THINGS ARE LOOKING UP: Rates will be going down and a fair look at Fannie and Freddie’s new LLPA’s

By Mathew Schulz, CVLS, CML

President, Residential Loan ProgramsC.M.L.A. Board of Directors

Welcome back to this quarter’s edition of Notes from a Mortgage Professional, brought to you by your local embittered mortgage professional. NO, that’s not the case. In fact, there are great things on the horizon; a positive outlook on the increased loan level price adjustments from Fannie Mae and Freddie Mac and imminently improving interest rates! Of course, I always tell my clients, “Hey, I’m a loan guy, it’s my job to be the glass is half full guy”. In all seriousness, I do believe there are good things happening.

What Are They Doing? The Real Story Behind Increasing Costs for Borrowers

First, I would like to address the increase in loan level price adjustments (LLPA’s) by Fannie Mae and Freddie Mac. To begin, I would like to dispel the myth by the media that this is a Biden Administration initiative. While I don’t have a children’s desk in the Oval Office, I am willing to bet my reputation that there wasn’t a staff meeting in the Oval Office in which the Biden Administration asked the Director of the FHFA, Sandra Thompson, how can we make homeownership more expensive, especially for perfectly qualified borrowers? When you dig in a little further to the actual adjustments, you will see that, yes, some adjustments became more expensive for well qualified borrowers (minimally, I would say), and other adjustments became less expensive for the average to lower credit score and lower down payment borrower. This is not discrimination against wealthy people, this is not a socialist agenda, it is an effort to make housing more affordable to the masses.

Is it the right effort? Most have criticized it, but “hey, I’m a loan guy, my job is to be glass half full”. I would rather give a lower to middle income borrower a break on their interest rate than a couple thousand more in down payment assistance. At least the lower rate gives them longer term savings in addition to monthly savings. Does this come at the expense of the “better qualified”? Yes, but we’re not talking about tens of thousands of dollars. At most, on a $600,000 loan amount, with a credit score of 720-759 with a down payment of 20% (the hardest hit category of borrower), the change in closing costs is $4,500. For most other categories negatively impacted by this, the change in cost would range from $750 – $3,000.

Let me hit this pickle from another angle. As a recent buyer, I would’ve been impacted by this change costing me .125% in additional closing costs. On my last home purchase, that would’ve been a change in closing costs of $718.75. Personally, I am fine with that. I am also an individual that has run for city council in the past (another story for another therapist). When I describe my theory on taxes, I always say, I don’t mind paying more taxes than most, I just wish I had great confidence in where those tax dollars were spent. If you want to call this a form of taxation on wealthier or more well qualified borrowers, but it allows other, hardworking American’s that have had their credit scores impacted from medical collections for sick children or extended credit card debt from being laid off during COVID, then I have no problem with that, and I ask you to tug at your own heartstrings to answer that questions for yourself.

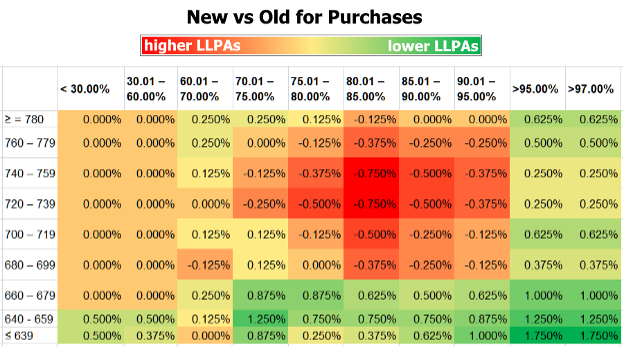

Below is a chart of the actual changes to the LLPA’s, the deeper red boxes indicate the hardest hit and the darker green indicate the most improved. This chart was brought to you by your friends at Mortgage News Daily. I might note that all neutral change sections appear in orange, messing with one’s senses making the chart appear worse than it is.

In conclusion to this topic, yes, the cost of homeownership has gone up for some well qualified individuals while helping many others. We know that there is an affordable and attainable housing crisis in this county, I believe that this is one small step of many that need to be taken to begin to tackle this elephant of a crisis.

Love Roller Coasters? Follow Mortgage-Backed Securities!

On a lighter, more fun, and exciting front, interest rates are coming down imminently! Through the past 17 months, more particularly, January through October of last year, we saw some of the fastest increasing interest rates in history topping out in October of 2022 with conventional rates above 7.0%. Depending on who you speak to or listen to; The Mortgage Banker’s Association, Fannie Mae, or Freddie Mac’s economists, all have predicted that we will be seeing rates below 5.5% before the end of 2024, some are expecting these rates to begin to fall as early as this month, May 2023.

My favorite mortgage economist is Barry Habib, original founder of the Mortgage Market Guide and present owner of MBS Highway. I have followed him nearly my entire career and this man gets things right with an uncanny ability. Barry has been so bold as to say that we would begin to see these falling rates beginning as early as May 10th. The big reason that Barry went so far as to put a date on his prediction of falling rates: On May 10th, inflation numbers were announced, and it was a positive report for inflation improving. On that positive news, we saw mortgage-backed securities – MBS (the true tool to determine mortgage rates – see August 2022 article in Colorado REALTOR® Magazine for background on mortgage-backed securities) improve by 44 basis points (bps)! For those that don’t follow MBS, that’s a nice one-day improvement! Things have stalled out for the week at the time this article was written, however, Barry goes further to predict that when June’s Consumer Price Index (CPI) report comes out the second week of July, the index will fall from 4.9% presently to as low as 3.5-3.75% causing mortgage rates to continue to fall.

Reports like this that continue to point us in the direction of a recession are why most economists are predicting lower interest rates. As a further reminder, as bad economic news happens that tends to negatively impact the stock market, investors’ money will flow to the “safe haven” of the bond market including our mortgage-backed securities that are in fact bought and sold as bonds. I encourage you all to check out Barry’s website (it is subscription based) www.mbshighway.com and if you’re not thrilled with the subscription, follow him on LinkedIn or other social media. He is the most accurate economic predictor that I have followed through the years, and he gives other great real estate-related advice.

That does it for this edition of Notes from a Mortgage Professional, stay tuned for my next article, “How to Polish Your Resume for Exiting the Real Estate and Mortgage Industry”. Kidding! Don’t you dare! This is just another down cycle, as all cycles do, this will come back and will do so after weeding out the weaker players leaving you a nice slice of the pie when buyers begin to dip their toes back in the market – like the fast-food restaurant Good Times says, “It’s Gonna Be Big”!