Fast-paced spring housing market never arrived; Smaller pool of buyers starting to have a little more ‘fun’

ENGLEWOOD, CO – The typical fast-paced spring housing market just never materialized as higher interest rates and a less than eager group of potential sellers kept transactions limited and prices steady, according to the latest Market Trends Housing Report and analysis from the Colorado Association of REALTORS® (CAR).

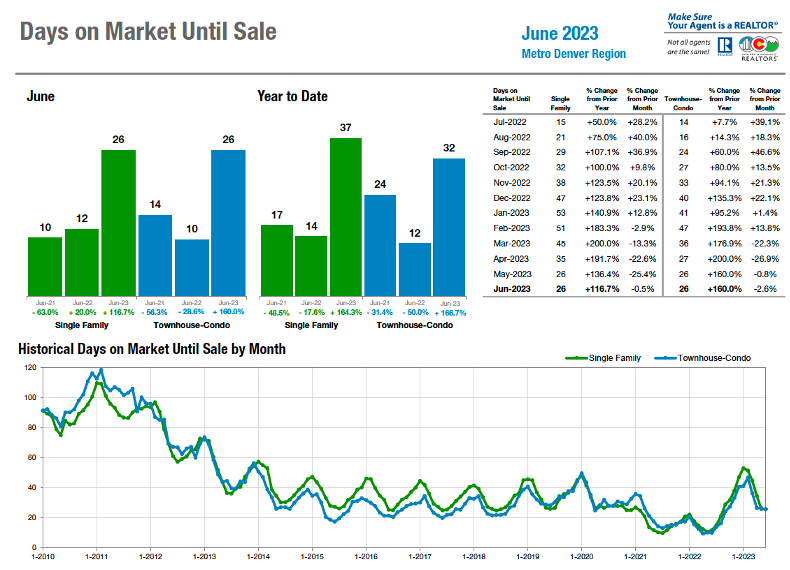

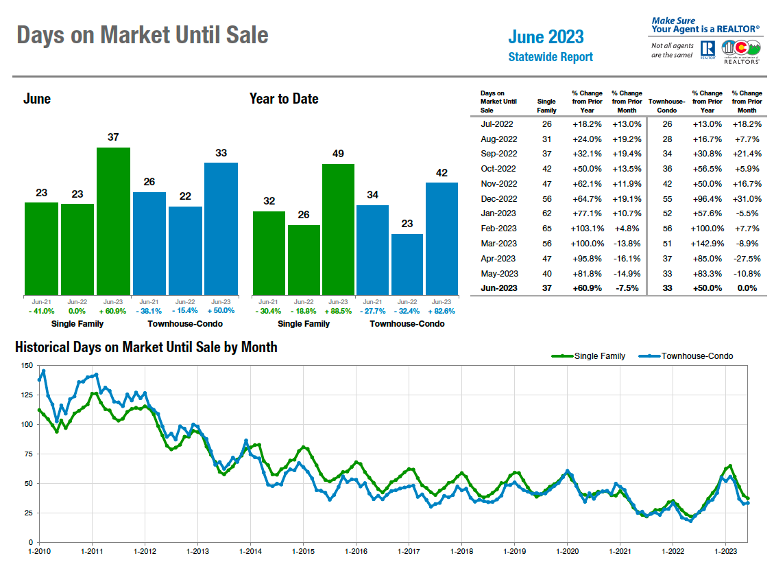

Despite the ongoing challenges, a smaller pool of buyers began to have ‘a little bit of fun’ as homes were sitting on the market a little longer and home shoppers enjoyed a little bit of time to analyze the market and seek out desired amenities and conditions. Supporting that buyer fun environment, average days on market hit 26 for the seven-county Denver area and 37 for the entire state, with the “over-asking price, bidding war mentality” of the past few years turning to a “list-price to sale-price ration right at 100%” — meaning, the asking price is the sale price.

“While ‘fun’ presents as subjective, it’s difficult to argue with the fact that it’s not been fun to be a buyer for many years and even the money being thrown at sellers has presented its own set of challenges,” said Denver-area REALTOR® Matthew Leprino.

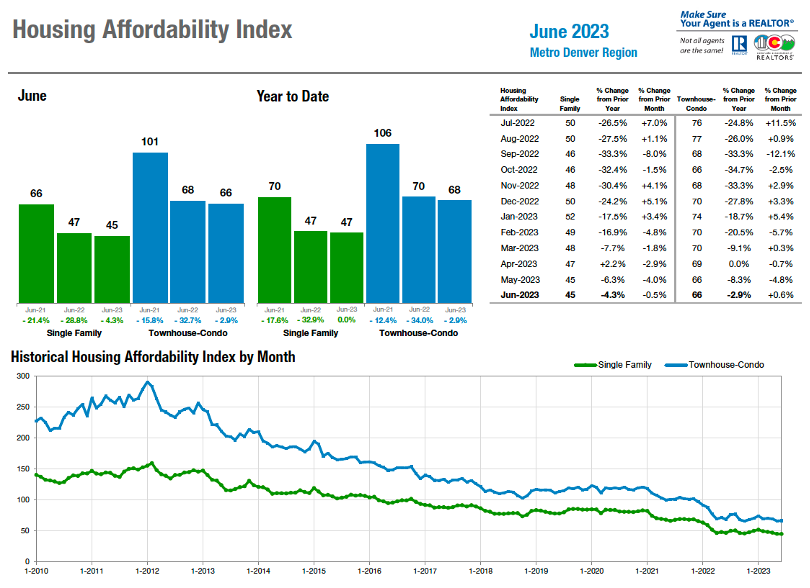

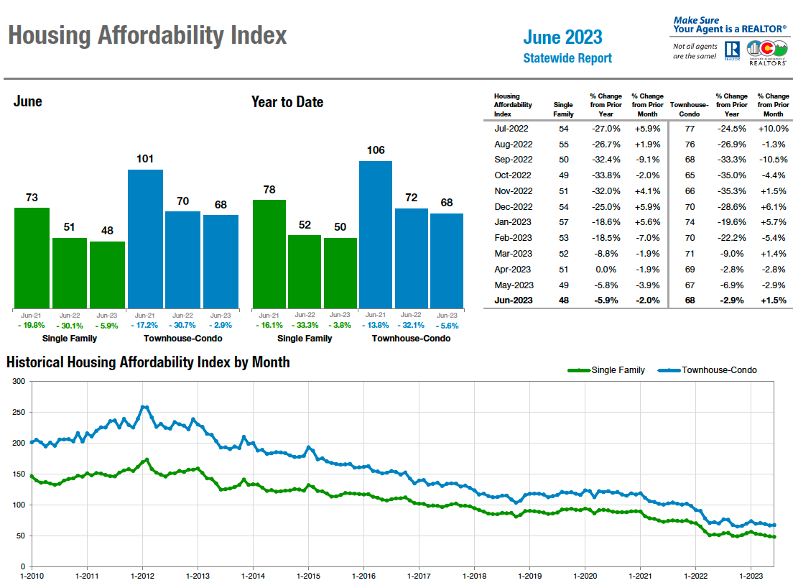

The combination of conditions in June continued to drag down the CAR Housing Affordability Index, a measure of how affordable a region’s housing is based on interest rates, median sales price, and median income by county. The index for all property types dipped again from May to June and sits at an all-time low for the seven-county Denver-metro region (48), and the statewide index of 51 is the second lowest since CAR began tracking in 2010. A value of 100 means that a family with the median income has exactly enough income to qualify for a mortgage on a median-priced home. An index of 48 signifies that a family earning the median income has only 48% of the income necessary to qualify for a mortgage loan on a median-priced home, assuming a 20% down payment.

“All in all, the house will sell in three-and-a-half weeks for asking price and it won’t be affordable as compared to our economy via the affordability index,” added Leprino.

“While a slowing market may appear concerning on the surface, it’s crucial to remember that the fast-paced, expensive conditions we’ve experienced over the past few years have been abnormal, and these changes are best characterized as a normalization of the market. Douglas County is and will continue to be one of the most desirable real estate markets in the country, and my outlook on property values is far from worrisome,” said Douglas County-area REALTOR® Cooper Thayer.

“The balancing act of economics and demand for homes will continue to wobble up and down as inflation reduction measures by the Federal Reserve continue to percolate through all the various indices. With overall sales numbers and new listings on the market down, the housing market remains competitive – but not nearly at the frenetic pace of a year ago since the homes available for sale are lingering on the market a bit longer,” said Fort Collins-area REALTOR® Chris Hardy.

“There is good news for buyers in that there are more negotiations happening with price and inspections, as well as good news for sellers that the market demand is often delivering a sales price that is close to the list price and still some multiple offers. The realities remain that with inventories constrained and new listings declining, affordability will continue to be a challenge,” said Steamboat Springs-area REALTOR® Marci Valicenti.

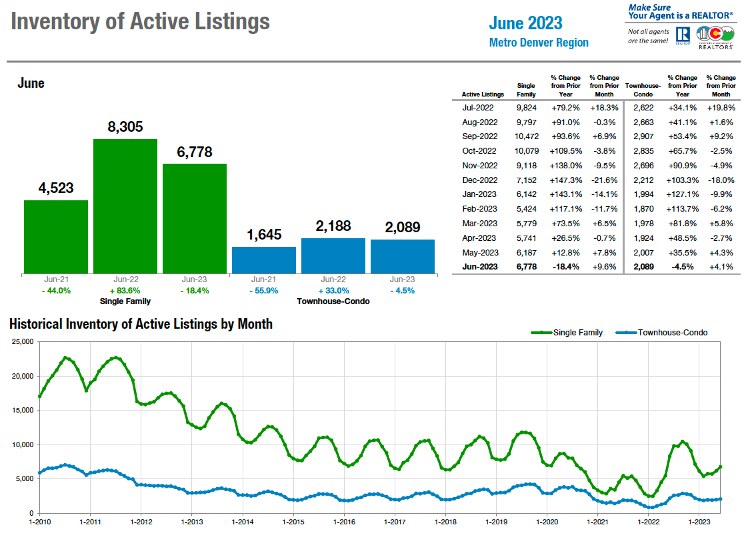

Seven County Denver area Market Overview:

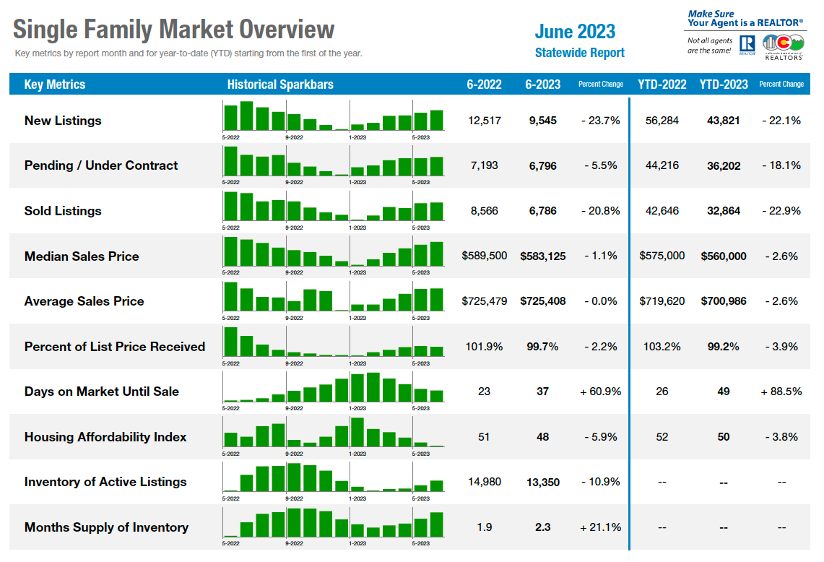

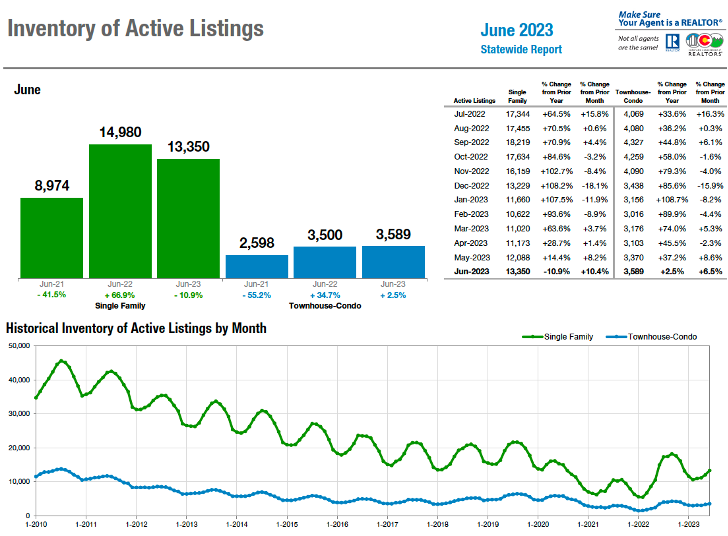

Statewide Market Overview

Taking a more in-depth look at some of the state’s local market data and conditions, the Colorado Association of REALTORS® Market Trends spokespersons provided the following assessments:

AURORA

“It’s been an interesting spring and continues into the summer as inventory across Aurora is down approximately 25% and prices down in many Aurora zip codes between 3-7%. Drilling down a bit on some specific zip codes, we see 80015 inventory down 36% and price down 3.3% to a median of $580,000 with an average of 17 days on market. Neighboring 80016 is down 25% in inventory, and up 2.3% in price to a median of $800,000 with a 38-day average on market. In the 80013 zip code, a large area of Aurora, inventory is down 27%, price is down 7%, and median price is now at $510,000. So, this unique market varies depending on the location.

“Looking to Greenwood Village, zip code 80111 is down 46% in inventory, with pricing up 23.7% and a median price of $ 1.175 million and just 18 average days on market. Overall, Arapahoe County is only down about 2% in pricing, with a median price at $600,000 and 20 days on market. More data and proof that real estate pricing is hyper local,” said Aurora-area REALTOR® Sunny Banka.

BOULDER/BROOMFIELD

“The real estate market in Boulder and Broomfield is starting to become a little boring. Our fast-paced spring market never arrived and, as we head into the historically slower months of the year, the numbers are just holding steady. In Boulder, prices are still off about 6% since the beginning of the year and down 11% since last summer. That correction was made early in the year and the pricing hasn’t changed since then. Average days on market doubled to an average of 57 days which indicates a drop in buyer demand. Our inventory remains low which holds our sales-price-to-list-price ratio pretty steady at just under 100%. Sellers are getting close to their list price, but they are having to wait and sweat it out a bit.

“Broomfield may be one of the only shining lights this month. It is one of the only counties that showed a price gain in both single-family homes and townhomes. The average days on market remains about 30 days as this area continues to outperform its more expensive neighbor. Popular new construction may be the reason as buyers flock to brand new homes with builders offering rate buydowns as incentives.

“The much-anticipated interest rate reduction hasn’t happened as expected and if they go up again, we can expect a further buyer retraction and more price reductions as we head into the fall. This is a prime opportunity for buyers to make a move,” said Boulder/Broomfield-area REALTOR® Kelly Moye.

COLORADO SPRINGS

“For the buyer waiting for prices to drop, it is going to take a little more patience in the Pikes Peak region. Although overall sales were down 23.1% across all properties, we were only down 1% on the median price from a year ago. As rates pushed up, inventory remained low, and prices remained stable. With the average days on market increasing over 100% for single-family homes, many are asking, what gives?

“Interest rates remain high so many believe that would shake out high prices and we would begin to see a correction. In many parts of the country, we are seeing corrections. But corrections take time. We hit the peak in spring 2022 and we are now transitioning. The last time we went through a housing correction we peaked in 2006 and did not see major signs of correction until Q3 2008. With unemployment remaining low and inventory in housing remaining low, we are stagnant. But don’t worry, the Federal Reserve is going to try their best to dislodge the economy without destroying it completely. The term soft landing has been thrown around more times than we can count, but the Fed has few examples of soft-landing recessions. The CEO of Bank of America, Brian Moynihan, said he saw a soft landing in the economy. That quote was in April 2023. And yet by the beginning of July, Michael Hartnett, chief investment officer at Bank of America, said the current stock market rally is a ‘big rally before a big collapse.’ And as the stock market goes, so does the economy.

“The Pikes Peak region stays resilient. For sellers that is great news. Buyers are simply priced out of the market. Rents are now lower than home payments. This is not normal and typically that difference will find balance and that should mean home price corrections are coming. The Fed has been very vocal on bringing down shelter prices. With the latest economic data in both jobs and then inflation we will likely see a .25 hike on the Fed rate in July, and another one before the end of the year. The Feds history shows they will continue to push until something major breaks. The first of the bank failures were the initial signs of this stress. But the commercial market is now feeling pain, which is a story all by itself. Regional banks continue to struggle. With credit card debt nearing $1 trillion, student loan payments likely to start back up in some capacity and no relief for many Americans, I still believe we are just at the first inning of a correction,” said Colorado Springs-area REALTOR® Patrick Muldoon.

COLORADO SPRINGS

“After prolonged periods of extraordinary boom, historically, the real estate market goes through another cycle of recalibration and adjustment. After the record-setting boom cycle through 2005, the Colorado Springs housing market went-through a season of adjustment and recalibration from 2006 to 2011. Then, starting in 2012, the real estate market began to improve gradually. By the end of 2015, the market started exploding, leaving the 2005 boom in the dust. The next extraordinary boom cycle prevailed through the summer of 2022. And now we are going through another season of adjustment and recalibration. However, aside from the exceptional market in June 2021 and 2022, June 2023 is healthier than June 2020, with over 39% more active listings, over 17% higher year-to-date sales volume, over 38% higher average sales price, and 35% higher median sales price.

“In June 2023, there were 2,059 active listings and 1,286 sales, the monthly sales volume was $673.85 million, the year-to-date sales were 6,210, the year-to-date sales volume was $3.3 billion, and the average and median sales prices were $555,403 and $485,000, respectively.

“Last month, 53.3% of the single-family homes sold were priced under $500,000, 35.2% were between $500,000 and $800,000, and 11.5% were priced over $800,000. Year-over-year, there was a 32.3% drop in the sale of single-family homes priced between $400,000 and $600,000, a 32% drop in homes priced between $600,000 and $1 million, and a 10.6% drop in homes priced over $1 million.

“When looking back five years and comparing single-family/patio homes sales in June 2023 with June 2018, the active listings were down 4.8%, monthly sales were down 26%, and the year-to-date sales declined 19.4%. However, the monthly and year-to-date sales volumes were up 7.3% and 23.3%, respectively, and the average and median sale prices were up 53.6% and 49.3%, respectively. Compared with June 2013, the monthly and year-to-date sales were up more than 16%, the monthly and year-to-date sales volumes were up by 139% and 157%, respectively, and the average and median sale prices escalated over 117% and 115%, respectively.

“The inconceivable affordability challenges culminating from a staggering combination of high-interest rates, steep home prices, and daunting inflation, continue to be the most formidable barriers for the Colorado Springs area home buyers,” said Colorado Springs-area REALTOR® Jay Gupta.

CRESTED BUTTE

“Despite lower sales and increased time on the market, the real estate market in the Gunnison Valley continues to be strong. This is especially true in the Gunnison area as you will see below. In the Crested Butte area, there have been 25 Single Family homes sold this year for a total of $48,631,650 vs. 40 sold last year to date for $87,822,800. This is the only segment where the average price has decreased year-over-year from $2,195,570 to $1,945,266. However, the average price per square foot has gone down only slightly from $755 to $733. The number of luxury properties sold has gone down as well which would affect the average price. Last year, 10 homes sold for $3 million or more vs. only 3 this year and 4 homes sold for over $4 million last year vs. 2 this year-to-date.

“Looking at condos and townhomes in the same area, there have been 36 sales for a total of $30.36 million vs. 89 that had sold last year at this time for a total of $53.48 million. The average price has increased from $600,973 in 2022 to $843,550 in 2023.

“For single-family homes in the Gunnison area, there have been 51 homes sold for a total of $36.3 million. At this time in 2022, there had been 35 homes sold for a total of $19.1 million. The average price is now $712,388 vs. $546,996 at this time last year. So, while Gunnison remains an excellent way to get a more affordable home, the prices are increasing, and it is still competitive to purchase a home there.

“Our inventory continues to increase in anticipation of the summer visitors and real estate shoppers arriving. The number of properties for sale is higher than it was at this time last year and, in some cases, substantially higher. In all of GCAR, there are 696 active/pending listings vs. 588 last July – an 18% increase.

“In the Crested Butte segment of the market, there are 401 active/pending listings vs. 288 last July – a 39% increase! For just residential the numbers are 220 vs. 151 or a 46% increase. Some really notable numbers are Mt. Crested Butte Condos – 85 this year vs. 41 last year (107% more). Crested Butte homes – 39 this year vs. 22 last year (77% more).

“There is still a lot of demand for property in the area so I expect the summer and fall to be considerably busier than the first 6 months of 2023 have been, but prices and interest rates remain high so sellers will need to adjust prices if the interest isn’t there from the start. Buyers have a lot more to choose from, but it seems unlikely that prices are going to drop much from recent sales levels,” said Crested Butte -area REALTOR® Molly Eldridge.

DENVER COUNTY

“Hold the applause, please, until we’ve finished this statement; ‘real estate is fun again in Denver’. While no doubt ‘fun’ presents as subjective, it’s difficult to argue with the fact that it’s not been fun to be a buyer for many years and even the money being thrown at sellers has presented its own set of challenges. Among the contributing factors is a much lower median sales price than last year, now $700,000 vs. 2022’s $750,000 for July. While the year-over-year price decreases are now in their sixth month, for a while that decrease has simply been erasing a year or two of maddening ascension. While still higher than June 2021’s $650,000, the 7.6% increase in two years is a far cry from that year’s 29% increase from 2020 to 2021. The summit having been realized in 2021 and 2022 is translating not to a nosedive like everyone’s worst a la 2008 fears but rather toward a correction to the prior trajectory of pre-pandemic years.

“In Denver the average days a home is on the market is now 21 – three weeks vs. last year’s nine days and worse still in 2021: just seven days on market. More pre-pandemic levels showed a variation between 17 and 20 days from 2017 to 2019 and a further rebalancing of ‘normal’ returns to the timeframe buyers and sellers alike can expect.

“In years past, we’ve discussed inventory in great length, the cause of most price increases prior to 2020. This June however, we have finally seen that the river began to follow a more favorable direction. At 1.7 months in the freestanding home category, the last time we had that much available was the summer of 2018 which ranged between 1.8 and 1.9 from May to September. While 1.7 still represents just half of a ‘balanced’ market, it’s still a very positive direction as we’ve seen that number dip to only 0.2 months during 2021 and 2022.

“All in all, despite data showing that there are dips and descending figures across the board, things are beginning to go very well for the Denver market. We still have a ways to go to achieve any type of full balancing act – and statistically speaking we may never actually achieve one – but for the buyer in today’s market, things are significantly better than in the last couple of years and the seller also now may have the opportunity to enjoy the process. While every market presents its opportunities and threats, the headline this month is that we’ve started the path back to balance and when speaking about ‘good’ vs. ‘bad,’ the current climate is really neither of the above,” said Denver-area REALTOR® Matthew Leprino.

DOUGLAS COUNTY

“The June real estate market showed signs of slowing down as mortgage rates continued to climb throughout the month. Compared to May, there were around 15% more new listings, but sold listings remained relatively stagnant, causing months supply of Inventory to creep upwards to nearly two months. The median sales price for single-family homes in the county remained unchanged at $725,000. Listings also spent slightly longer on the market, with days on market in the MLS climbing to 28 days, a large jump from last year’s figure of just 16 days (+75%).

“With large-scale single-family development projects underway in Douglas County, I project inventory numbers to remain slightly elevated in the near future, as buyer’s budgets continue to be constrained by mortgage rates. Monthly affordability is one of the top indicators of market conditions, and slight changes in rates can have large impacts on monthly payments, resulting in downward price pressure on the market. With townhouse/condo sales representing just about 15% of all closings, that market segment will likely continue to experience higher prices and lower inventory.

“While a slowing market may appear concerning on the surface, it’s crucial to remember that the fast-paced, expensive conditions we’ve experienced over the past few years have been abnormal, and these changes are best characterized as a normalization of the market. Douglas County is and will continue to be one of the most desirable real estate markets in the country, and my outlook on property values is far from worrisome,” said Douglas County-area REALTOR® Cooper Thayer.

DURANGO/LA PLATA COUNTY

“The La Plata County real estate market continued to be strong in June 2023 with a median home price of $865,000, a 21.7% increase from June 2022. The average sales price for June 2023 was $981,000. The number of homes for sale remained low, with just under four months of inventory on the market. New listings remained the same, with 120 new units versus 118 last year. This is well below the six-month inventory level that defines a balanced market.

“The strong demand for homes in La Plata County is being driven by several factors and it remains a very favorable time for sellers who are likely to get top dollar for their homes. Potential buyers should be prepared to act quickly. Homes are selling fast and often above the asking price. One trend we are beginning to see is more contracts terminating due to inspection-related issues or financing terms. Buyers are quick to secure the new listing inventory, only to have buyer’s remorse set in after the initial excitement wears off. With the average price of homes and interest rates continuing to climb, purchasing a home has become extremely challenging for most buyers, and they expect the properties to be a perfect fit,” said Durango-area REALTOR® Jarrod Nixon.

Some of the key takeaways from the June 2023 La Plata County real estate market report:

- Median home price: $865,000

- Year-over-year median price change: 19%

- Number of homes for sale: 192

- Days on the market: 65

- Percentage of list price received: 98.3%

- Sold listings in June: 67

ESTES PARK

“The summer season is starting with a bang as it does here in Larimer County, but it’s a one-sided bang.

Homes are listed, but no offers, just price reductions and lengthened time on the market. Not quite the same atmosphere as this time last year.

“Year to date, townhouse/condos are exceeding expectations with 1.6% more listings. Single-family homes are lagging behind with fewer listings, down 16.3%, than this time last year. Are buyers staying in their homes longer and not looking for the next move? With interest rates climbing, investors are not buying as much as I saw last year either.

“Sold listings are down 26.7% from this time last year for single family and even less for townhouse/condos, -27.1% from this time last year. Average days on market is a flip between townhouse/condos and single-family homes. Townhouse/condos have decreased 47.5% from 101 to 53 days and single-family homes increased from 28 days to 50, a 78.6% increase. Average sales prices continue to creep up compared to the same time last year with single-family homes up 3.2%, and townhouse/condos up 1%. We’ll keep hanging on for the next episode and hope to find the hidden hole of buyers, wherever they are,” said Estes Park-area REALTOR® Abbey Pontius.

FORT COLLINS

“What do you get when you combine high mortgage interest rates, increasing inventory, resilient employment numbers, pent-up demand for housing, and an incremental reduction of inflation? Oddly, these combine for a balancing of the housing market not seen in our area for over a decade.

“Reviewing the current sales statistics, it’s striking what a difference 12 months makes. In June 2022, the housing market was superheated by historically low interest rates, low inventory, and seemingly insatiable buyer demand. Homes were being sold within days if not hours on the market (sometimes even before they hit the market). Sale prices exceeded asking prices on average by over 4%. By all accounts, it was a super challenging market for buyers as sellers enjoyed quick sales and put lots of cash in the bank. Oh, and the consumer price index had crept up over 9%.

“Fast forward 12 months following a rigorous effort by the Fed to raise interest rates and curb alarming inflation, the current scenario is by comparison, quite remarkable. While the most current CPI inflation numbers came in at an odds-beating 3% – this figure is still too high for the Fed to attain their 2% benchmark and will likely bump interest rates at their next meeting. This is bad news for mortgage rates. At face value, this is bad news for homebuyers since there doesn’t appear to be any near-term relief in affordability. Not only have 30-year fixed interest mortgage rates continued to hover near 7% or higher, median prices for homes in northern Larimer County have only dropped by a modest 2%. Employment growth and wage growth have increased but appear to be leveling off – so it’s not as if first-time homebuyers are making up the difference in wages to offset the increased cost of borrowing money to buy a house.

“That being said, the cooling of the housing market is creating some breathing room for buyers and a bit of an expectations reset for sellers. Instead of less than 2 weeks of inventory on the market like last spring, there is now over 2 months of inventory available for sale (based on current sales activity). This correlates to the 44% increase in days on market (DOM) which is approaching 52 days (last June DOM was 36). Sellers must ensure their homes are in top shape and priced aggressively to attract the fewer buyers in the market who now have multiple properties from which to choose. While the statistics show that homes are selling for about what their final list price is, that doesn’t mean sellers are getting what they expected for their homes. For homes that have been on the market for over 50 days and then sell – the original list price is often higher than the final list price (the price listed in the multiple listing service at the time the house goes under contract).

“The balancing act of economics and demand for homes will continue to wobble up and down as inflation reduction measures by the Fed continue to percolate through all the various indices. With overall sales numbers down by 20% and new listings on the market down by 20%, the housing market remains competitive – but not nearly at the frenetic pace of a year ago since the homes available for sale are lingering on the market a bit longer,” said Fort Collins-area REALTOR® Chris Hardy.

GLENWOOD SPRINGS

“The first half of the year finished like a fizzling firecracker. New listings for single-family homes in the Roaring Fork and Colorado River valleys was as flat as a defunct sparkler. June 2023 had the same exact number of new listings for homes as were listed in June 2022. Pending sales were up slightly from 61 in 2022 to 70 this June. Sold listings were also flat (slightly down) closing out June of this year with 65 versus 69 in June 2022. We did see an increase in the average sale price which was up 30% this year at $1.09 million compared to the average last June of $837,369. The median sales price was stagnant at $675,000 compared to $672,000 last year. Days on market was a sign of a slight change in the market, increasing 42% to settle at 50 days, which is still a decent timeframe for most sellers. Sellers also have started experiencing a shift in the percentage of list price received as buyers have had to adjust to the continued interest rate increases that affect their ability to purchase more house. Our month’s supply of homes continues to remain low at 3.1 months inventory which is the catalyst keeping the prices where they are.

“If the single-family market is a fizzling firecracker, you could call the townhome/condo market a dud that would not light! New listings were down almost 38% with 23 listings compared to 37 last June. This brought the pending sales down 53% with 15 under contracts compared to 32 last year. Multi-family sold listings bottomed out at 20 compared to 27 in June 2022. Like the single-family market, the average sale price rose 72% over 2022 to come in at $855,083. The median sale price rose as well by a substantial 81%, putting the multi-family units, which are usually starter properties for buyers, at a somewhat unreachable price of $652,900. Active listings were down 31% bringing the months supply to 1.7 months or 33 listings,” said Glenwood Springs-area REALTOR® Erin Bassett.

GRAND JUNCTION

“Inventory, or lack of it, continues to be a big problem in Mesa County. During June, only 323 new listings were received, down 29.5% from June of 2022, and bringing the total number of listings so far for 2023 to 1778, 25.2% lower than same time in 2022. The total property sales for the year so far are 1477.

Even though all activity, as noted above, is down, prices are not. The median sold price is up 1% to $386,850 and the average sale price, year-to-date, is up 1.4% to $425,941. In the month of June alone, average sale price was $447,246. Buyers are taking longer to find the house they want, and we have seen a significant jump in days on market to 88, an increase of 37.5%.

Our supply of active listings continues to drop, a trend that has been consistent since August of 2022. Currently, there are 532 properties available, that includes single family, townhome, and condo. Less than half of the available properties are priced under $500,000. With the continuation of tight inventory, interest rates, and local income statistics, 2023 will continue to be a challenging year,” said Grand Junction-area REALTOR® Ann Hayes.

JEFFERSON COUNTY – ARVADA/GOLDEN

“Buyers are still on the fence and sellers are pausing to put their home on the market in fear of not being able to find a replacement home. The Federal Reserve did not raise rates last week and there was an increase in buyer mortgage applications. Buyers still want to buy, and they will. Once rates drop, more buyers will be in the market bringing more competition. With very few homes to choose from, a strong seller’s market may return. In Jefferson County, new listings fell dramatically (- 32.7%), sold homes were down 17.5% decreasing inventory 35.1% for single-family homes year over year. The median home price for June came in at $711,450.

“For townhome/condos, new listings decreased 25.4%, and sold homes were down 24.1% from this time last year. The median price is $427,500 with average days on market at 27, a huge increase of 237.5%. It may not seem like this is a good time to buy, however, it may very well be before there are multiple offers again with home prices starting to tick up with higher demand and low supply,” said Jefferson County-area REALTOR® Barb Ecker.

PUEBLO

“The Pueblo market continued its path from the first five months of the year with many significant housing measurements falling. New listings dropped 18.2% in June 2023 compared to June 2022 and are down 17.7% year-to-date. Pending sales fell 8.6% from June 2022 and are -21% year to date. Solds took a big drop, down 27.8% and are -29.7% year to date.

“The one plus in the June numbers is median price, up 2.7% to $325,450. The percent of list price received is at 98.7% in June and 98.4% year to date, only down 1.5% year to date. Average days on market rose to 75 in June and is now 88 year to date. The market is beginning to reflect conditions we experienced in 2017 – 2019, taking 2 – 4 months to get houses under contract.

“Looking at new construction, new home building permits hit 28 in June, down 12 from May. Permits are down 46.4% year to date compared to 2022. Interest rates are holding in the high 6% to mid 7% range which is keeping buyers on the sidelines waiting for rates to drop,” said Pueblo-area REALTOR® David Anderson.

STEAMBOAT SPRINGS/ROUTT COUNTY

“Luis Alberto Urrea may have said it the best; ‘Numbers never lie, after all: they simply tell different stories depending on the math of the tellers.’ After the country’s two ‘unicorn’ years, the Steamboat Springs area is normalizing and returning to its seasonality of lower and higher demand. The third quarter historically produces the largest sales volume for the Yampa Valley. Routt County’s new listings and active listings were down about 30% each for both single and multi-family properties from June of last year. Sold listings are down 50% for single-family; however, with demand still outpacing supply this has kept pressure on housing prices with median and average sales prices exceeding June 2022 and up year-to-date 1.5% and 7.7% respectively. Home sellers are getting on average about 2.6% less of their list price than they did last year. Sold listings for multi-family were down 57.4% with the median sales price down 11.3% to $710,000 and average sales price down 27% to $819,463. These condo/townhome stats at face value may not tell the true tale for June- it doesn’t necessarily mean there have been market price reductions since sellers received 98.9% of their list price – on average 3.9% less than last year. With only 20 transactions one may want to look harder at the offerings of the period with multi-family months’ supply at 2.1 months.

“The U.S. has now had 10 months of interest rates hovering around 6-7%; buyers are coming to terms with these rates and are being incentivized by some lenders who may offer re-fi concessions if rates drop within five years. The National Association of REALTORS® has reported the country’s average months’ supply between 2011 – 2019 as five months with the current months supply at three months; single-family for Routt County is currently 3.6 months. There is good news for buyers in that there are more negotiations happening with price and inspections, as well as good news for sellers that the market demand is often delivering a sales price that is close to the list price and still some multiple offers. The realities remain that with inventories constrained and new listings declining, affordability will continue to be a challenge, as the county has had too many years of non-diversified new construction to provide relief.

“Luis Alberto Urrea’s message should resonate with all of us: if you are a buyer or a seller, do not act on any singular ‘tellers’ medium or article on real estate on a given day. Consult with a real estate advisor, mortgage broker or financial advisor and dig deeper into the stats that gets more housing specific to your personal situation– knowledge is power, with accurate information you can make a decision that is right for you,” said Steamboat Springs-area REALTOR® Marci Valicenti.

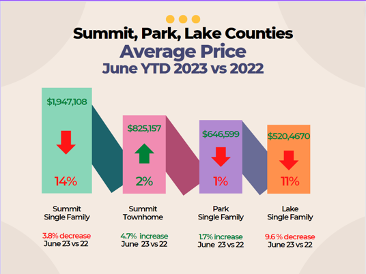

SUMMIT, PARK, AND LAKE COUNTIES

“With summer tourists and enthusiasts visiting, there are properties selling, just not at the rate they were last year. Although sales are down compared to last year, the number of listings has also gone down.

“Median sale prices were down 10.8% and the number of sold properties fell 23.1% compared to last year. Active listings were down almost 6%, which is lower than we had seen in the last couple of months. Fewer sales and fewer listings mean prices are bouncing around. The Summit condo market remains strong with prices increasing, but single-family home prices keep decreasing compared to the previous year.

“Comparing June ‘23 to June ’22, the average sales price for single-family homes in Summit dropped -3.8%. The year-to-date drop is even higher at -14% and the average price is $1.94 million. The average sale price for all types of residential properties was $1.22 million and the condo sale price average was $825,157. Sellers received a little under 98% of their list price.

“Park County’s YTD average single-family home price was $646,599, while Lake County’s was $500,457.

There are 617 residential active listings in the Summit MLS that range from a low-price, mobile home in Grand County for $80,000 and a high price single-family home in Breckenridge for $19.5 million (on the market for 1,056 days). Out of the 108 sales in June, the lowest was a condo in Dillon for $336,000 and the highest was a single-family home in Dillon for $4.59 million. These numbers exclude deed restricted, affordable housing.” said Summit-area REALTOR® Dana Cottrell.

TELLURIDE

“Telluride’s regional real estate market for the first half of 2023 is about what I guessed it would be. Down 34% in the dollar amount of sales and down 37% in the number of sales. June sales were $69.2 million across 31 sales. Mountain Village finished the first two quarters of 2023 controlling 60% of all sales in San Miguel County. The average home sales price in the Mountain Village is up 48% for the first six months of 2023 as compared to the same period in 2022. Another fluke in our market is that the inventory for the 12 most popular real estate areas for homes, condominiums and residential lots has the exact same available inventory of 226 in San Miguel County as it did on Dec. 31, 2022.

“I get asked almost daily by current property owners in our region about the status of our market. I usually pause and say something like, ‘who knows.’ There are just too many mixed signals nationally about a possible recession, more interest rate hikes and global conflicts,” said Telluride-area REALTOR® George Harvey.

VAIL

“The market trend continues to be negative versus the previous two years and slowly finding a new normal. Closed sales for the month of June were down 39% compared to June 2022 and the year-to-date sales are negative 39% 2022 versus 2023. Pending sales for the month are positive 46% compared to June 2022, while the YTD pending sales have improved slightly to a negative 31%. Active listings have improved to a negative 10% versus 2022 with the single family/duplex almost even and the condo/townhouse still lagging. Comparing inventory to prior month both categories are showing double digit improvement. When looking at this inventory improvement combined, we see the growth in inventory coming from the $1.5 million niche up with the weakness still in the niches below this price point. The improving inventory and stabilizing sales have raised the months supply to 4.5, the highest level since 2019.

The chart below depicts the performance in sales by price compared to prior year and six-month performance 2022 compared to 2023:

| June-22 | mkt % | June-23 | mkt % | 6/30/2022 | mkt % | 6/30/2023 | mkt % | ||

| <$1 mil | 60 | 44% | 37 | 48% | 257 | 40% | 152 | 42% | |

| $1-2 mil | 38 | 28% | 17 | 22% | 188 | 30% | 95 | 23% | |

| $2-3 mil | 15 | 11% | 8 | 10% | 73 | 11% | 54 | 13% | |

| $3-4 mil | 11 | 8% | 5 | 6% | 40 | 6% | 39 | 9% | |

| $4-5 mil | 7 | 5% | 4 | 5% | 31 | 5% | 21 | 5% | |

| $5 mil + | 6 | 4% | 7 | 9% | 51 | 8% | 31 | 8% | |

| 137 | 100% | 78 | 100% | 640 | 100% | 392 | 100% |

“It is interesting that the percentages of market are relatively stable in-spite of significant changes in gross sales inventory by niche. However, if we look back over the past twenty years the biggest swings have in the opening price niche and the top niche. Historically, they represented 67% and 4% for the historic period. The primary variable over the years has been inventory per niche. This variable has been affected the most by macro-economic factors and probably have become the new normal. The current forecasts for mortgage rates and inflation would indicate we may hit our stable market,” said Vail-area REALTOR® Mike Budd.

SEVEN-COUNTY DENVER METRO AREA

STATEWIDE

SEVEN-COUNTY DENVER METRO AREA

STATEWIDE:

SEVEN-COUNTY DENVER METRO AREA

STATEWIDE

The Colorado Association of REALTORS® Monthly Market Statistical Reports are prepared by Showing Time, a leading showing software and market stats service provider to the residential real estate industry and are based upon data provided by Multiple Listing Services (MLS) in Colorado. The June 2023 reports represent all MLS-listed residential real estate transactions in the state. The metrics do not include “For Sale by Owner” transactions or all new construction. CAR’s Housing Affordability Index, a measure of how affordable a region’s housing is to its consumers, is based on interest rates, median sales prices and median income by county.

The complete reports cited in this press release, as well as county reports are available online at: https://coloradorealtors.com/market-trends/

###

CAR/SHOWING TIME RESEARCH METHODOLOGY

The Colorado Association of REALTORS® (CAR) Monthly Market Statistical Reports are prepared by Showing Time, a Minneapolis-based real estate technology company, and are based on data provided by Multiple Listing Services (MLS) in Colorado. These reports represent all MLS-listed residential real estate transactions in the state. The metrics do not include “For Sale by Owner” transactions or all new construction. Showing Time uses its extensive resources and experience to scrub and validate the data before producing these reports.

The benefits of using MLS data (rather than Assessor Data or other sources) are:

Accuracy and Timeliness – MLS data are managed and monitored carefully.

Richness – MLS data can be segmented

Comprehensiveness – No sampling is involved; all transactions are included.

Oversight and Governance – MLS providers are accountable for the integrity of their systems.

Trends and changes are reliable due to the large number of records used in each report.

Late entries and status changes are accounted for as the historic record is updated each quarter.

The Colorado Association of REALTORS® is the state’s largest real estate trade association representing nearly 29,000 members statewide. The association supports private property rights, equal housing opportunities and is the “Voice of Real Estate” in Colorado. For more information, visit https://coloradorealtors.com.