Summer slowdown or shift in the housing market?

FOR IMMEDIATE RELEASE

Summer slowdown or shift in the housing market?

https://coloradorealtors.com/market-trends/regional-and-statewide-statistics/

ENGLEWOOD, Colo. – July 12, 2018 – With median and average sales prices continuing to rise due to ongoing inventory issues, other key measurements of the housing market have buyers, sellers and REALTORS® asking the same seasonal question; is this the typical summer slowdown or are we seeing a shift in the housing market?

Small, month-over-month increases in active inventory, months’ supply of inventory, and new inventory were easily countered by strong seasonal sales and remain down year-over-year, according to the latest housing report from the Colorado Association of REALTORS® (CAR).

Key findings from the June 2018 Housing Reports from the Colorado Association of REALTORS®:

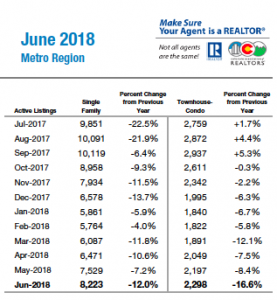

Denver Metro Area – (Adams, Arapahoe, Boulder, Broomfield, Denver, Douglas & Jefferson counties)

- New listings for single-family residence and condo/townhomes remained flat from May to June and are in line with the same numbers from a year prior.

- Active listings rose more than 9 percent month-to-month for single-family homes and 4.5 percent for condo/townhomes but remain down 12 percent and 16.5 percent year-over-year, respectively.

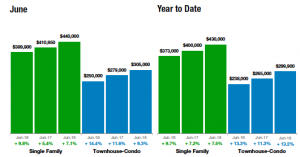

- The median sales price for a single-family home in the seven-county metro area rose just over one percent from May to June to $440,000 and the median price of a condo/townhome stayed flat at $305,000, up 7 percent and 9 percent year-over-year, respectively. Nearly identical gains were recorded for the average sales price with single-family homes reaching $519,000 and condo/townhomes topping $362,000.

- Total months’ supply of inventory edged up slightly for both single-family (2 months) and condo/townhomes (1.5 months) from May to June but also remain well below a balanced market inventory of 4-6 months.

- Days on the market dropped from 24 to 22 for single-family residence between May and June but rose two days to 21 for condo/townhomes.

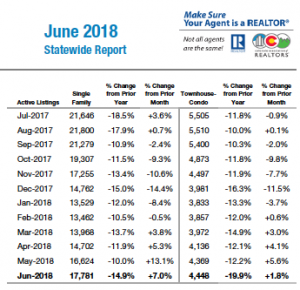

Statewide –

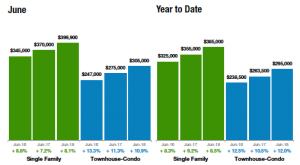

- Up again slightly from May to June, the median sales price for a single-family residence statewide sits just shy of $400,000 and is up more than 8 percent from a year ago.

- Condo/townhome median pricing continued to edge up from its May record high and now sits at $305,000, up nearly 11 percent from June 2017.

- Despite a solid number of new single-family listings (11,909) and condo/townhome listings (3,335) in June, those figures are down more than 5 percent year-over-year as sold listings and under contract properties rose slightly from May to June.

- Statewide, there were 17,781 active listings for single-family homes in June, down nearly 15 percent from this time last year. Condo/townhomes saw a slight increase in active listings from May to June but remain down nearly 20 percent from a year ago.

- The average sales price of single-family residence and condo/townhomes remained relatively flat at $472,603 and $381,061, respectively. These prices reflect a 7 and 8 percent increase year-over-year.

Here’s a snapshot of metro-area and statewide market conditions from several of the Colorado Association of REALTORS® research spokespersons:

AURORA

“Continuing the low inventory trend in Aurora, active single-family homes on the market (554 listings in the month of June) are down 8.6 percent from 2017. While the median sales price ($381,000) is up 8.9 percent, Aurora remains a very affordable option in comparison to home prices around the Denver metro area.

“With days on the market (18) up over 2017, it appears that we are seeing a very typical summer slowing, a trend we have experienced over the past 3-5 years. Whether the market is shifting, or this is just part of the summer trend we have been experiencing remains to be seen. The condo market reflects the same lack of inventory. With just 196 listings in June, we’re down almost 16 percent year-over-year. The median condo price is up nearly 9 percent at $245,500 and the days on the market sits at just 16 days.

“It’s a good time for buyers in the market. While inventory is down from June 2017, it has increased from the March 2018 lows. It’s possible that buyers will not experience the crazy bidding wars that they experienced in the early spring,” said Aurora-area REALTOR® Sunny Banka.

BOULDER/BROOMFIELD

“Is the market finally experiencing a shift? That’s what REALTORS® ask themselves each summer and this year is no different. Listings are down, which means that sales are also down. In Broomfield County, single-family homes have experienced a modest appreciation of 4.3 percent and townhomes and condos are actually down a bit (-1.5 percent) since the beginning of the year. But signs of a strong market still remain with average days on the market still hovering at 30 days and the sales to list price ratio right at 100 percent.

“Boulder County looks similar, but with heftier appreciation at 8.7 percent and longer days on the market, likely due to the higher price points in this area. Townhomes and condos remain strong, up 6.8 percent, which often can be attributed to the strong condo sales for college students. The lack of inventory continues to be an issue, driving up prices and keeping days on the market low.

“The seasonal shift in our market is well under way and only time will tell if this shift continues into the fall or if it is the same summer slowdown we have seen every year for the last five years,” said Boulder-area REALTOR® Kelly Moye.

DENVER

“It appears that the Denver market peaked early this year. Following a three-year high for new homes entering the market in May at 1059, June dipped slightly to 886. Although this may not seem like much, that performance is just 89 percent of June 2017 and 84 percent of May 2018. The amount of sold inventory in Denver stayed steady both month-over-month and year-over-year with 99 percent as many homes selling in June over May and 101 percent over June 2017. Curiously enough, the median price in Denver dropped nearly 3 percent from last month but remains up 1 percent over this time last year. With the month’s supply of inventory and days on market remaining virtually unchanged and the amount of sold homes remaining steady, there is no cause to suggest a massive market shift at this point – though the numbers do suggest a potential sizzle rather than boil,” said Denver-area REALTOR® Matthew Leprino.

FORT COLLINS

“The monthly numbers are consistent with word on the street that interest rate increases have shifted buyers to lower price points. Combined with the seasonal slowing we see at the end of May and through June (end of school, family vacations, etc.) it is no wonder that sold listings ebbed, new listings dipped, and price reductions have made a comeback!

“While total homes sold are down slightly year-over-year, prices are still on the rise. It is heartening to see the townhome/condo market rebound a bit after years of stagnant activity in that sector. Affordability will remain a key driver moving forward since borrowed money is getting more expensive, wage growth remains behind the pace of home prices, and the northern front range of Colorado attracts hundreds of relocations every month. Hopefully, condos and townhomes under $300,000 will provide a much-needed lower price point for entry-level home owners,” said Fort Collins-area REALTOR® Chris Hardy.

GOLDEN AND JEFFERSON COUNTY

“Jefferson County is experiencing a flux in the market – whether it be a seasonal slowdown or an actual change in the market, we will see. Buyers continue to show more patience, more pickiness about what they are purchasing. And, the natural progression of first-time homes buyers into condos/townhomes with those people moving into larger homes is not happening. With the median home price sitting at $465,000, there simply isn’t enough affordable housing and there are a vast number of apartments being built. As a result, first time homebuyers that would typically buy a condo/townhome are looking into year-long apartment leases rather than buying.

“For single-family homes there were 1,003 new listings that hit the market in June compared to 1,065 last year. Days on the market dropped to 19 from 22 at the same time last year with the month’s supply of inventory sitting at 1.4. There were 772 homes sold in June compared to 878 this time last year.

“For townhomes/condos there were 327 new listings that came on the market in June compared to 335 this time last year, the days on the market increased to 14 from 9, and the month’s supply of inventory sits at one month. There were 249 sold in June compared to 273 this time last year and the median sale price is at $295,000.

“In downtown Golden there were 14 homes/townhomes/condos out of a total of 29 that lowered their price after 30 days on the market. Yes, homes and townhomes/condos above $500,000 are sitting longer or lowering their prices. There might be a bit of recovery in August as there was last year but only time will tell,” said Golden-area REALTOR® Barbara Ecker.

PUEBLO/PUEBLO WEST

“Wow, the median sales price for a single-family home in the Pueblo market hit $200,000 in June, up more than 11 percent from May to June and up more than 14 percent from where we sat just a few years ago. With listings down 3 percent, month-over-month, pending sales were up 14.2 percent as homes come on the market, they sell. We continue to see more new construction with permits up to 237 in the first 6 months of the year – twice the number as this time last year. Days on the market is roughly 8 weeks but is dropping. Still, multiple offers and low inventory are making it a challenge for buyers and getting to the closing table takes a lot more work, inspections, appraisals and a lot of hand-holding,” said Pueblo-West REALTOR® David Anderson.

ROYAL GORGE AREA – FREMONT AND CUSTER COUNTIES

“The Royal Gorge area real estate market, Fremont and Custer Counties, continues its slowing trend for new listings. Active inventory was down more than 22 percent from the month of June 2017. Year-over-year new listings are down 8 percent from 2017. Sold listings were lower by 31 percent from May of 2017 and 11 percent year over year.

“Lower inventories have caused an increase in our year-over-year median home price of 9 percent and the average sold price of just over 12 percent. Properties are closing an average of 34 days quicker than they were last year at this time.

“It looks like we are going to miss the summer trend of increased listings and sales this year. This stingy market will continue to drive prices higher, days on the market lower and fewer homes sold going into the fall and winter months,” said Royal Gorge-Area REALTOR® David Madone.

TELLURIDE

“The Telluride market hasn’t changed much this year. Through the first six months, sales volume is down 18 percent and the total number of sales is down 27 percent. However, the volume of sales can change quickly with a few large transactions. Yes, lack of inventory in the bottom 50 percent of the market has slowed overall sales, as well as some ‘international trade war’ challenges. However, the economy in Texas is booming and that is the biggest single one source of our second home client base. There seems to be a steady pace of properties going under contract with rumor of some very, very big transactions possible soon. Telluride continues to receive great press as a small-town resort community with more and more tourists discovering all that it offers. My prediction for the summer sales is strong and upwards in dollars and number of sales. Time will tell,” said Telluride-area REALTOR® George Harvey.

VAIL

“June is the transition month as we swing into the summer sales season for the Vail Valley. Overall transactions were slightly ahead of May but slightly down from June of 2017. The performance reflects a stable transactional standpoint with dollar increases coming from the upper end market. In 2017 year-to-date, 15 percent of the transactions represented 48 percent of dollar volume. In 2018 the relationship of 15 percent of transactions represents 54 percent of dollars which is a significant jump. This trend has been holding since the end of the first quarter and may hold through the balance of the year. One of the drivers of the trend is lack of inventory in the price points representing 85 percent of transactions. Inventory in the historically volume price points are down on average 38 percent from June of 2017. The problem shows no near-term signs of changing thus, a forecast of maintaining the current trend indicates a relatively stable market for the balance of the year. The next two months will be the key, as our summer season continues to grow a percentage of the yearly market,” said Vail-area REALTOR® Mike Budd.

Inventory of Active Listings — Statewide

Inventory of Active Listings – Denver Metro Region

Median Sales Price Denver Metro area – (includes – Adams, Arapahoe, Boulder, Broomfield, Denver, Douglas and Jefferson counties)

Median Sales Price – Statewide

The Colorado Association of REALTORS® Monthly Market Statistical Reports are prepared by Showing Time, a leading showing software and market stats service provider to the residential real estate industry, and are based upon data provided by Multiple Listing Services (MLS) in Colorado. The June 2018 reports represent all MLS-listed residential real estate transactions in the state. The metrics do not include “For Sale by Owner” transactions or all new construction.

The complete reports cited in this press release, as well as county reports are available online at: https://coloradorealtors.com/market-trends/

###

CAR/SHOWING TIME RESEARCH METHODOLOGY

The Colorado Association of REALTORS® (CAR) Monthly Market Statistical Reports are prepared by Showing Time, a Minneapolis-based real estate technology company, and are based on data provided by Multiple Listing Services (MLS) in Colorado. These reports represent all MLS-listed residential real estate transactions in the state. The metrics do not include “For Sale by Owner” transactions or all new construction. Showing Time uses its extensive resources and experience to scrub and validate the data before producing these reports.

The benefits of using MLS data (rather than Assessor Data or other sources) are:

Accuracy and Timeliness – MLS data are managed and monitored carefully.

Richness – MLS data can be segmented

Comprehensiveness – No sampling is involved; all transactions are included.

Oversight and Governance – MLS providers are accountable for the integrity of their systems.

Trends and changes are reliable due to the large number of records used in each report.

Late entries and status changes are accounted for as the historic record is updated each quarter.

The Colorado Association of REALTORS® is the state’s largest real estate trade association representing more than 25,000 members statewide. The association supports private property rights, equal housing opportunities and is the “Voice of Real Estate” in Colorado. For more information, visit https://coloradorealtors.com.