condos. Zip Code 80111, which includes Greenwood Village and the Englewood area, has a median price of $905,000, up 12% over the same time last year.

“The statistics seem to indicate buyers have a little more leverage and stand a chance to get the home they have been dreaming of,” said Aurora-area REALTOR® Sunny Banka.

BOULDER/BROOMFIELD

“Stuck. That’s how REALTORS® describe this market. Sellers are stuck in the prices of the past and buyers are stuck with the fear of what the future may hold. The statistics in Boulder and Broomfield counties show sold properties down by 20% from this month last year. Fewer homes are selling due to unrealistic list prices and fear of continued interest rate hikes. Even though inventory has increased, there is only 2.2 months of supply on the market, indicating a strong, even seller’s, market.

“Prices are up 10% so far this year for single-family homes and townhomes/condos are up about 17%. Houses are selling in about 30 days and townhomes/condos around 44 days. In Broomfield, they are moving even faster, 16 days for homes and 20 for attached dwellings. None of these numbers indicate a significant downturn in the market, but REALTORS® report that it seems slow – likely due to the frenetic pace of last spring, coupled with a seasonal slowdown.

“That being said, sellers are learning to price to 2021 numbers if they hope to sell in a reasonable time. Buyers are learning to leverage motivated sellers by requesting concessions to buy down their interest rate. Both seem to be working to keep the market rolling in what typically would be a slow time of year, anyway,” said Boulder/Broomfield-area REALTOR® Kelly Moye.

COLORADO SPRINGS

“Despite the continued economic tightening, that pesky inflation number does not seem to budge. The Fed is bent on bringing it down, but as we look in each month, it’s just not cooperating. Which then allows the Fed to raise rates, again. To make matters worse, the 10-year yield has also placed itself firmly above 4% and therefore, we see 30-year mortgage rates nearing 7%. All of this translates into what was recently a robust housing market feeling some real pain.

“Locally, we see this play out with a sharp decline in year over year sales, a drop of 35.2%. As sales dropped, inventory rose a whopping 108% over this time last year. To call this a shift is being dishonest. This is a full-on retreat under way. Buyers are just not feeling any rush locally. They have disengaged and those that are left are very patient. So patient that, combined with sellers not catching on that their market left back in May, days on market rose 146.2%.

“Nationally, these are the beginning signs of what could be a housing collapse. Builder sentiment hit 10 straight months of declines. That has not been the case since 2012. Mortgage demand continues to plummet to a time reflective of 2010. With the news of layoffs entering the news cycle, we could see unemployment begin to rise after the new year. And that would be the proverbial nail in the coffin. Housing is 20% of the overall economy. It is stated that, as housing goes, so does the economy. And we are seeing that play out in real time. Optimism has left the building as consumers grapple with double- digit rises in groceries, gas, and debt. Now that we are post-election, I believe we are going to get a real taste of how bad the economy is, and with that which way housing is headed. Look for a very interesting first quarter of 2023. The housing bulls are going to likely be left holding a muleta in an empty arena of disbelief,” said Colorado Springs-area REALTOR® Patrick Muldoon.

CRESTED BUTTE/GUNNISON

“Comparing 2022 to 2021 is a tough exercise because 2021 was unlike anything we had seen before. Sales are down 35%year over year and median prices are up 35% in the same time period. Average prices are up between 45-50% and the Housing Affordability Index is way down – which is not surprising to anyone who has been following the Crested Butte / Gunnison Market.

“2022 will end the year with statistics closer to what we had in 2019 – before COVID changed how people considered buying and selling in mountain resort towns. Sellers are still receiving close to their asking prices (around 97%), but the number of days on the market continue to creep up. Inventory is growing compared to our low point of March 2022 but remains historically low. We are not in the solidly seller’s market that we were in 2021, but we have not swung to a buyer’s market either.

“Sellers need to be aware that the market has shifted and therefore it is more important than ever to consider comparable sales and to present your property in the best light. An experienced REALTOR® can help guide sellers so they can sell their home quickly to buyers who have been waiting for the right opportunity.

“Buyers should step into the market with a renewed sense of hope. No longer do you need to strategize on how to win in a multi-offer situation and you can take a little time to decide if and when you want to make an offer. There are no indications of a major price correction in the near future, but reasonable negotiations should be attempted as sellers adjust to the new reality. A “wait and see” strategy may or may not pay off since low inventory is allowing sellers to keep their prices where they have been and not much less. Interest rates are an unknown, but unlike prices which generally go up over time, there is likely to be an opportunity to refinance to a lower rate at some point.

“We are looking forward to a great ski season at Crested Butte Mountain Resort and hope to have more real estate opportunities as the visitors come to enjoy it,” said Crested Butte-area REALTOR® Molly Eldridge

DENVER COUNTY

“October’s market is weird. It’s weird every year, and every year we speculate that the warmer or colder weather may be to blame. The fact of the matter is though, it’s only weird when viewed through the context of the other 11 months. April after April, July after July, we begin to develop routines and a seasonal look and predictability to our market.

“Unlike the routine months, Denver saw a 9.8% year-over-year median price appreciation in the freestanding home category for October but, the year before that, 2021, that number was only 4% – an arguably redder-hot seller’s market than today that reflects a $23,000 vs. $55,000 upward price change. The year before that, the oddest of all odd years (2020), year-over-year prices jumped a staggering 21.3% which represented a change of $102,000 upward and an even weirder-still result from 2018 to 2019, the median price dropped $8,000. There is little to no predictability or routine in pricing during October. With that in mind, October 2022 was consistently inconsistent.

“October shows us time and time again that fall is a transformative time. As interest rates jumped again last week, the price of borrowing is likely to stay on a path upward and with that, a lessened demand. Viewed through October’s numbers, our month’s supply of inventory or better-put, the amount of inventory available to sell through came in identical to October 2019 at 1.6 months’ worth. If you believe the pundits, and I tend to, that still falls well-short of a ‘balanced’ market at four months and therefore, inventory at less than 50% of demand. In Denver County.

“Where there is demand, there is stability and although the overall rate of price appreciation is slowing, the presence of demand almost certainly predicts stability. Prices may continue to rise right now as is with the price of everything else, but until we see inventory rise – be it in October or June – we don’t immediately see price regressions on the horizon,” said Denver-area REALTOR® Matthew Leprino.

DOUGLAS COUNTY

“The single-family market throughout the county continued its slowdown in October, with a significant decrease in both the number of transactions (-54% month-over-month) and median sales price (-0.5% month-over-month). Average days on market continued to rise as well, increasing three days to 37 last month. The pattern my team has noticed over the past few months is that quality is more important than ever. The ‘average’ home is struggling to draw the attention of buyers and help them justify accepting near 7% mortgage rates. However, ‘exceptional’ homes, those with premium fixtures, desirable locations, and modest pricing are still finding success.

“The townhouse/condo market in Douglas County is a very different environment, with median sales prices continuing to increase and listings spending about 37% less time on the market than single-family homes. Median sales prices reached $499,995 in October, and it isn’t unlikely they will breach the $500,000 level next month. With many buyers having been priced out of the single-family market this year, an imbalance of supply and demand has been created in the townhouse/condo market, pushing prices up. Last month, townhouse/condo transactions made up about 18% of transactions in the county, a significant increase over the 10% figure in September.

“What strategic insights can we draw from these statistics? For sellers: while the cold weather generally brings a cold market, you can expect sales to slow significantly this year. As I mentioned earlier, it’s the ‘exceptional’ homes that are finding success in this challenging environment. Anything you can do to make your home stand out against comparable listings will greatly benefit you. And of course – a bit of modesty in pricing goes a long way for buyers.

“For buyers: patience is key. With inventory remaining below two months, you may not find the perfect home worth stretching your monthly payment budget for right away. As the market shifts more in your favor, you can expect more leverage in negotiating purchase price and terms. Taking your time in your home search (when possible) will improve your experience and knowledge of the market, assisting you in finding the right home,” said Douglas County-area REALTOR® Cooper Thayer.

DURANGO/LA PLATA COUNTY

“As the Federal Reserve continues to raise interest rates, mortgage financing has become more expensive, and our already-expensive housing market has become even less affordable. The result is fewer new and fewer sold listings. Since this month last year, sold listings were down 17%, and new listings were down 11%.

“Supply remains low because sellers with low-interest mortgages are reluctant to sell and take on a new higher rate mortgage. With inventory remaining low, we should not expect significant price drops like what we saw during the last housing market downturn. Even with prices dropping in certain segments of the market, home values should remain much higher than they were three years ago. La Plata County’s median home price for October 2022 was $750,000 compared to $412,500 in October 2019.

“The shifting market is beginning to benefit buyers, offering them more options and stronger negotiating positions. At the same time, sellers are still enjoying the substantial appreciation they gained over the past few years. Despite the negative factors affecting the local market, Durango is still experiencing year-to-date double-digit appreciation.

“I will leave you with a great quote I recently read regarding buying in the current market: ‘Marry the house, date the rate, and divorce the rent.’ Homeownership is still one of the best wealth-building opportunities available today,” said Durango-area REALTOR® Jarrod Nixon.

ESTES PARK

“It has been quite a while since a listing has sat so long on the market, and I am not talking about a $2 million property, but rather a $299,000, two-bedroom condo that would have gone under contract in 3 hours just six months earlier. Now, it’s been 60 days and showings here and there, but nothing in hand to provide to the seller as motion towards close. Things are selling, but not quite as fast, the feverish pace has slowed dramatically. This is a welcomed refresher to catch up on things and regroup, but there is a fearful tinge to the air as the market is shifting. We still have incredibly low inventory and higher prices due to the tourism in the area.

“New listings are cramped and dropping compared to last year. Single-family home listings are down 7.8% year to date and, compared to October 2021, are down 4%. Townhouse/condos are feeling the cramp even more with new listings down 23.6% year to date and a whopping 39.7% less than October 2021. Average sales price continues to climb with single-family homes up 14.8% year to date and townhouse/condos up 11.8%. The percent of list price received is seeing a ‘correction’ if I can use that term… a small dip in single-family homes to 98.6% of list price, down 2.3% from October last year. Townhouse/condos are staying similar at a 100.3% of list price, but down 1.4% from October last year. Year to date townhouse/condos have kept a growing pace of 1.2% more than list. But as we can see in the comparison of October last year we are on a downturn. Days on the market for single-family homes has not changed much from 46 days in October 2021 to 46 this October. Townhouse/condos are seeing the most delay in closings from 60 days in October 2021 to 88 days this October. That falls right into what we are seeing with the condo I currently have listed. Is it the HOA dues in addition to the mortgage that is pushing townhouse/condos to a lesser desirable status? Or are we still riding the COVID mindset and homeowners want to be in single-family living situation?” said Estes Park-area REALTOR® Abbey Pontius.

FORT COLLINS

“The housing market outlook isn’t all bad news. With a slight shift in perspective and if one looks a bit deeper than the headlines, there is some good news. Bad news: Sellers are not getting as much for homes as they were earlier in the year. Median price has continued to decline and was at $575,000 down from the peak of $633,947 in May of this year. Interestingly, $575,000 is still 12% higher than October 2021. The good news: housing prices in most segments of the market have either stabilized or are starting to come down incrementally as compared to the meteoric rise experienced in the first half of 2022.

How is this good news? A drop in pricing can create opportunities for buyers despite higher interest rates. A common phrase right now is “marry the house, date your mortgage rate” meaning, take advantage of an improved price on a house, which in the median price ranges can be as much as a 30k-60k difference from what the same house was getting in April or May. Yes, the interest rate is nearly 3% more – but by using alternative mortgage products like adjustable rate mortgages, mortgage interest rate buy-down programs, and yes, even seller contributions – to reduce a buyer’s 30 year mortgage interest rate can help get a motivated buyer into a home. Many of the economic projections I’m seeing indicate that in the next 12 months, interest rates are likely to come back down into the 5% realm. At that point, a buyer who purchased a home at 7.1% could refinance their home and enjoy a much lower monthly payment. Further, with so many buyers priced out of the market due to either lack of down payment or the inability to qualify for a loan with the higher interest rates, there is far less competition for the number homes on the market. In Fort Collins, there is currently 2 months if inventory available for sale. That number fluctuates across different price thresholds but considering the competition for homes earlier in the year, the current environment is much more favorable to buyers.

As with any shift in the market, it is easy to make this a zero-sum situation (no winners). However, a shift in the market creates opportunities on both sides of the transaction as long as both parties to the sale are well-informed and understand both the short term and long-term ramifications of either acting now or waiting later. Seek out those experts in your market to explore the opportunities available to enjoy a win-win scenario,” said Fort Collins-area REALTOR® Chris Hardy.

GLENWOOD SPRINGS

“REALTORS out and about are finally starting to feel a slight softening in the local market and, despite interest rate hikes, buyers seem to be optimistic the market is changing to their benefit. Not so quick though, as the statistics still show a seller’s market due to a lack of inventory. New listings were down 16.5% in the single-family market and 56.5% in multi-family. Pricing has continued to hold with the single-family median home price coming in 3.7% higher than last year to settle at $674,000. Multi-family was up 19.4% coming in at $400,000. The tale tell signs of a softening market can be seen in the decrease in pending sales, 43% for single-family homes and 54% for multi-family, as well as days on market which increased 26.3% in single family and 70.3% in the townhome-condo sector. We are hopefully returning to a more balanced market in the Roaring Fork Valley,” said Glenwood Springs-area REALTOR® Erin Bassett.

GRAND JUNCTION/MESA COUNTY

“Just like the fast-changing Colorado weather, the same can be said for the real estate market. Sellers are getting creative in what they offer as incentives, with some even offering seller financing substantially under the mortgage market rate. Other sellers are holding back, as new listings are down 27.3%, with only 280 new listings in October. Pending sales are down 34% and solds are down 22%. This has resulted in a growth in the inventory, with active listings at 704, up 30%, and months supply increased to 2.2%. However, most of the growth in inventory is in the $400,000 to $1 million range. The median price year to date is up to $365,000 and the average is up to $425,453 however, this will need watching as sales move forward and price reductions are happening.

“Mesa County real estate is starting to hibernate as rates continue their climb, and prices have not yet reflected any substantial change,” said Grand Junction-area REALTOR® Ann Hayes.

PUEBLO

“October was the third straight month the Pueblo housing market has been down by what would be defined as bigger numbers. New listings were down 7.1% from October 2021 to October 2022. The big drop is in the pending sales category, down 37.7% from this time last year, with solds down 40.5% October to October. The title companies have felt this slowdown as buyers have gone into hiding.

The median price was up less than 1% from October 2021, but remains up for the year, 12.1% to $313,900.

“The percent of list price received dropped to 98.4%, down 1.1% from October 2021 and is at 99.6% year to date. We have seen many sellers dropping the list price of their home to entice buyers who can be a little more demanding with price and conditions of homes now. Despite an average of 64 day on market, and a 2.5 months supply of inventory, this is still a seller’s market. Active October listings shot up 39.1% over October 2021.

“Building permits dropped to 16 compared to last October’s 63. New permits for the year sit at 448, down from 577 at the end of October 2021,” said Pueblo-area REALTOR® David Anderson.

STEAMBOAT SPRINGS/ROUTT COUNTY

“You can’t sell out of an empty wagon, or more simply stated, you can’t sell what you don’t have.

Both new listings and active listings for single-family homes were down 22.7% from the same period last year; new listings for multi-family were down 61.7% with active listings up just six listings to total 68. Months supply for homes was the same as last year – about 2.6 months, where condos and townhome supply was up from 1.1 months to 1.9 months. Pending home sales and sold listings were 27.8% and 41.2% less, respectively; condos/townhomes are -61.7% and -51.6%. Median and average sales prices are still up from the same time last year, as well as year to date, with the percent of list price received for the year sitting at the same as 2021 for single family and slightly above for multi-family.

“Buyers today are weighing the four key economic concepts—scarcity, supply and demand, costs and benefits, and incentives in their decision making. The rise in interest rates has eliminated some would-be buyers who may now feel caught in a rental trap where they realize no financial nor non-financial benefits. To stay in perspective, current interest rates are at 30-year historical averages – however, the rapid interest increase along with inflation are unsettling to many. Sellers that wantto successfully sell in existing market conditions, will likely find themselves pricing more according to condition and location to sell, as buyers are perceiving value before they will buy. In addition to lack of inventory and higher interest rates influencing sales, local government restrictions on short-term rentals that were implemented mid-year is also having impacts to sales. To effectively navigate the short-term rental market, buyers should work with a local REALTOR®.

“Meanwhile, Steamboat Resort is full steam ahead with almost $200 million in base-area redevelopment and on-mountain improvements. Much has been accomplished since summer 2021. Opening day for 2022 includes Skeeter’s Ice Rink. Notable improvements projected to be complete by the Winter 2023-2024 season are the 650-acre expansion into Pioneer Ridge making Steamboat the second largest resort in Colorado and completion of Wild Blue- the longest and fastest 10-person gondola in the U.S.,” said Steamboat Springs-area REALTOR® Marci Valicenti.

SUMMIT, PARK, AND LAKE COUNTY

“With snow falling and the ski resorts opening, the chair lifts, like the interest rates, are going up, up, up. So, not surprisingly, like the weather, the market is cooling but not cold enough to keep enthusiasts away.

“Sales have decreased 46%, and there are about 42% more listings to choose from. That sounds like tons of properties but, 2022’s active listings are still lower than every year except for 2021. With approximately four months of inventory supply, we statistically remain in a seller’s market – still well short of the six months needed for a balanced market.

“To give an example of how much the interest rates have impacted buying power, if you took out a 30-year-fixed loan for $1 million in January with interest rates at 3%, the monthly mortgage cost alone would be $4,216. Today, if you took that same loan with an interest rate of 7%, the monthly cost would be $6,653. About a 58% increase. “There are 452 residential active listings in the Summit MLS that range from a lower-priced condo in Lake County for $130,000, to a higher priced single-family home in Breckenridge at $18.9 million, which has been on the market for more than 2 years. Out of the 177 sales in October, the lowest was a home in Park County for $170,000 and the highest was a single-family home in Breckenridge for $6.6 million. October saw about 34% cash buyers. These numbers exclude deed restricted, affordable housing. In Summit County, an average-priced home is back above the $2 million mark at $2.1 million, up about $189,000 from a month ago,” said Summit-area REALTOR® Dana Cottrell.

TELLURIDE

“In my 39 years of selling real estate in Telluride, I have never seen a market like we have now. The number of sales in October at 40, was the lowest number of October sales since 2011. Yet the average sales price in San Miguel County is up 29% as compared to 2021, year-to-date. The Ski Ranches subdivision that was developed in 1972 when the Telluride Ski Area opened, had its highest priced home sales ever at $14.85 million, double the previous highest home sale there.

“Total sales for October in the Telluride market area came in at more than $90 million again, with only 40 sales. We still have a very tight inventory, and it is still a seller’s market,” said Telluride REALTOR® George Harvey.

VAIL

The market trend has continued, albeit with a couple of more dramatic changes. October 2022 compared to 2021 had a significant decline with transactions down 49% and dollar volume down 44%. Several factors contributed to this scenario: the rising mortgage rates, our more traditional seasonal softness, and macro-economic factors. On the economic scene, people tend to lump everything into a lump-sum game but, as we all know, real estate is local, and every market is different to a certain degree. When we compare our year-to-date performance in transactions by pricing the share of market for each niche except for the opening price niche is relatively similar. This is the issue we have been dealing with for the last six months and inventory is still the problem in that niche. Overall, inventory is positive 28% but some key price points are still lagging. Year to date transactions are down 27% and dollar volume down 17% due to the strength earlier in the year. The ski areas will be opening over the next couple of weeks and hopefully we will see a jump in visitors which historically leads to a more robust sales pattern.

“As the season begins, and hopefully macro-economic trends become more predictable, we should see an improvement in business,” said Vail-area REALTOR® Mike Budd.

SEVEN-COUNTY DENVER METRO AREA

Inventory of Active Listings

STATEWIDE

Inventory of Active Listings

SEVEN-COUNTY DENVER METRO AREA

Percent of List Price Received

STATEWIDE

Percent of List Price Received

SEVEN-COUNTY DENVER METRO AREA MEDIAN SALES PRICE

STATEWIDE MEDIAN SALES PRICES

The Colorado Association of REALTORS® Monthly Market Statistical Reports are prepared by Showing Time, a leading showing software and market stats service provider to the residential real estate industry and are based upon data provided by Multiple Listing Services (MLS) in Colorado. The October 2022 reports represent all MLS-listed residential real estate transactions in the state. The metrics do not include “For Sale by Owner” transactions or all new construction. CAR’s Housing Affordability Index, a measure of how affordable a region’s housing is to its consumers, is based on interest rates, median sales prices and median income by county.

The complete reports cited in this press release, as well as county reports are available online at: https://coloradorealtors.com/market-trends/

###

CAR/SHOWING TIME RESEARCH METHODOLOGY

The Colorado Association of REALTORS® (CAR) Monthly Market Statistical Reports are prepared by Showing Time, a Minneapolis-based real estate technology company, and are based on data provided by Multiple Listing Services (MLS) in Colorado. These reports represent all MLS-listed residential real estate transactions in the state. The metrics do not include “For Sale by Owner” transactions or all new construction. Showing Time uses its extensive resources and experience to scrub and validate the data before producing these reports.

The benefits of using MLS data (rather than Assessor Data or other sources) are:

Accuracy and Timeliness – MLS data are managed and monitored carefully.

Richness – MLS data can be segmented

Comprehensiveness – No sampling is involved; all transactions are included.

Oversight and Governance – MLS providers are accountable for the integrity of their systems.

Trends and changes are reliable due to the large number of records used in each report.

Late entries and status changes are accounted for as the historic record is updated each quarter.

The Colorado Association of REALTORS® is the state’s largest real estate trade association representing more than 30,000 members statewide. The association supports private property rights, equal housing opportunities and is the “Voice of Real Estate” in Colorado. For more information, visit https://coloradorealtors.com.