With slowing activity across the state, housing prices buoyed by luxury market sales

ENGLEWOOD, CO – Despite small increases in the overall inventory supply, higher mortgage interest rates continue to broaden the traditional seasonal slowdown in housing markets across the seven-county Denver metro area and in markets statewide. As a result, buyers willing to come off the sidelines have gained a little advantage and sellers, willing to sacrifice their 3.5% and lower interest rates, find a market calling for pricing concessions and interest rate buydowns to secure contracts, according to the latest Market Trends Housing Report from the Colorado Association of REALTORS® (CAR) and analysis from the Association’s spokespersons across the state.

Mortgage interest rates continue to reach heights not seen in two decades and affordability/attainability has become even more challenging for most first-time home buyers as moderately-priced homes coming on the market are few and far between.

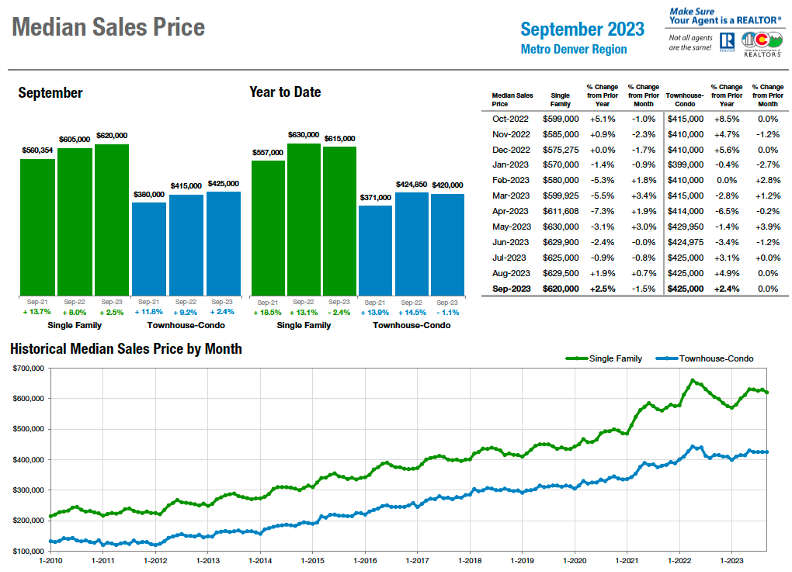

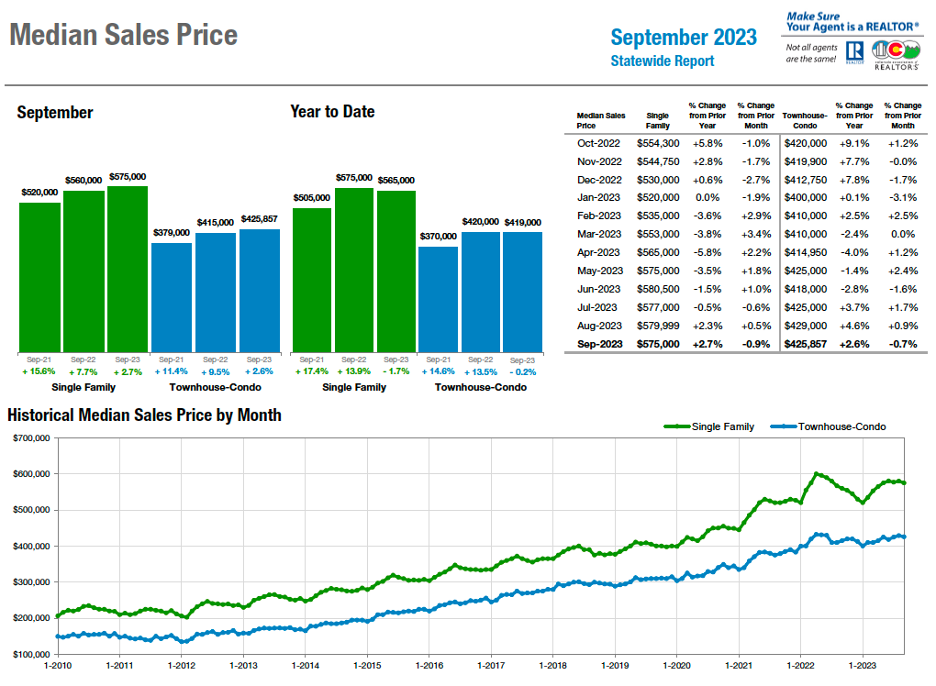

“While most price points saw double digit declines in the number of homes sold, interestingly, the million-dollar price band has seen a decline of just 1.4%. With fewer homes selling across the other price bands, it’s no surprise that median price has crept up – but don’t be misled that home price appreciation continues to rise. At best, prices appear to be stabilizing, if not declining ever so slightly,” said Fort Collins-area REALTOR® Chris Hardy.

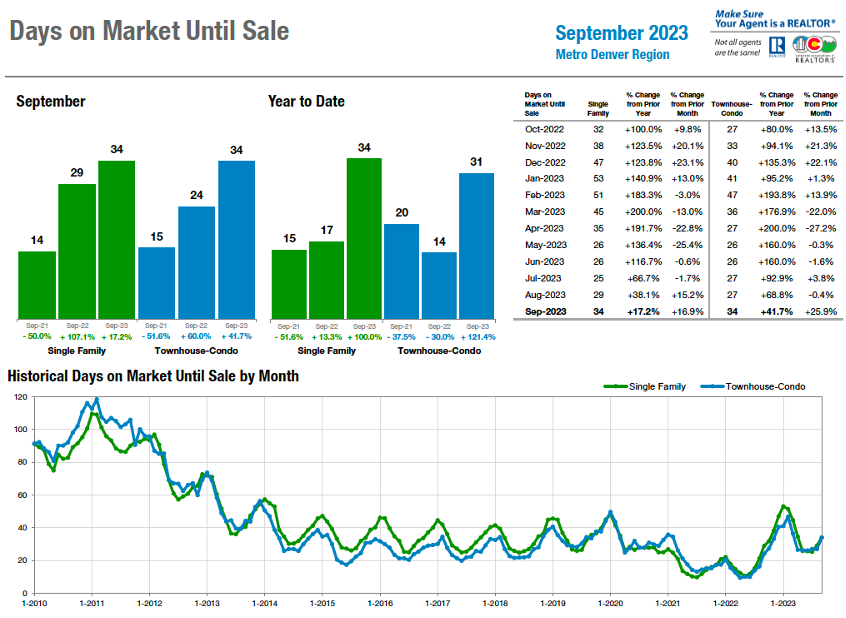

Showing volume has decreased quickly into the fall/winter season and the competitive edge has shifted slightly towards buyers, but only those who can stomach mortgage rates above 7%, according to Douglas County-area REALTOR® Cooper Thayer.

“Interest rates steadily climbed throughout September, pressuring sellers to be more aggressive with pricing to convince buyers to consider their homes. The list-price to close-price ratio dropped to 98.9% for single-family homes last month (98.7% statewide), indicating buyers are more in control than they’ve been in a while,” said Thayer.

Looking to the southern end of the front range, the Colorado Springs housing market is choking due to continuing worsening of affordability by the staggering combination of escalated record-high housing prices, spiraling interest rates, and daunting inflation, according to Colorado Springs-area REALTOR® Jay Gupta.

“Since September 2018, the monthly mortgage payments (principal and interest alone), on an average priced home at the annual average 30-year fixed interest rate, have soared 126%, and over 10 years, it is up 238%,” said Gupta. “Many home buyers would like to buy but they simply can’t afford it.”

In Boulder County, the number of price reductions exceeded the number of new listings, according to REALTOR® Kelly Moye. In September, 45% of listings that went under contract did so after a price reduction.

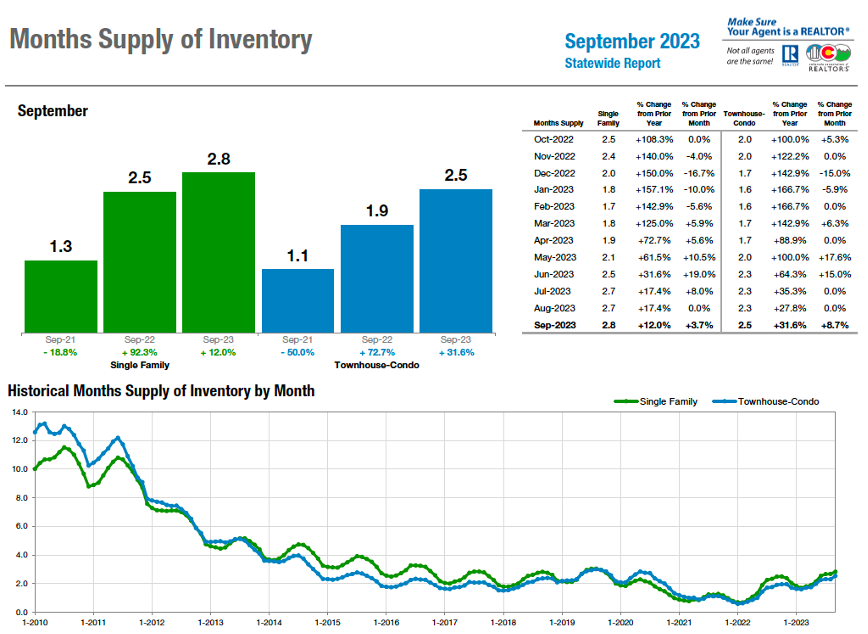

With the months supply of inventory continuing to creep up and pricing stabilizing a bit, financing the home has become the key driver for any buyer in the market.

“For the financed buyer, it’s beginning to be your time to wheel and deal. Incentives exist with the abundance of inventory and sellers who are opting to throw their home into the ring now understand that assistance, possibly by way of rate buydowns, are a present negotiating necessity,” said Denver-area REALTOR® Matthew Leprino.

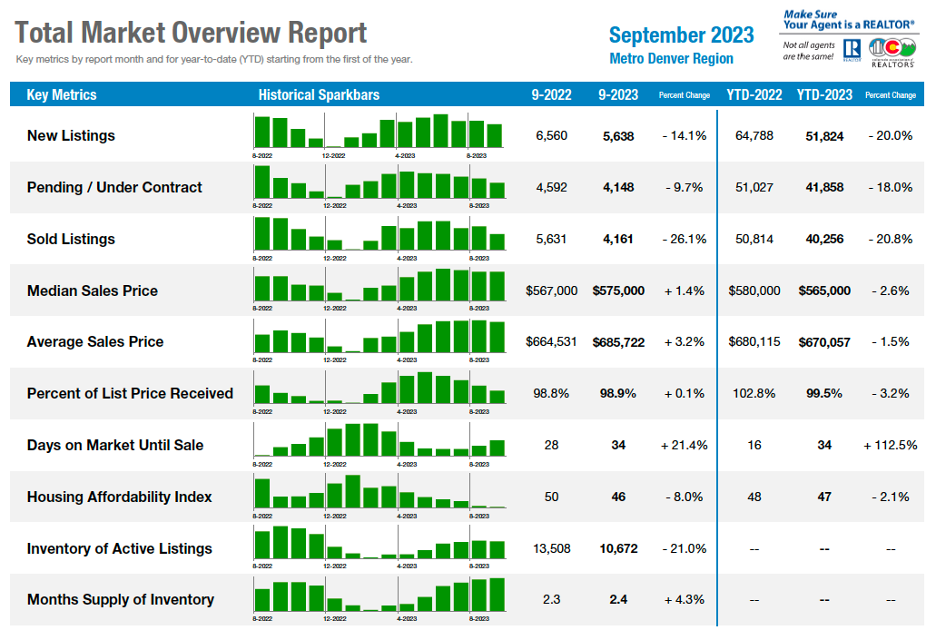

Seven County Denver area Market Overview:

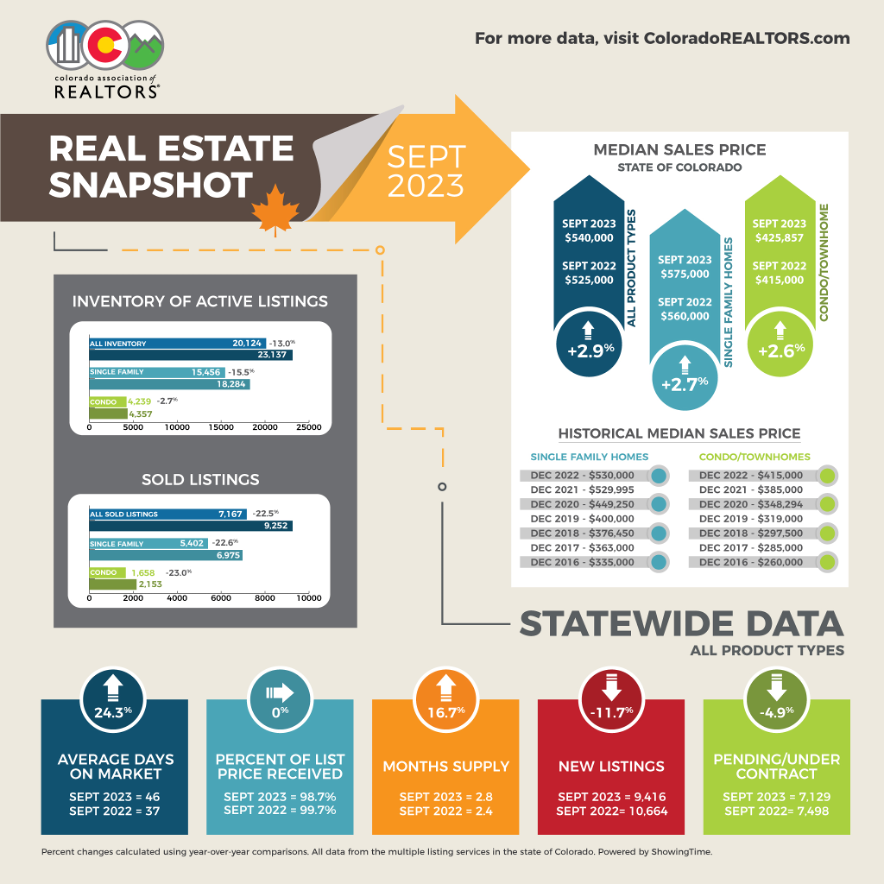

Statewide Market Overview

Taking a more in-depth look at some of the state’s local market data and conditions, the Colorado Association of REALTORS® Market Trends spokespersons provided the following assessments:

AURORA

“September home sales reveal an early trick or treat market with inventory down as much as 33% in some Aurora, Adams County, and Arapahoe County markets compared to a year prior. The treat for buyers being that while inventory is down substantially, pricing is only up approximately 2% over 2022 in the same areas with average days on market a little longer, in some cases as much as 31 days on market. Buyers are not seeing the incredible bidding wars of the past couple of years. They may pay a little more than last year however, they do not have to buy the spooky, scary house with just one look. Pricing varies depending on the zip code. The best buys are in the 80010 and 80011 zip codes, which are also seeing some of the best appreciation.

“I do not expect to see large inventory increases as potential sellers are holding on to their low interest rates just as kids hold on to the good chocolate in their treat bags. For sellers wanting to sell, the home needs to be in good condition. Buyers are not looking for the haunted, unkept house look. With higher prices, high interest rates, and high costs of living in general, most buyers do not want to have to go in and rehab a home needing repair. Good homes, priced correctly, are still selling, and smart buyers who realize interest rates may not be going down anytime soon but rental rates are continuing to climb are still buying,” said Aurora-area REALTOR® Sunny Banka.

BOULDER/BROOMFIELD

“In Boulder and Broomfield counties, the market is cruising along at a much slower pace, even more than is typical for the fall. Buyers and sellers are both waiting for interest rates to come down, which leaves the current inventory a bit longer on the market with a lack of urgency among our buyers to buy them.

“Broomfield is holding steady, still up in median sales price about 3% since the beginning of the year. Sales are down 15% but when they do sell, the average days on market remains around 30. Boulder County has taken a slight hit in values with the average prices down about 5% so far this year. With an average of 54 days on the market, homes are taking longer to sell, and sellers are negotiating more on the sales price.

“As a REALTOR® watching the market daily, the number of price reductions far exceeds the number of new listings. In September, 45% of listings that went under contract did so after a price reduction. Sellers are learning how much these changes in rates are truly affecting our buyers and are attempting to adjust to get their home sold.

“Buyers who are waiting on the sidelines are missing an enormous opportunity. They have the chance to negotiate on the sale price and potentially get concessions from the seller to buy down their rate. It’s a chance to get a great deal in this market for the first time in years,” said Boulder/Broomfield-area REALTOR® Kelly Moye.

COLORADO SPRINGS

“As we look at September housing data, you begin to see a real anomaly. Active homes across all properties dropped just shy of 12 % year-over-year. We also had a 26.8% drop in total sales year-over-year. But then out of nowhere, you have a 4.5% jump in median sales price. Why? We have dropped so low on units sold that only the upper-end properties are being counted. We are struggling to sell entry level and mid-level homes in many areas. And as those upper end homes sell, they are pulling up values on our statistics. We are grading on a bell curve and that number is now skewed. We are struggling in these lower price points because middle America continues to feel the pain of higher for longer. A term we are all getting annoyed with. So, let’s see how that is affecting other areas of our economy.

“The 30-year mortgage continued its trek north. The pressure on lending and housing is real. Home values holding does not just wish away that we are losing a massive amount of home sales year-over-year. And we are off 2021 numbers by almost 50% for units sold. The current mortgage is the highest it has been in two decades. Mortgage applications continued to crater through September. With housing accounting for 20% of GDP for the economy, these are real numbers that really affect a lot of people in a lot of industries. That does not bode well for the economy in the long term.

“So why is there no recession yet? I believe the odds of a 2024 recession are increasing and many people are starting to take note. Typically, recessions follow a drop in M2 money supply by two years. M2 began its decline in 2022. That math then works out. The Motley Fool dropped an article recently titled, ‘For the First Time Since the Great Depressions, US Money Supply Is Shrinking. History suggests this spells trouble for stocks.’ Market Insider had an article titled, ‘The U.S. housing market is headed for the largest sales slowdown since 2011, Fannie Mae says.’ That article quoted a report from Fannie Mae stating that a mild recession is likely in the first half of 2024. I believe that we have plenty of other signs showing the economy is seeing a shift. How hard that shift hits will be based on the future employment situation. If the Federal Reserve can keep a balance to employment, then we may have a miracle soft landing. The flip side is, if they cannot, it will be the most epic bubble pop we have ever seen and it will be seen across many sectors, to include housing,” said Colorado Springs-area REALTOR® Patrick Muldoon.

COLORADO SPRINGS

“The housing market in Colorado Springs is choking due to continuing worsening of affordability by the staggering combination of escalated record-high housing prices, spiraling interest rates, and daunting inflation. In just the past 5-years since September 2018, the monthly mortgage payments (principal and interest alone), on an average priced home at the annual average 30-year fixed interest rate, have soared 126%, and over 10 years, 238%. Many home buyers would like to buy but they simply can’t afford it.

“September 2023 delivered a 22.1% year-over-year blow in the sale of single-family/patio homes, bringing it down to 1,008 sales, and an 7.7% decline in the number of active listings to 2,484 homes. Average days on market climbed to 38 days compared to 25 days in September 2022. As the average and median prices escalated to $540,882 and $475,000 respectively, there were 19.5% and 24.5% decreases in the monthly and year-to date sales volumes, respectively.

“Last month, 57.1% of the single-family/patio homes sold were priced under $500,000, 35.7% were between $500,000 and $800,000, and 13.1% over $800,000. Year-over-year, there was a 24.7% drop in the sale of single-family/patio homes priced under $400,000, a 24.8% decline in homes priced between $400,000 and $600,000, a 17.5% decrease in homes priced between $600,000 and $1 million, and a 3.5% increase in homes priced over $1 million.

“In September 2023, 51% of the active listings in the Pikes Peak MLS in El Paso County had price reductions. The future of the real estate market will depend on factors impacting affordability either positively or negatively, and the consumer confidence,” said Colorado Springs-area REALTOR® Jay Gupta.

DENVER COUNTY

“It’s a little tricky to wrap your head around fewer homes coming on the market while inventory is going up. One would typically consider that fewer properties equal fewer choices but that is not the case in Denver. The reason? Demand. This September, 14% fewer homes came on the market than last year, 26% fewer than in 2021, and while that may sound like the familiar ‘we don’t have enough inventory’ dialogue, it’s anything but. While 14% less came on the market over the last 12 months, 18.9% fewer homes sold – showing that even less property is selling with more choices. With interest rates and the general ‘everything is more expensive’ climate, sellers are choosing to stay in their 2.5-4.5% mortgages rather than trading them in for the 6-8% option today which inevitably equals a trading down of property to keep payments the same.

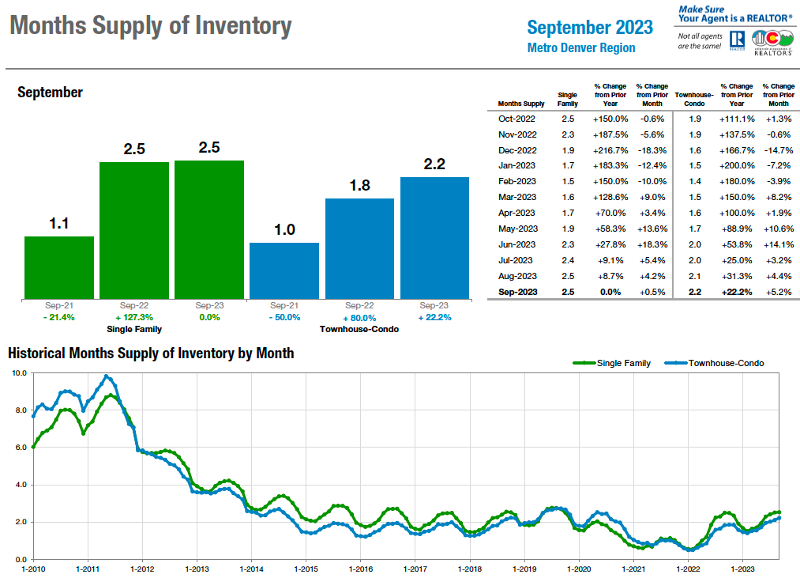

“The days on market timeframe is the same as last year, 25 days of marketing time in total while inventory, as calculated by how quickly homes are being gobbled up, is approaching 20% at 18.4. To further illustrate this point, at no time in the last 8 years has the months supply of inventory been so high – now at 2.3 in total for the freestanding home and 2.8 for condos and townhomes.

“Despite the higher costs of, well, everything, housing is stabilized in terms of acquisition costs while financing them is another matter entirely. For the cash buyer who can afford to buy now, the time is prime to take advantage of stagnant pricing. For the financed buyer, it’s beginning to be your time to wheel and deal. Incentives exist with the abundance of inventory and sellers who are opting to throw their home into the ring now understand that assistance, possibly by way of rate buydowns, are a present negotiating necessity,” said Denver-area REALTOR® Matthew Leprino.

DOUGLAS COUNTY

“With supply on the rise and interest rates showing no mercy toward buyers, it’s clear the real estate market has entered hibernation for the winter. In September, there were 2.4 months supply of homes on the market in Douglas County, the highest supply figure we’ve seen since fall 2019. The seasonal slowdown combined with buyers sitting on the sidelines due to budget constraints has caused listings to stay on the market longer, and prices are starting to take a significant impact. Between August and September, the median sales price in the county fell over 5.2% to $719,163 while average days on market rose three more days to 33.

“With showing volume decreasing quickly into the winter season, the competitive edge in the market has certainly shifted slightly towards buyers, but only those who can stomach mortgage rates above 7%. Interest rates steadily climbed throughout September, pressuring sellers to be more aggressive with pricing to convince buyers to consider their homes. The list-price to close-price ratio dropped to 98.9% for single-family homes last month, indicating buyers are more in control than they’ve been in a while,” said Douglas County-area REALTOR® Cooper Thayer.

FORT COLLINS

“The most recent and better-than-expected national jobs numbers all but guarantee the Federal Reserve will hold its short-term lending rate higher for the foreseeable future. Our national economy keeps chugging along despite negative reports, negative consumer confidence, and inflation incrementally in retreat. Mortgage interest rates continue to reach heights not seen in decades. Home ownership remains unaffordable and unattainable for most first-time home buyers as moderately priced homes coming on the market are few and far between.

“So, where’s the demand coming from if the median price of homes is still going up? Look no further than the luxury market. While most price points saw double digit declines in the number of homes sold, interestingly, the million-dollar price band has seen a decline of just 1.4%. With fewer homes selling across the other price bands, it’s no surprise that median price has crept up – but don’t be misled that home price appreciation continues to rise. At best, prices appear to be stabilizing, if not declining ever so slightly.

“With homes taking nearly twice as long to sell as just two summers ago, and nearly three months of inventory leftover at the end of the month, the remaining active buyers in the market are demanding properties in turn-key condition along with cash concessions from sellers to reduce buyers’ mortgage costs. What’s more, buyers are willing to wait for the right property to come on the market at the right price or for those properties languishing for 60 days or more to come down in price,” said Fort Collins-area REALTOR® Chris Hardy.

GLENWOOD SPRINGS

“The Roaring Fork Valley real estate market remains stable in September 2022, despite some slight declines in key indicators. The median home price for a single-family home dropped by 4% from 2022, reaching $675,110. This is the first time this year that the price has decreased. New listings increased by 3.1%, adding 2 more homes to the market, while pending sales and sold listings decreased by 3.3% and 6.7%, respectively. The average time on the market was 57 days, which is 17 days longer (42.5%) than last September. There were 181 active listings for single-family homes at the end of September, resulting in a 3.4-month supply. Year to date, the single-family market has seen a 10.6% decrease in both new and sold listings, while the median sold price has increased by 5.2%, reaching $673,550.

“The townhome condo market also showed some signs of slowing down in September 2022. New listings rose by 22.2%, adding 4 more units to the market, but pending sales and sold listings fell by 5.3% and 45%, respectively. The latter was a significant drop from the 35 units sold in September 2021. The average time on the market was slightly shorter, at 50 days, which is a 9% decrease from last year. There were 44 active listings for townhomes and condos at the end of September, which is an 18.5% decrease from last year, resulting in a 2.8-month supply. Year to date, the townhome condo market has experienced a sharp decline of almost 25% in new listings and 35% in sold units, while the median sale price has risen by 8.6%, reaching $485,000.

“The lack of inventory in the Roaring Fork Valley has been a persistent challenge since 2019, and it has been exacerbated by the increase in interest rates. It remains to be seen whether sellers will be willing to trade their low-rate mortgages for new homes, and whether buyers will adjust to higher rates. Is this the new normal?” said Glenwood Springs-area REALTOR® Erin Bassett.

GRAND JUNCTION/MESA COUNTY

“Mesa County is feeling the impact of the interest rate increases as activity has fallen off. The only up statistic is days on market, now at 75. New listings are down 22.7%, pendings down 6.6%, and solds down 23%. Prices, however, continue to hold steady, with the median $397,500 and the average $434,078. We even still see occasional multiple offers and overbids. The active inventory continues to shrink and is down 23.1% from the same time last year, with 634 active listings. Interest rates are the key to our activity and those don’t appear to be coming down any time soon,” said Grand Junction-area REALTOR® Ann Hayes.

GUNNISON/CRESTED BUTTE

“The real estate market in the Gunnison and Crested Butte area really died in the final quarter of 2022 so, while the total numbers for 2023 are down from 2022, things are actually looking up when you compare September 2022 to September 2023. We would have to have some record sales for the next three months to come close to the numbers in 2022, but based on pending sales, new listings and active listings, there should be some ground made up. Prices continue to stay steady and even go up a bit, but we are a small market so one or two expensive sales can really skew the average prices. There is very little for sale at the lower end of the price range and any of these more attainable properties that do come to market sell quickly and often with multiple offers. Navigating the ever-changing market requires constant attention and flexibility,” said Crested Butte-area REALTOR® Molly Eldridge.

JEFFERSON COUNTY – ARVADA/GOLDEN

“Not much has changed over the past month as interest rates have once again increased, leaving buyers on the fence. Sellers are not listing their homes because they do not know where they can go and afford a home that they desire. Jefferson County new listings decreased 18.9% and sold listings were down 25.9% year-over-year. The median sales price increased to $715,900 and average days on market jumped to 28 days. For condo/townhomes, new listings were down 19.6% and sold listings were off 27.4% from this time last year. The median sales price sits at $400,000 with average days on market at 23,” said Jefferson County-area REALTOR® Barb Ecker.

PUEBLO

“The Pueblo real estate market continues to slow as we hit the ninth straight month with the market delivering negative numbers. New listings were down 17.3% from last September and down 16.9% year-over-year. Pending sales were down 19.5% year-over-year and solds down 6% compared to September 2022. Solds are down 25.1% year-to-date.

“Looking at pricing, we saw the median price fall 2% from September 2022 and we’re down 1.6% year-to-date at $309,900. The percent-of-list-price received was down slightly to 98.4% reflecting sellers’ willingness and need to lower prices to get their homes sold. Sellers are also attracting buyers with price reductions ranging from $500 to $25,000, depending on the homes stated price.

“All of these factors are pushing the average days on market up, where we now sit at 84 days. We’re seeing more open houses as agents look to get buyers off the sidelines however, interest rates still seem to be the primary blocker for buyers.

“Finally, new home permits are very low, only 13 pulled in September in Pueblo County. New construction permits are down 47.8% compared to the first 9 months of 2022,” said Pueblo-area REALTOR® David Anderson.

ROUTT COUNTY

“Despite what one might read in the national news, the Routt County real estate market seems to be relatively insulated from the doom and gloom of high interest rates, decreased sales, increased days on market, and the like. In fact, the Routt County market is, on the whole, on par with 2022 numbers from this time last year, and up from 2019 numbers.

“The total volume closed in September 2023 across all market segments was $93 million; September 2019 saw $52.5 million of total activity. Average days on market across all market segments was at 53 days in September 2023, compared with 45 days in 2022 and 76 in September 2019. The average closed price in September 2023 was at about $1.6 million for properties under $2 million, up from $1.1 million in 2022 and up considerably from the average closed price of $657,000 in 2019.

“While closed listings appear to be holding steady compared to this time last year, the market segment of $500,000 – $1 million is down about 20%, and the market segment in the $1.5 – $2 million range is down about 50%. Interestingly, the $1 – $1.5 million and $2 million and above segments are flat. Active listings are down across all market segments about 36%.

“If there’s a story to be had here, it’s that certain market segments are feeling a bit of a pinch and are being buoyed by the luxury market. Even then, there is activity at all levels, even if market activity is down slightly. The decrease in activity could be due to traditional seasonal market slowdowns, or maybe interest rates,” said Routt County REALTOR® Geoff Petis.

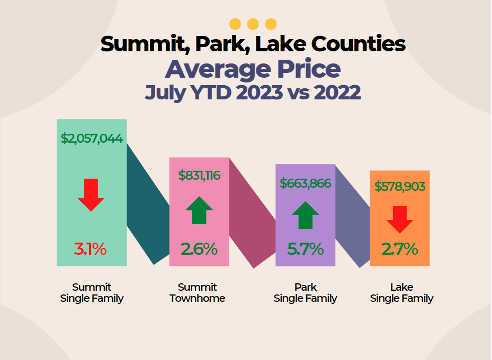

SUMMIT, PARK, AND LAKE COUNTIES

“There are more homes listed and fewer homes sold, and it is taking longer to sell those homes. With that information, logic would indicate that prices would go down, but Summit and Park County defy logic again with the average price of all properties sold going up to $1.4 million.

“In Summit, September 2023 vs 2022, the median sale price was up 16.9% and the average sale price was up 4.4% ($2.14 million) for single-family homes. The townhouse-condo median sale price was up 4.8% while average rose 6.4% ($841,731). Year-to-date, the numbers are still down 3.1% for single-family homes and up 2.6% for townhouse-condos. Sellers received about 97.5% of their list price. Park County’s year-to-date average single-family home price hit $663,866, while Lake County’s was $578,903.

“There are 620 residential active listings in the Summit MLS that range from a low-price, mobile home in Grand County for $69,000 and a high price single-family home in Breckenridge for $19.5 million (on the market for 1,129 days). Out of the 166 sales in September, the lowest was a home in Park County for $195,000 and the highest was a single-family home in Breckenridge for $5.6 million. These numbers exclude deed restricted, affordable housing,” said Summit-area REALTOR® Dana Cottrell.

VAIL

“September has been an interesting month in the Valley as the Aspen were spectacular and the first snowfall hit the high peaks. Historically, our summer season begins to slide downward as we enter the offseason and prepare for the ski season.

“Transactions for the month were down 14% versus last year however, dollars were positive 27% for the same period. Obviously, there is some price increase holding in the transactions but the transition to sales in the higher pricing niches is the primary reason for the increase. When we look at the same data for year-to-date, the transactions are negative 28.5% with dollars positive 16%. Some of the other data points reflect the continuing trends we have experienced over the past months. New listings saw a smaller decline than year-to-date, down 8.3% for the month versus the -22% year-to-date. The overall inventory is currently positive 1.2% however, that level is still less than 50% of historical levels. Another shift in this area is single family/duplex is positive 8.1% while condo inventory is negative 8.9%. We hope to see a bump in inventory as the ski season kicks in over the next two months. Pending sales are flat versus 2022 which is a positive trend versus the year-to-date -19.3%. This strength in pending sales is an indicator of positive activity considering the macro factors of interest rate increases and inflationary pressures. The months supply of inventory is up to 4.5, still below the six-months supply considered to be a stable inventory to sales activity level.

“All things considered, the market trend continues to show a reasonable movement considering the macro and local market activity. We watch the macro pressure constantly to assist in projecting future trends albeit the only thing we can do is work with our buyers and sellers to assure they are positioned accordingly,” said Vail-area REALTOR® Mike Budd.

SEVEN-COUNTY DENVER METRO AREA

STATEWIDE

SEVEN-COUNTY DENVER METRO AREA

STATEWIDE

SEVEN-COUNTY DENVER METRO AREA

STATEWIDE

The Colorado Association of REALTORS® Monthly Market Statistical Reports are prepared by Showing Time, a leading showing software and market stats service provider to the residential real estate industry and are based upon data provided by Multiple Listing Services (MLS) in Colorado. The September 2023 reports represent all MLS-listed residential real estate transactions in the state. The metrics do not include “For Sale by Owner” transactions or all new construction. CAR’s Housing Affordability Index, a measure of how affordable a region’s housing is to its consumers, is based on interest rates, median sales prices and median income by county.

The complete reports cited in this press release, as well as county reports are available online at: https://coloradorealtors.com/market-trends/

###

CAR/SHOWING TIME RESEARCH METHODOLOGY

The Colorado Association of REALTORS® (CAR) Monthly Market Statistical Reports are prepared by Showing Time, a Minneapolis-based real estate technology company, and are based on data provided by Multiple Listing Services (MLS) in Colorado. These reports represent all MLS-listed residential real estate transactions in the state. The metrics do not include “For Sale by Owner” transactions or all new construction. Showing Time uses its extensive resources and experience to scrub and validate the data before producing these reports.

The benefits of using MLS data (rather than Assessor Data or other sources) are:

Accuracy and Timeliness – MLS data are managed and monitored carefully.

Richness – MLS data can be segmented

Comprehensiveness – No sampling is involved; all transactions are included.

Oversight and Governance – MLS providers are accountable for the integrity of their systems.

Trends and changes are reliable due to the large number of records used in each report.

Late entries and status changes are accounted for as the historic record is updated each quarter.

The Colorado Association of REALTORS® is the state’s largest real estate trade association representing nearly 29,000 members statewide. The association supports private property rights, equal housing opportunities and is the “Voice of Real Estate” in Colorado. For more information, visit https://coloradorealtors.com.