Spring has sprung, minus the houses

Interest rates and market uncertainty push start of selling season back more than a month

ENGLEWOOD, CO – In what would typically be a rush of new listings hitting the market in April for the start of the home buying and selling season, consumers on both sides of the transaction seem content to watch and wait, reluctant to make a move in a higher interest rate market with sometimes confusing variables, including new property tax assessments and plenty of unknowns, according to the latest Market Trends Housing Report and analysis from the Colorado Association of REALTORS® (CAR). The result, REALTORS® say, are market conditions described as “atypical,” “murky,” and “muddy” with a mix of buyers and sellers who are “dazed and confused.”

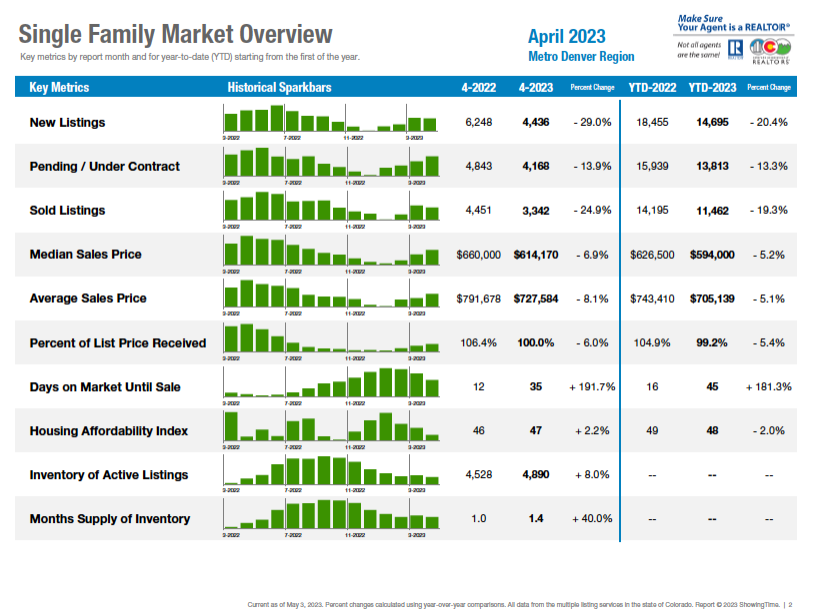

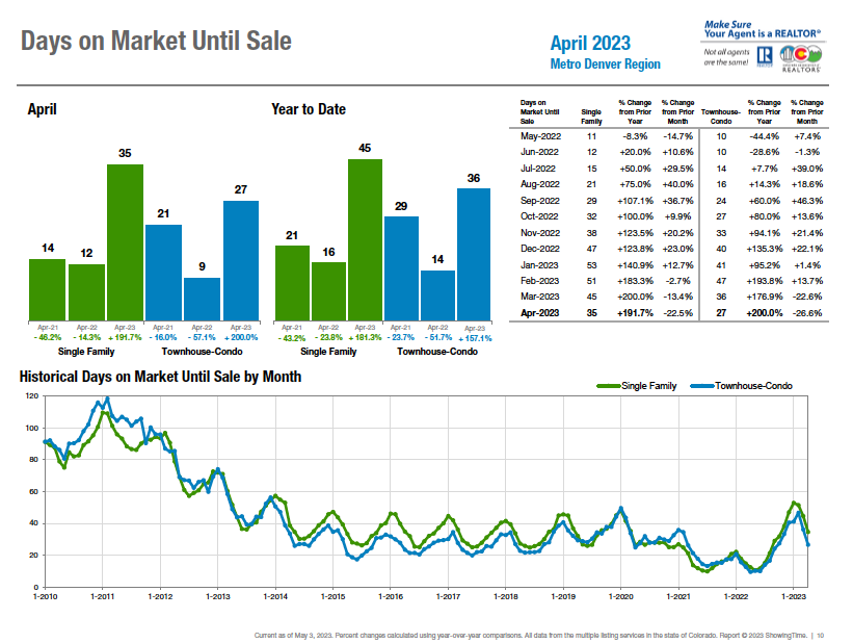

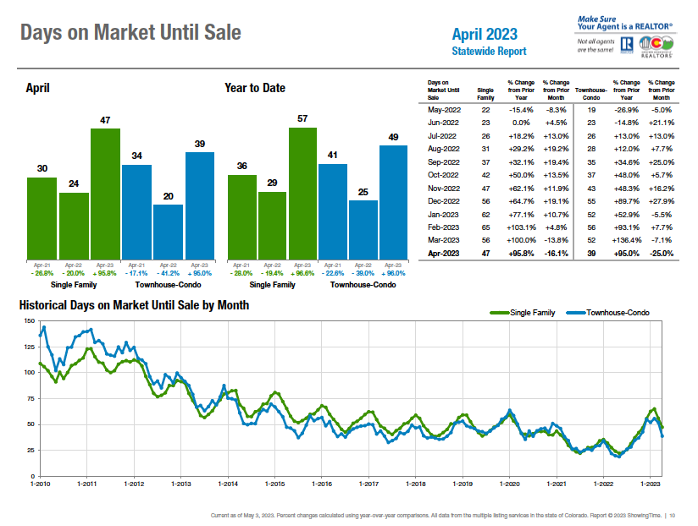

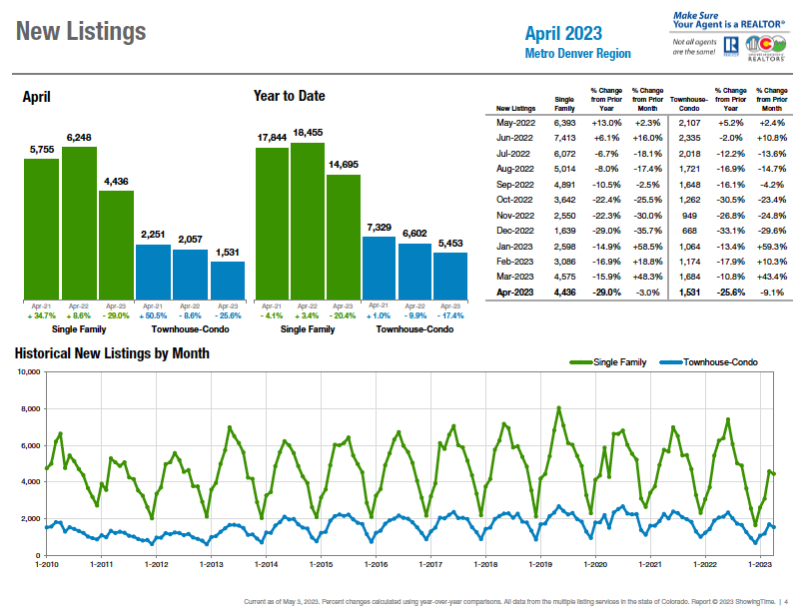

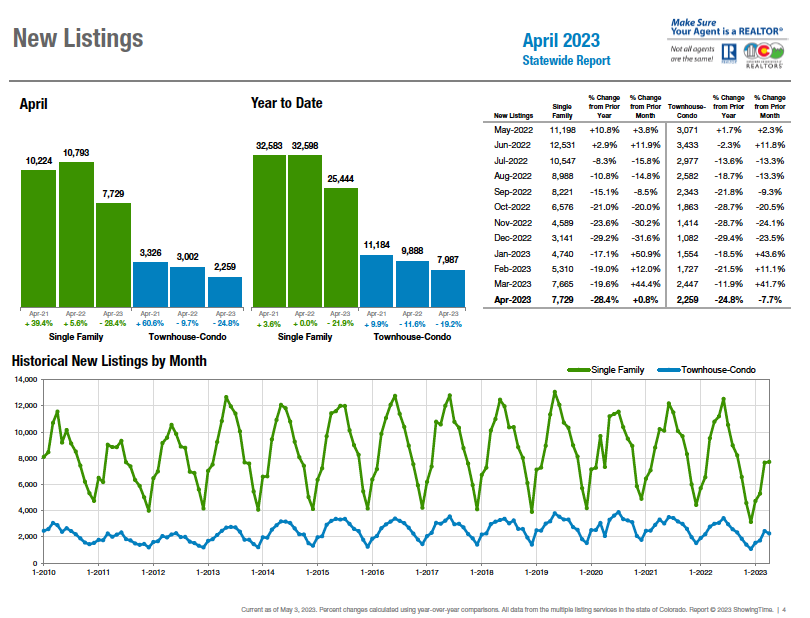

Across the seven-county Denver metro area and statewide as well, April’s inventory of new listings fell 25% for condos/townhomes and as much as 29% for single-family homes compared to a year prior. Sold listings fell into the same range of declines as buyers continue to sit on the sidelines. Inventory is hitting the market, but it is taking quite a bit longer for it to get to close. In the Denver-metro area, average days on market for all property types is up 167% from a year prior (12 days to 32 days). For a single-family home that number grows to nearly 192% — 12 days to 35 days. A “remarkable number given that it occurred in April, one of our most desirable home buying and selling months of the year,” said Denver-area REALTOR® Matthew Leprino.

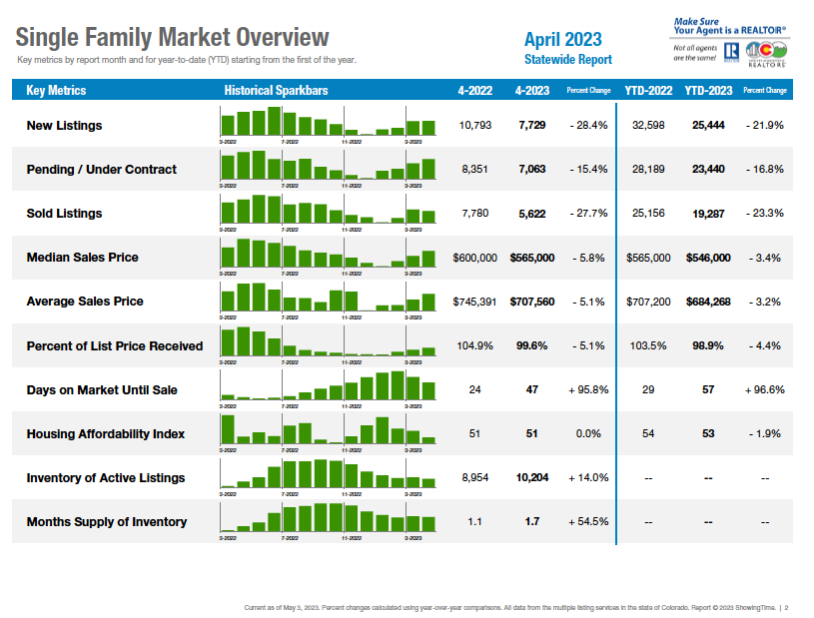

Statewide, average days went from 23 to 46, an increase of 100%.

And the story is much the same regardless of where you may be in the state.

“Where is the beginning of the selling season?” asks Jefferson County-area REALTOR® Barb Ecker. “The selling season, which typically starts in mid-March or, in the case of the past few years, late February, is just trickling in as we work into May.”

“We enter our spring selling season with expectations a bit vague as the macro-economic factors impacting the market are a bit difficult to forecast,” said Vail-area REALTOR® Mike Budd. “We aren’t seeing the usual influx of new inventory so far and that will be critical in invigorating the market. The two drivers in this conundrum are mortgage rates and the fact that pricing for replacement product has not seen significant price erosion. The economy will be the driver of any change in the current market trend. Needless to say, the multitude of opinions on what is going to occur and when is at best murky.”

“Typically, spring brings more listings, not happening in the Roaring Fork Valley. Be it the fluctuation in interest rates or the lack of inventory. Buyers seem to be grasping the concept of the higher interest rates and willing to pay the price to get the home they want. We have replaced seller paid inspection concessions with seller paid interest rate buydowns,” said Glenwood Springs-area REALTOR® Erin Bassett.

“Homeowners are dazed and confused,” said Boulder/Broomfield-area REALTOR® Kelly Moye. “The market in Boulder and Broomfield counties is pulling along at a slower pace with prices down from this month last year (12% in Boulder and 2% in Broomfield) and days on market hovering around two months. The number of listings is down about 19% in Broomfield and 11% in Boulder, continuing the inventory struggle that we’ve experienced all year. Some listings are selling in a weekend with bidding wars and others idle for a few months before a sale. It’s a bit hard to understand.”

CAR’s Housing Affordability Index, a measure of how affordable a region’s housing is based on interest rates, median sales price, and median income by county, finished the month of April up 2% compared to the same time last year for the Denver metro area and was flat when looking statewide.

Seven-county Denver metro area Single-Family Overview:

Statewide Single-Family Overview:

Taking a more in-depth look at some of the state’s local market data and conditions, the Colorado Association of REALTORS® Market Trends spokespersons provided the following assessments:

AURORA

“Once again, interest rates have taken another hike, which might explain why in every zip code in Arapahoe and Adams County new listings and overall inventory are down. It only makes sense that the number of sold properties would be down. Buyers simply do not have many choices however, for those properties that are available, prices are down slightly. The median price in Aurora came in at $535,000 with average days on market up. Sellers are reluctant to move away from their current low interest rate and are hanging on to the home and interest rate they currently have. That said, it seems some of our buyers are waiting for more inventory, which is slowly coming on the market,” said Aurora-area REALTOR® Sunny Banka.

BOULDER/BROOMFIELD

“Homeowners are dazed and confused. The market in Boulder and Broomfield counties is pulling along at a slower pace with prices down from this month last year (12% in Boulder and 2% in Broomfield) and days on the market hovering around two months. The number of listings is down about 19% in Broomfield and 11% in Boulder, continuing the inventory struggle that we’ve experienced all year.

“Numbers for townhomes and condos in Boulder are down across the board – new listings, sales, and median price. The would-be, first-time buyer is waiting for rates to come down and the attached properties are feeling the decreased demand.

“Some listings are selling in a weekend with bidding wars and others idle for a few months before a sale. It’s a bit hard to understand. Then, the tax assessments were just sent to all homeowners causing even more confusion. The valuations are based on comparable sales during an 18-month period which happened to be the top of our market. The tax assessments reflect those prices while the market value now is less. Sellers are dazed and confused and reaching out to their REALTORS® for explanations and assistance with appealing the value” said Boulder/Broomfield-area REALTOR® Kelly Moye.

COLORADO SPRINGS

“Spring has sprung, but housing hasn’t. The real estate industry was waiting for spring. Rumors and speculation on social media were that spring would bring sellers to the market and buyers would jump back in as prices had seemed to stabilize and interest rates had pulled back. Social media would have given you the impression that all homes were seeing multiple offers, and that buyers should consider jumping back in now because this market was heating up. And for many homes that was true. But the overall truth seems a bit dimmer to me.

“The one-year change on sold listings dropped a whopping 31%, a trend we continue to see month over month from the previous year. Hardly a barn burner number despite historically low inventory. We are now pacing with 2015 numbers. And the median price dropped 5.3% year over year. So, despite some properties seeing multiple offers and the industry making it seem like this year is on fire via social media, the numbers just do not show that. I would compare this to any company that tracks numbers. If widget A is setting record sales, but overall, the company reported a 31% drop in overall widgets sold, that would still be bad news. So yes, some homes are seeing multiple offers, but there is no question both REALTORS® and lenders are feeling this squeeze.

“Will inventory increase as we move through the spring into summer? Inventory is now up 31% year-over-year, and I suspect that will remain elevated compared to last year. But the Achilles heel is interest rates, which remain high and housing affordability remains out of reach for many. The Federal Reserve continues to raise rates putting more pressure on debt that many carry in the form of credit cards. Inflation remains an issue and the overall cost of living is elevated. While many across the country and in our industry believe that housing is safe from a crash, I lean on the side that unemployment is going to spike and that is going to leave a different landscape for housing. In its history, the Fed has proven that it misses signs the economy has taken a turn towards the worse, and by the time they react to it, it’s too late. If unemployment remains low, housing seems relatively safe from a massive drop in values thanks to low inventory. But if unemployment increases, look for downward pressure into next year as the economy shifts. We are running a country with historic debt at every level and the world economy is showing signs that we have a storm ahead. We have bank failures in the news, corporate bankruptcies increasing, layoffs being reported, and I have a hard time believing that leaves housing untouched. But we will track the data and see where that takes us,” said Colorado Springs-area REALTOR® Patrick Muldoon.

COLORADO SPRINGS/PIKES PEAK

“’All good things must come to an end’ is now so sadly true about the Colorado Springs real estate market’s long skyrocketing streak during the past several years. Due to inconceivable affordability challenges, in April 2023, the monthly sales suffered a severe knock-back punch dropping below the April 2015 level, year-to-date sales declined below the April 2016 level, monthly sales volume suffered a whopping 31% year-over-year decline, and the year-to-date sales volume, the average and median sale prices endured the first year-over-year decline in the month of April since 2014. Year-over-year in April 2023, the inventory of single-family/patio homes was over 64% higher, the days-on-the-market shot up from 12 to 39 days, monthly sales fell by 27%, and the average and median sales prices plummeted by 5.3%. In April 2023, 32.3% of the El Paso County active listings in the Pikes Peak MLS had price reductions compared to 13.2% in April 2022.

“When looking back five years and comparing single-family/patio homes sales in April 2023 with April 2018, the active listings were up over 4.3%, monthly sales were down 15.2%, and the year-to-date sales declined by 16.3%. However, the monthly and year-to-date sales volumes were up by 29%, and the average and median sale prices were up over 51%. Compared with April 2013, the average and median sale prices escalated 126.3% and 113.6%, respectively.

“The affordability challenges culminating from a staggering combination of high-interest rates, steep home prices, and daunting inflation, continue to be the most formidable barriers for the Colorado Springs area home buyers,” said Colorado Springs-area REALTOR® Jay Gupta.

DENVER COUNTY

“April was a gigantic month for numbers in Denver County. Looking back, 2022 will likely go down as the pinnacle of the price and competitiveness bubble with figures fairly steadily decreasing ever since. According to the data, the median price change from this time last year has dropped a whopping 10.8% year-over-year. While that may sound like a lot – and it is – it’s worth noting that the previous timeframe, April 2021 to 2022 saw a 16.3% increase following a 21.5% increase from 2020 to 2021. A 10.8% decrease is great news for buyers as it’s irrefutably less expensive to purchase a home as calculated by sales price than it was just last year.

“Additional figures paint an even wilder correction as the number of new homes arriving on market is down 30.2% from April 2022, 37.6% fewer sales and an overall available inventory increasing 50%. With that, not only do buyers have substantially more choices but their buying power goes a lot further.

“Interest rate changes have been all the buzz this year but, with buyers paying less this year than last and having the inventory to pay far closer to asking price (100.8% this year vs. 108.5% on average last year), the rates have almost certainly been absorbed and are now part of an average buyer’s expectations. With four out of the last five months seeing a price decrease, now two consecutive months in the double digits, the time to sell is now and the time to buy is also now – a rare and highly desirable balance in a very inconsistent recent history,” said Denver-area REALTOR® Matthew Leprino.

DOUGLAS COUNTY

“The single-family market in April continued to heat up, as month-over-month median sales prices inched upwards 1.96% to $715,000, and average days on market was reduced by a week to 38 days. While buyers get used to elevated interest rates, demand has increased as the spring season progresses. However, the increase in demand is unmatched by supply constraints, as inventory has remained stable at approximately 1.3 months.

“Affordability remains at the top of everyone’s mind this year, as monthly housing costs have increased due to rising rates, major tax reassessments, and real discretionary income reduced by general inflation. This focus on affordability has created an anomaly in the townhouse/condo market in Douglas County, where prices have increased at a much more rapid pace in recent years relative to single-family homes. Median sales prices rose above the $500,000 mark once again to $506,720, reaching its highest level since the market’s peak in May 2022. The lack of townhouse and condo development in the county will likely continue to push prices up throughout the remainder of the summer,” said Douglas County-area REALTOR® Cooper Thayer.

DURANGO

“The Durango real estate market for single-family homes in April experienced a decrease in pending sales compared to the same month last year, with 84 pending sales compared to 96 in April 2022. The number of single-family homes for sale increased to 130, up from 125 in April 2022, even though there were just 77 new listings in April compared to 94 last year, an 18% decrease.

“However, sold listings were down significantly, with only 34 homes sold in April 2023 compared to 66 in April 2022, a 48% decrease. Homes also stayed on the market longer, with an average of 116 days on the market compared to 82 days in April 2022. The supply of homes remained at 2.4 months, which is higher than the 1.6 months seen in April 2022.

“Despite the increase in supply, the average sales price for single-family homes increased significantly, with an average sales price of $1,106,000 compared to $792,000 in April 2022. The median price for April 2023 was $785,000 compared to $698,000 in April 2022. However, the percentage of the closed price to list price decreased to 97.8% in April 2023, compared to 101.4% in April 2022.

“Higher-interest rates continue to be a major contributing factor in the inventory crunch. Sellers with interest rates below 4% are reluctant to make a move. With the weather warming up, we hope that the market will, too. However, the decrease in sold listings suggests that buyers may still be hesitant to make a purchase, perhaps due to the higher prices and higher interest rates,” said Durango-area REALTOR® Jarrod Nixon.

FORT COLLINS

“The most recent sales results from the month of April lack excitement and intrigue – especially compared to last year when interest rates were low and houses were getting bid up by tens of thousands of dollars over-asking price. This April, the real estate market is a bit like the set-up of Waiting for Godot but instead of waiting for the enigmatic and illusory Godot, the market is waiting for interest rates to come down – and like the play, life trudges onward while we wait and see if what we are waiting for ever shows up.

“The market year-over-year is reflective of the waiting: listings are down – likely because potential sellers don’t want to sell and face higher interest rates for the replacement property purchase. Closed sales are down because a huge chunk of the buyer pool is on the sidelines waiting for interest rates to come down (or prices to come down) so they can afford to purchase a home. Days on market are up – homes are taking longer to sell as the active buyers have a bit more time to look before deciding on the home to purchase. This coincides with total active properties for sale being up as is the months supply of inventory at nearly two months. With that additional time, we are also seeing homes sell for less than asking price. The number of homes that sold for less than listing price represented 42% of the sales in Fort Collins in April. This is as balanced a market as we’ve seen in many, many years given the interplay between demand and supply.

“In broad economic terms, the Fed has perhaps made its last interest rate increase this year, the most recent jobs report shows employers are still hiring at a brisk pace, and many folks are waiting for a recession to show up and mortgage rates to start trickling down. Time will tell – but the summer selling season is just about to get under way and may very well prove to be a summer of sustained activity rather than peaking in June and trickling down to September. Interest rates will be the determining factor in how active the summer real estate market will be,” said Fort Collins-area REALTOR® Chris Hardy.

GLENWOOD SPRINGS

“Nothing this year in real estate seems typical. Typically, spring brings more listings, not happening in the Roaring Fork Valley. Be it the fluctuation in interest rates or the lack of inventory, April had new listings down 40.2% in the single-family home sector and -27.3% for townhomes and condos. The lack of inventory left pending sales in the single-family market flat at 75 homes and caused a decrease of 37.5% in the multi-family market with 15 units under contract. One thing that is not flat is the median sales price for April which was up 41.5% for a single-family home, coming in at $850,000. The townhome condo market came with a decrease of 8.2% to arrive at $420,000.

“Buyers seem to be grasping the concept of the higher interest rates and willing to pay the price to get the home they want. We have replaced seller paid inspection concessions with seller paid interest rate buydowns. Multiple offers, although not as common as last year, are still seen when a property is priced correctly for its location and condition,” said Glenwood Springs-area REALTOR® Erin Bassett.

GRAND JUNCTION

“Mesa County and Grand Junction continue to feel the impact of higher interest rates. The slower sales pace has resulted in an increase in active listings to 534, 21.6% higher than this time last year. Also, properties are staying on market longer with days on market now at 88. However, in comparison to the same time last year, our 309 new listings are down 27.4%, pending sales of 312 are down 13.3% and 227 solds are down 32.8%. Year-to-date solds sit at 816, down 30.4% from year-to-date last year. These downward trends are starting to have a slight negative effect on median and average prices, now at $367,750 and $410,096, respectively,” said Grand Junction-area REALTOR® Ann Hayes.

JEFFERSON COUNTY – ARVADA/GOLDEN

“Where is the beginning of the selling season? The selling season for REALTORS® usually starts in mid-March and in the last few years, late February. This year however it is trickling in. Sellers are skeptical of rising rates, realizing they may not be able to buy the house they want in return. Buyers are very picky because of rising rates and will only offer on homes that are upgraded, in great condition and the home checks all the boxes. In Jefferson County, for single-family homes, new listings are down once again 29.6%, sold homes have declined 23% with the remaining inventory down 9.3% year over year. The median sales price for single-family homes is $685,000. Average days on market increased a whopping 155.6%, up from 9 days to 23 days from this time last year.

“For condo/townhomes, a decline of 24.6% with new homes to the market and sold homes declining 30.5%. However, condo/townhome inventory increased 18% and of course, days on market had a large increase of 233.3% from 6 days on the market to 22 days year over year. The median sales price for condo/townhomes is $405,000,” said Jefferson County-area REALTOR® Barb Ecker.

PUEBLO

“The Pueblo market, in this year’s fourth month, is still trending down. New listings were down 30.1% over last April and down 17.8% year-to-date. Pending sales were down 9.9% from last April and sold listings were down 25% from a year ago.

“Besides REALTORS® feeling the decline, title and mortgage companies are feeling the slow down, too. The Fed interest rate hikes have played a big role in keeping buyers on the sidelines. Home showings are still down even with the inventory increasing. We are over a two-month supply of homes. The percent of list price received is holding at 98.1%, down 1.7% year-to-date. The median price is sticking around $315,000 year-to-date up 1%.

“Many REALTORS® have said they are waiting for buyers to get back into the market. Sellers have slowly lowered the home’s price to get buyers to look at their homes. Patience is the key word for sellers as these homes will sell, it just may take a little longer and a little price concession.

“New home permits in April fell to 30 and are down 50.2% for the year compared to the first four months of 2022. Pueblo West, with 50 permits so far this year, is still leading all other areas. April is the last month to compare numbers from the three years of fast sales. Beginning in May, we will be comparing more apples to apples,” said Pueblo-area REALTOR® David Anderson.

STEAMBOAT SPRINGS/ROUTT COUNTY

“The first tale to be told is that there just isn’t enough inventory. Nationally, the historical average of available inventory for new construction is 15%. Looking back to 2020, sales of new construction for the 2020-2023 period in Routt County amounts to 8% of the transactions. Currently, there are 75 active listings with 13 of those new construction; eight of those listings have a Steamboat address ranging from a townhome at $1.24 million, to a custom, single-family home on acreage for $7.9 million. While this places the Yampa Valley slightly above the average at 17% new construction, the need for more affordable housing persists.

“Active listings continue to decline year-over-year and similarly, so do new listings with 33% fewer houses and 69% fewer condos/townhomes hitting the market from the same time last year. There is a direct correlation to available inventory and pending/closed sales so it should not surprise anyone that there is also a decrease in those numbers. Single-family median and average sales prices were both higher than last year and the average sales price year to date is up 22.9% to $1.73 million; the months supply was slightly less at 1.5 months. With 26 multi-family units closing this April vs. 45 last April, the median sales price was 5.7% lower however, sellers still received 100.1% of their list price. Months supply for condos/townhomes is less than a month and the year-to-date average sales price is $837,500, up 7.7% from last year.

“With the bountiful season of snow, it was anticipated that spring listings might come to the market a little bit later as sellers ready their homes. Despite the higher interest rates, there are still many buyers looking to purchase. Both buyers and sellers are adjusting to a market that seems calmer however, with low inventory, the undercurrent of a multiple offer scenario is still very real,” said Steamboat Springs-area REALTOR® Marci Valicenti.

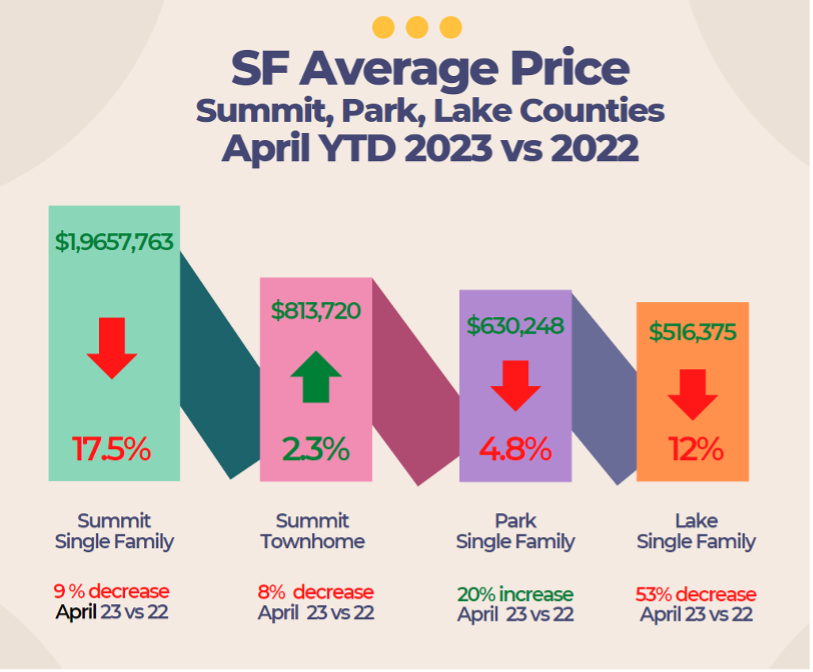

SUMMIT, PARK, AND LAKE COUNTIES

“Mud season in the mountains and mud season for real estate. New patterns in real estate after COVID remain muddy in April in Summit and Park counties. Median sale prices are up 6.6% and numbers of sold properties are down 18.5%. Although inventory is up 13.5% compared to last year, it is still very low. We have consistently seen higher inventory and fewer sales for months. The muddy part is that average or median prices have bounced from dropping to climbing, sometimes changing direction from one month to the next.

“Comparing April 2023 to April 2022, the average sales price for single-family homes in Summit dropped 9.1% to $1,933,578. The year-to-date drop is even higher at -17.5%. The average price for all residential properties was $1,647,643 and condo sale price average was $809,024. Sellers received about 97% of their list price.

“Park County’s YTD average single-family home price was $630,248, while Lake County’s was $516,375. There are 384 residential active listings in the Summit MLS that range from a low-price, mobile home in Park County for $140,000 and a high-price single-family home in Breckenridge for $19.5 million. Out of the 118 April sales, the lowest was a mobile home in Grand County for $219,000 and the highest was a single-family home in Keystone for $5.35 million. These numbers exclude deed restricted, affordable housing,” said Summit County REALTOR® Dana Cottrell.

TELLURIDE

“April is the month of the diamond which is an expensive stone. Telluride regional sales were the highest so far this year coming in at $94.12 million via 47 transactions. Most of that upside was created by home sales in the Mountain Village that was boosted by four home sales averaging $9.2 million. Total dollar sales have increased every month this year which is a big surprise to me. With the war in Ukraine, the federal reserve raising interest rates again last week, one would think that the affluent would be more cautious. Maybe they think life is unpredictable and they might as well enjoy life in a beautiful Colorado resort. The Mountain Village enjoyed 67% of April’s sales but total sales so far this year in our market area are down 42% compared to this time last year. Also, since it takes about two years in our market to plan and build a luxury home, buying one now seems like a good thing to do especially if you’re sixty years old and up,” said Telluride-area REALTOR® George Harvey.

VAIL

“April market performance for Vail and surrounding areas continued the trend started last fall. Both units and dollar sales were negative compared to April 2022. Units declined 40.5% for the month and are down 37.6% year to date versus 2022 comparisons. Dollar sales for the market are following the same trend with April sales negative 31% and year-to-date dollars -28%. The dollar performance continues to be mitigated by greater percentages of sales in the upper price niches of the market. Overall, inventory has improved 19% from April 2022 however, it is still only at one-third of historical levels with a skew toward the upper niches. The increased inventory is more a factor of slower sales than significant new listings. We have seen a decline in new listings versus 2022 in the 40% range. The month’s supply of inventory is an indicator of this trend as it has grown from 1.6 months to 2.9 months, up 81%, while inventory grew 19%. Pending sales for April are minus 40% versus the previous year which is consistent with the year-to-date trend of the same negative 40%.

“Looking forward, we begin entering our spring selling season with expectations a bit vague as the macro-economic factors impacting the market are a bit difficult to forecast. We aren’t seeing the usual influx of new inventory so far and that will be critical in invigorating the market. It appears owners are nervous about selling, not comfortable with the ability to find suitable replacement options in their pricing niches. The two drivers in this conundrum are mortgage rates and the fact that pricing for replacement product has not seen significant price erosion. The economy will be the driver of any change in the current market trend. Needless to say, the multitude of opinions on what is going to occur and when is at best murky,” said Vail-area REALTOR® Mike Budd.

DAYS ON MARKET – SEVEN-COUNTY DENVER METRO AREA

DAYS ON MARKET – STATEWIDE

SEVEN-COUNTY DENVER METRO AREA

STATEWIDE

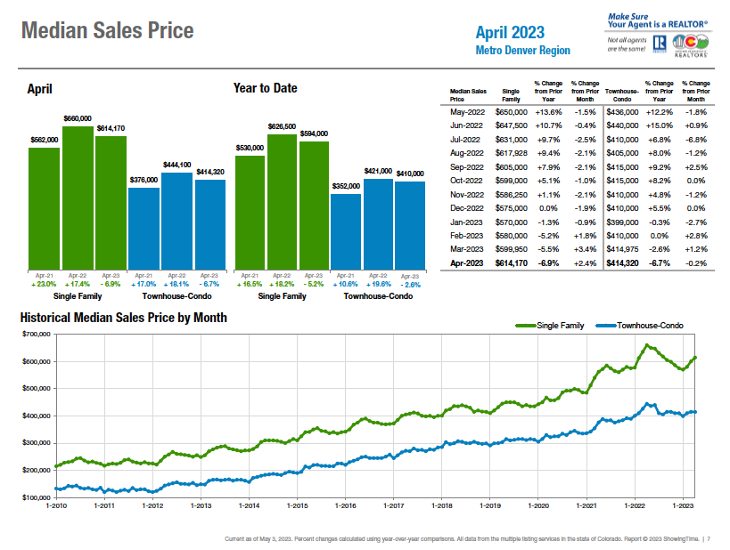

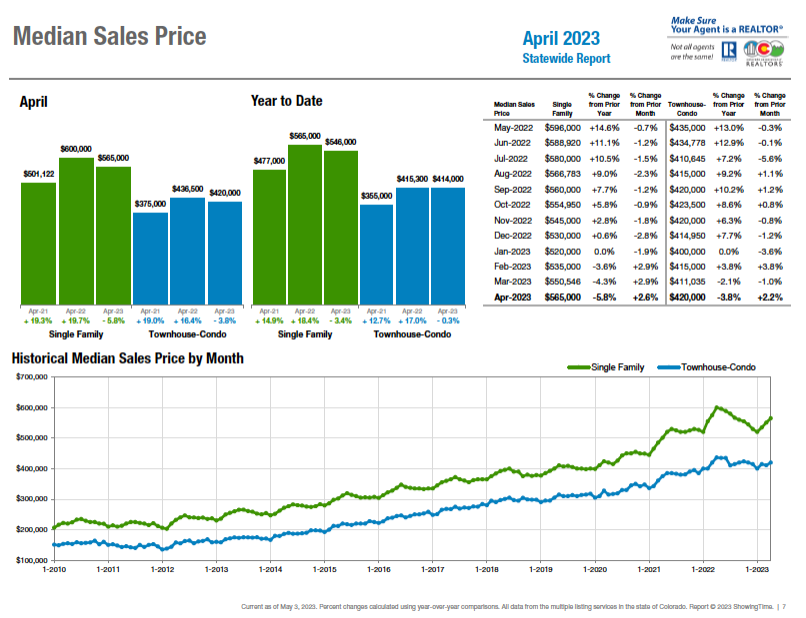

MEDIAN SALES PRICE – SEVEN-COUNTY DENVER METRO AREA

MEDIAN SALES PRICE – STATEWIDE

The Colorado Association of REALTORS® Monthly Market Statistical Reports are prepared by Showing Time, a leading showing software and market stats service provider to the residential real estate industry and are based upon data provided by Multiple Listing Services (MLS) in Colorado. The April 2023 reports represent all MLS-listed residential real estate transactions in the state. The metrics do not include “For Sale by Owner” transactions or all new construction. CAR’s Housing Affordability Index, a measure of how affordable a region’s housing is to its consumers, is based on interest rates, median sales prices and median income by county.

The complete reports cited in this press release, as well as county reports are available online at: https://coloradorealtors.com/market-trends/

###

CAR/SHOWING TIME RESEARCH METHODOLOGY

The Colorado Association of REALTORS® (CAR) Monthly Market Statistical Reports are prepared by Showing Time, a Minneapolis-based real estate technology company, and are based on data provided by Multiple Listing Services (MLS) in Colorado. These reports represent all MLS-listed residential real estate transactions in the state. The metrics do not include “For Sale by Owner” transactions or all new construction. Showing Time uses its extensive resources and experience to scrub and validate the data before producing these reports.

The benefits of using MLS data (rather than Assessor Data or other sources) are:

Accuracy and Timeliness – MLS data are managed and monitored carefully.

Richness – MLS data can be segmented

Comprehensiveness – No sampling is involved; all transactions are included.

Oversight and Governance – MLS providers are accountable for the integrity of their systems.

Trends and changes are reliable due to the large number of records used in each report.

Late entries and status changes are accounted for as the historic record is updated each quarter.

The Colorado Association of REALTORS® is the state’s largest real estate trade association representing nearly 29,000 members statewide. The association supports private property rights, equal housing opportunities and is the “Voice of Real Estate” in Colorado. For more information, visit https://coloradorealtors.com.